Is Buyer Demand Picking Back Up? What Sellers Should Know.

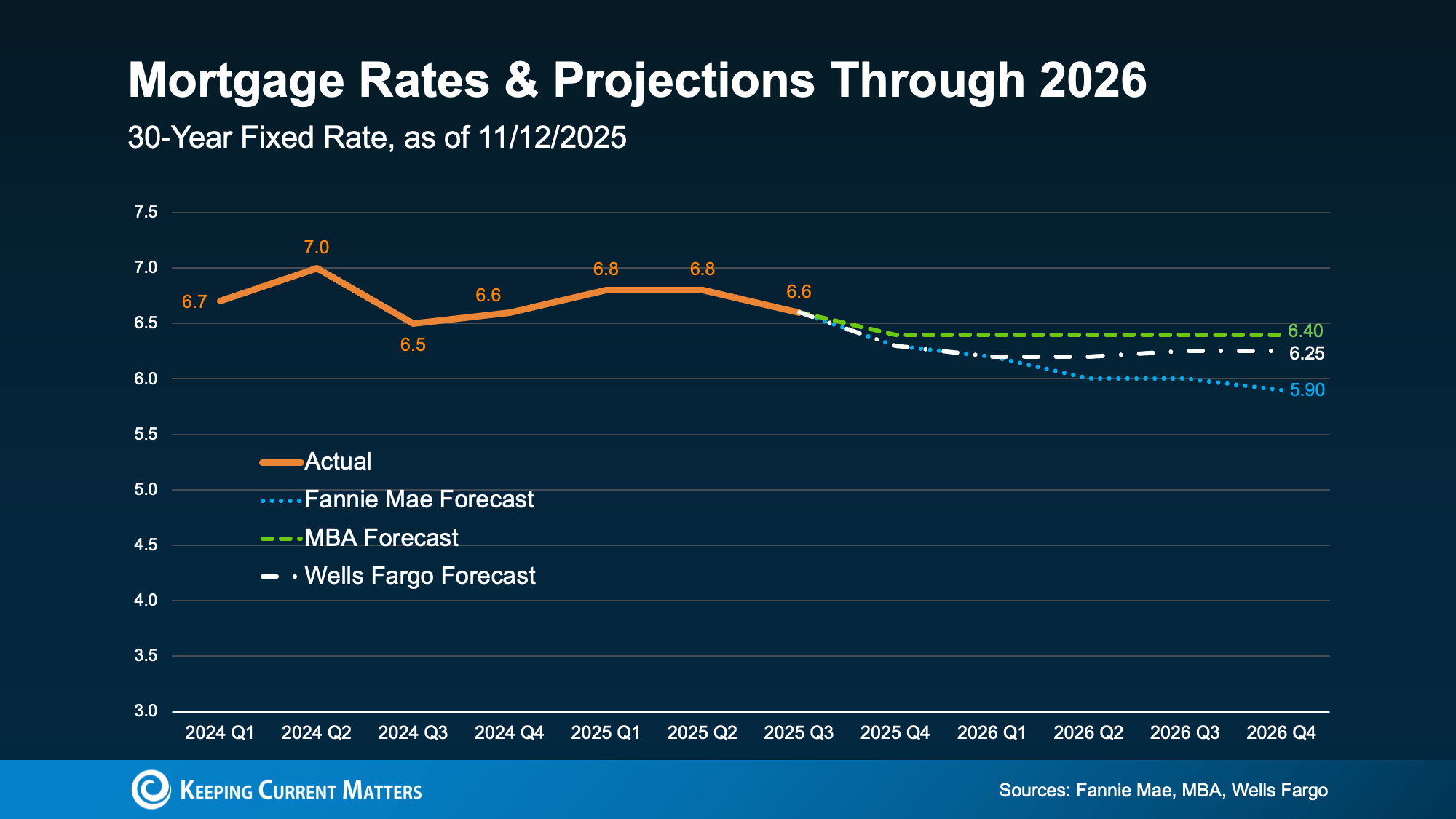

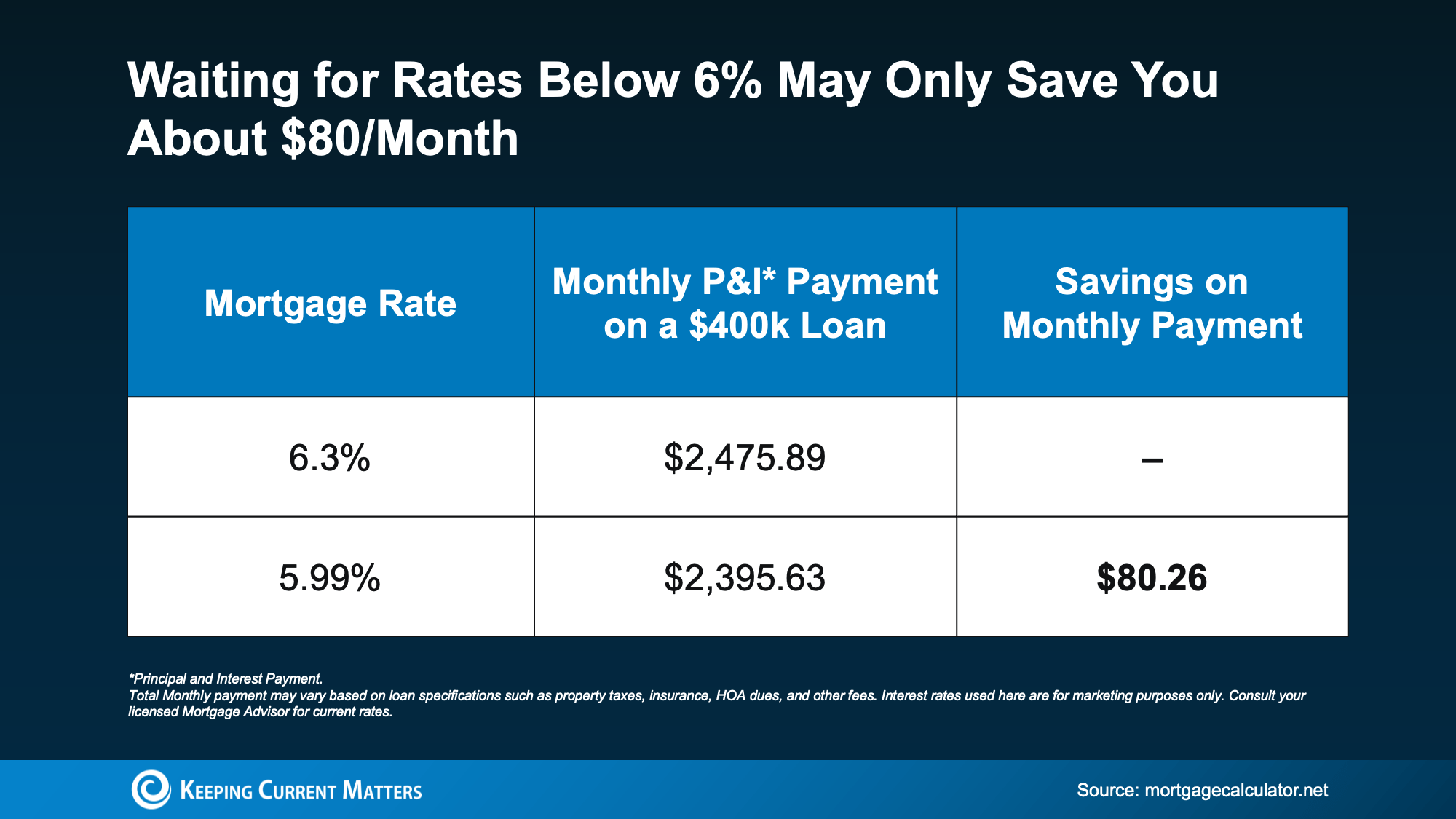

The housing market hasn’t felt this energized in a long time – and the numbers backing that up are hard to ignore. Mortgage rates have eased almost a full percentage point this year, and that shift is starting to wake up buyers.

Home loan applications have risen. Activity has picked up. And sellers who step in early could benefit from the momentum long before the competition catches on.

Let’s take a look at what’s happening behind the scenes and how you can take advantage of it.

When Rates Come Down, Buyer Activity Goes Up

In today’s market, buyer demand is closely tied to what happens with mortgage rates. As rates come down, applications for home loans go up. Rick Sharga, Founder and CEO of the CJ Patrick Company, explains it like this:

“We’re in an incredibly rate-sensitive environment today, and every time we’ve seen mortgage rates drop into the low-to-mid 6% range, we’ve seen an influx of buyers hit the market.”

And that’s exactly what the data shows. More people who were sidelined are applying for mortgages again now that borrowing costs have come down. Of course, that’s going to ebb and flow just like rates ebb and flow. But the bigger picture is, there’s been improvement as a whole since rates started coming down.

