Many homes aren’t going to make it to the finish line. That’s the harsh truth that sellers need to hear today as we’re in a market of rising cancellations. A cancellation is when a listing is terminated and no longer available for sale. Is this the worst number of cancellations ever? What price ranges are doing better than others? And what does it take to become a sale instead of a cancellation? That’s the question.

YES, CANCELLATIONS ARE UP

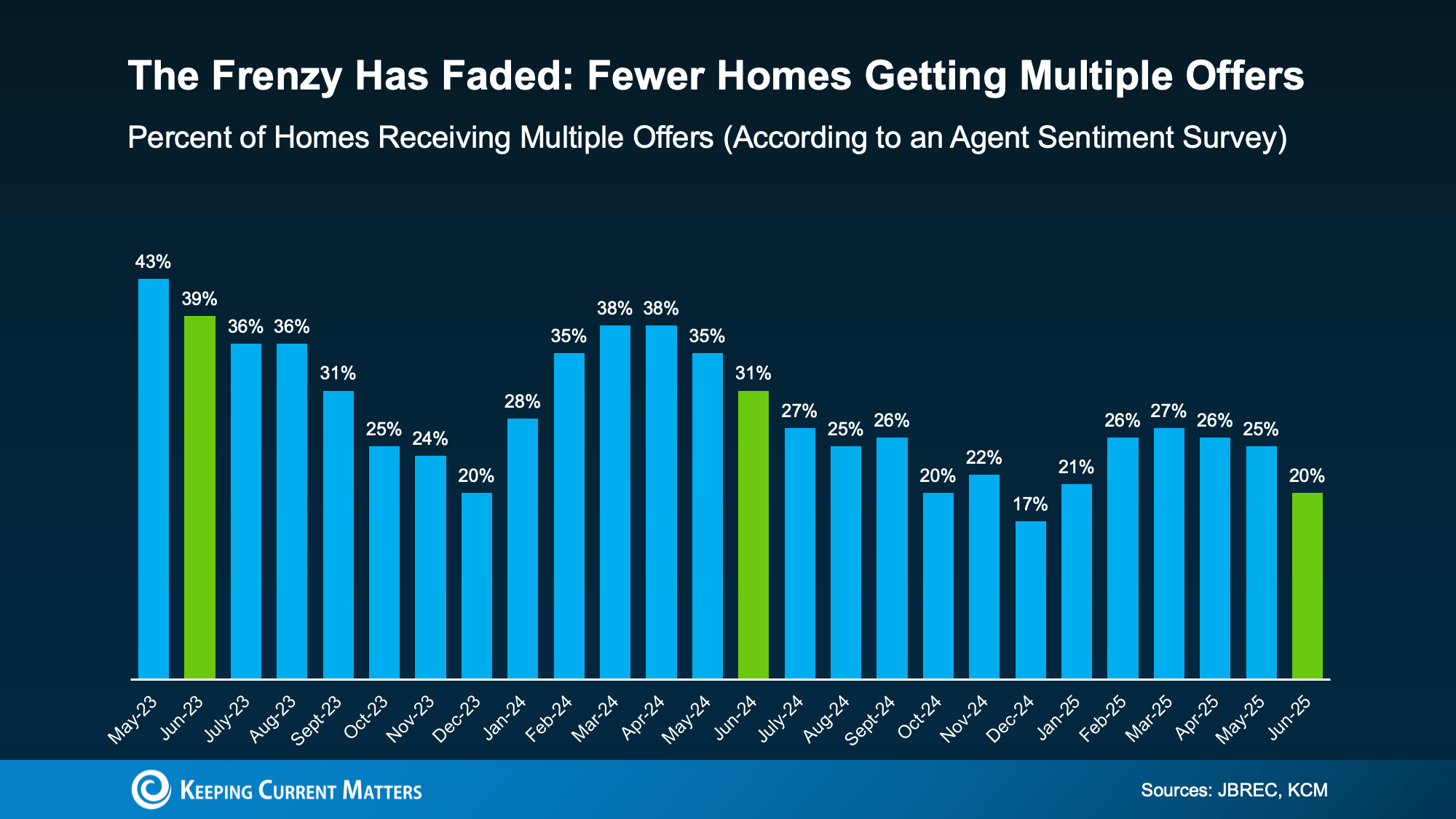

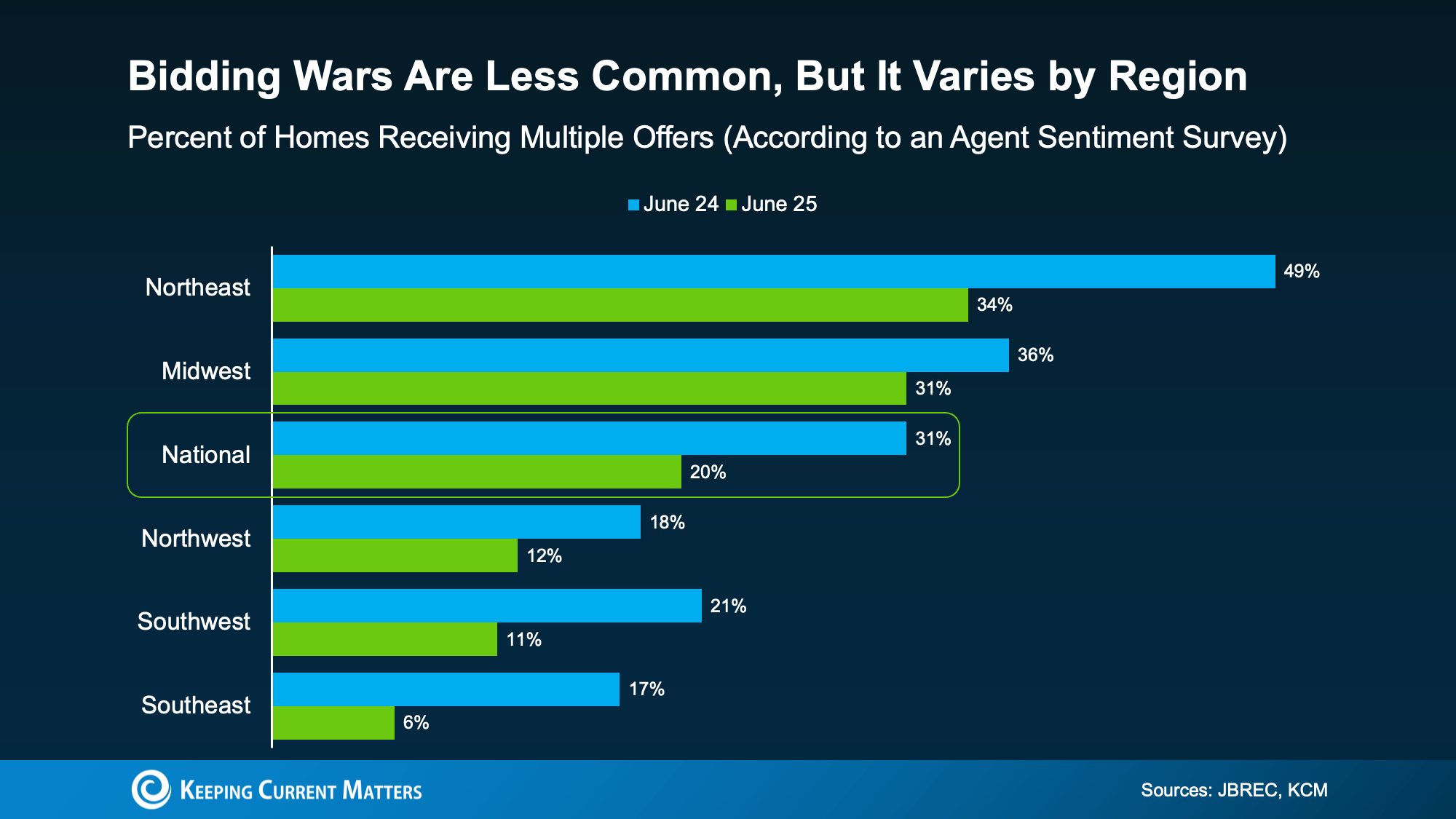

We’re seeing more listings pulled off the market, and locally we’re almost back to 2019 levels. The reality is the pool of buyers is smaller, so a growing number of listings aren’t going to make it to the finish line. But keep in mind, the total number of active listings today is 14% lower than what we had in 2019, so almost matching the number of cancellations back then is telling of a softer market today (duh, thanks).

SELLERS NEED TO ASK ONE QUESTION

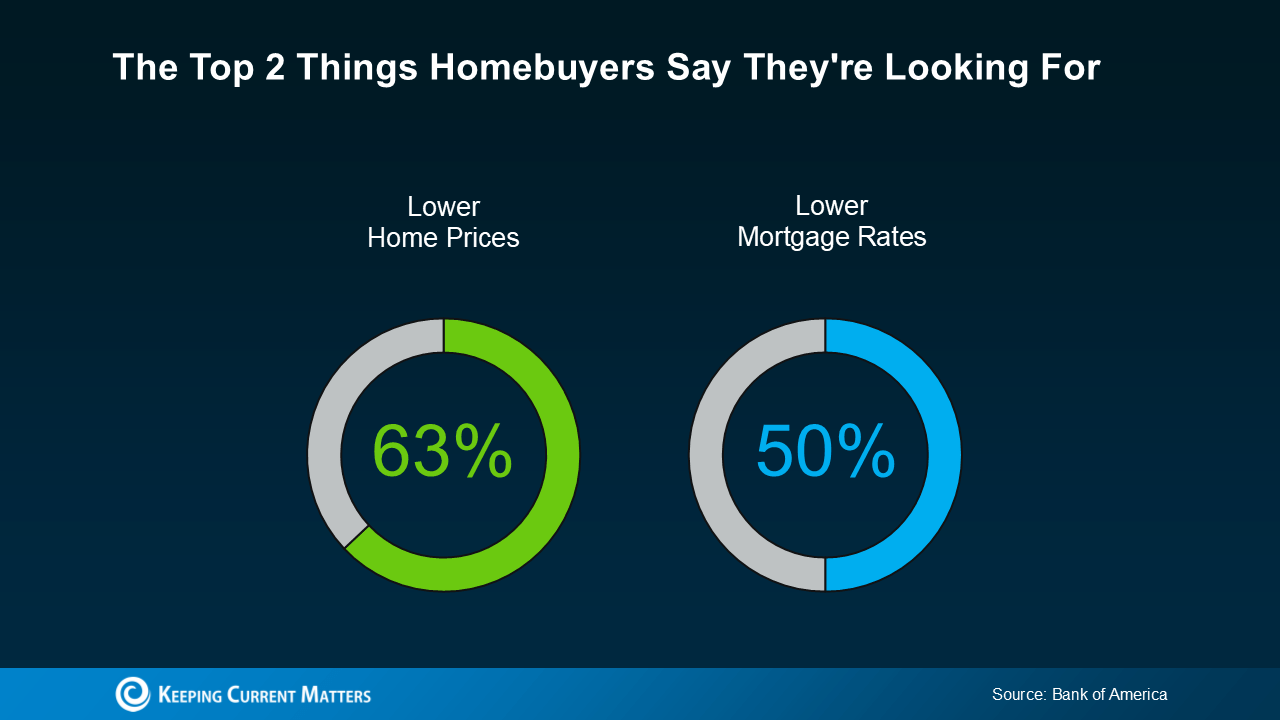

There is one question for sellers to ask today. How do you avoid becoming a cancellation? In other words, what does it take to become a sale in today’s market? I find some sellers are listening to a softer trend, but many are still stuck in the past in an aggressive market like 2021.

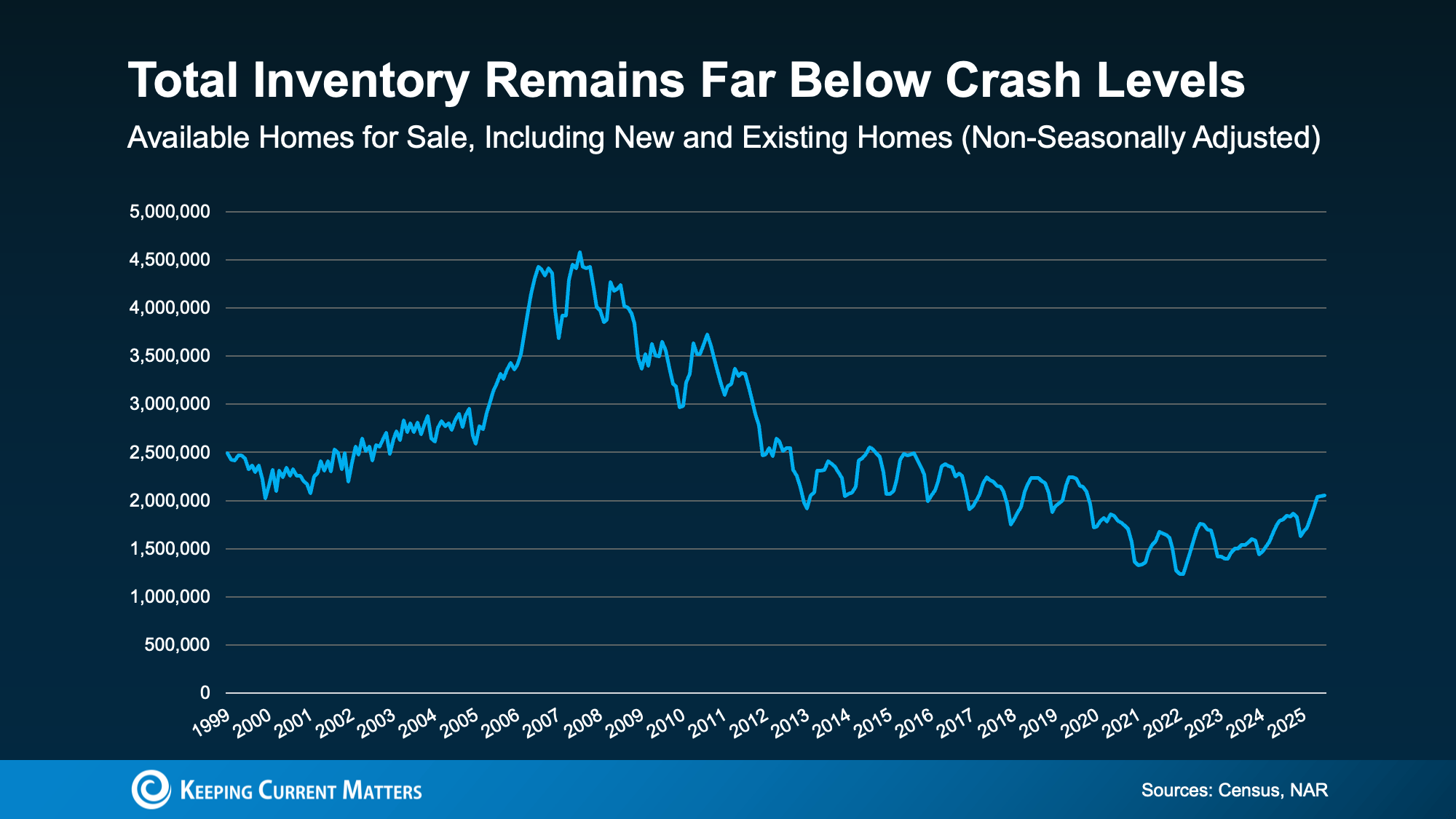

BE CAREFUL OF SAYING IT’S THE HIGHEST EVER

The narrative sometimes is that cancellations are the highest they’ve ever been, but that’s not real. One of the problems with some data sources is their stats only go back maybe ten years, so “highest ever on record” doesn’t include a year like 2007 or 2008. A good example is from Redfin’s data about sellers outnumbering buyers. The narrative quickly becomes, “Bro, we have more sellers than we’ve ever seen,” but that’s not statistically true. Look, I have nothing but love for Redfin, and I truly like their stats, but if we’re only looking at 2013 onward, we have to consider what “highest on record” really means. I’m not sugarcoating here, but older stats matter for the narrative too. On that note, I present you with cancellations from 2001 onward.

MORE CANCELLATIONS AT HIGHER PRICES

Higher prices are more overpriced, and we’ve seen more cancellations at the top. For instance, 50% of sales this year have been below $600,000 in the region, while 41% of cancellations have been under this price point. In contrast, above $1M represents about 10% of sales, but 28.5% of cancellations have been at this level. Here are cancellations by price range. I can develop this more if there is interest, so let me know what questions you have.

CONDO CANCELLATIONS ARE EVEN HIGHER

I mentioned this last week. The condo market is softer than the detached market, so it’s not a shocker to see more cancellations. Condos are having some headwinds in light of buyers being turned off from higher HOA fees, there could be a preference issue with attached living, and there are insurance and financing problems in the background. I wrote about SB326 last week too. This doesn’t mean every condo complex is having the same problems, so look to the comps in each location.

Listing cancellations for condos aren’t higher than ever either, but there is no mistaking condos are having a softer moment than detached units.

BUYERS & APPRAISERS SEE THE HISTORY

Sometimes sellers play games by removing a listing and then putting it back on the market, but buyers still see the history, and so do appraisers. Days on market keeps counting in MLS too unless the listing is removed for at least 30 days (may not be the case in every location). By the way, if you didn’t know, the Fannie Mae appraiser form asks appraisers to report on the listing history, so all the price changes and such literally get spelled out in the appraisal report. This is a good reminder that lenders see the history. In short, there is no hiding.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link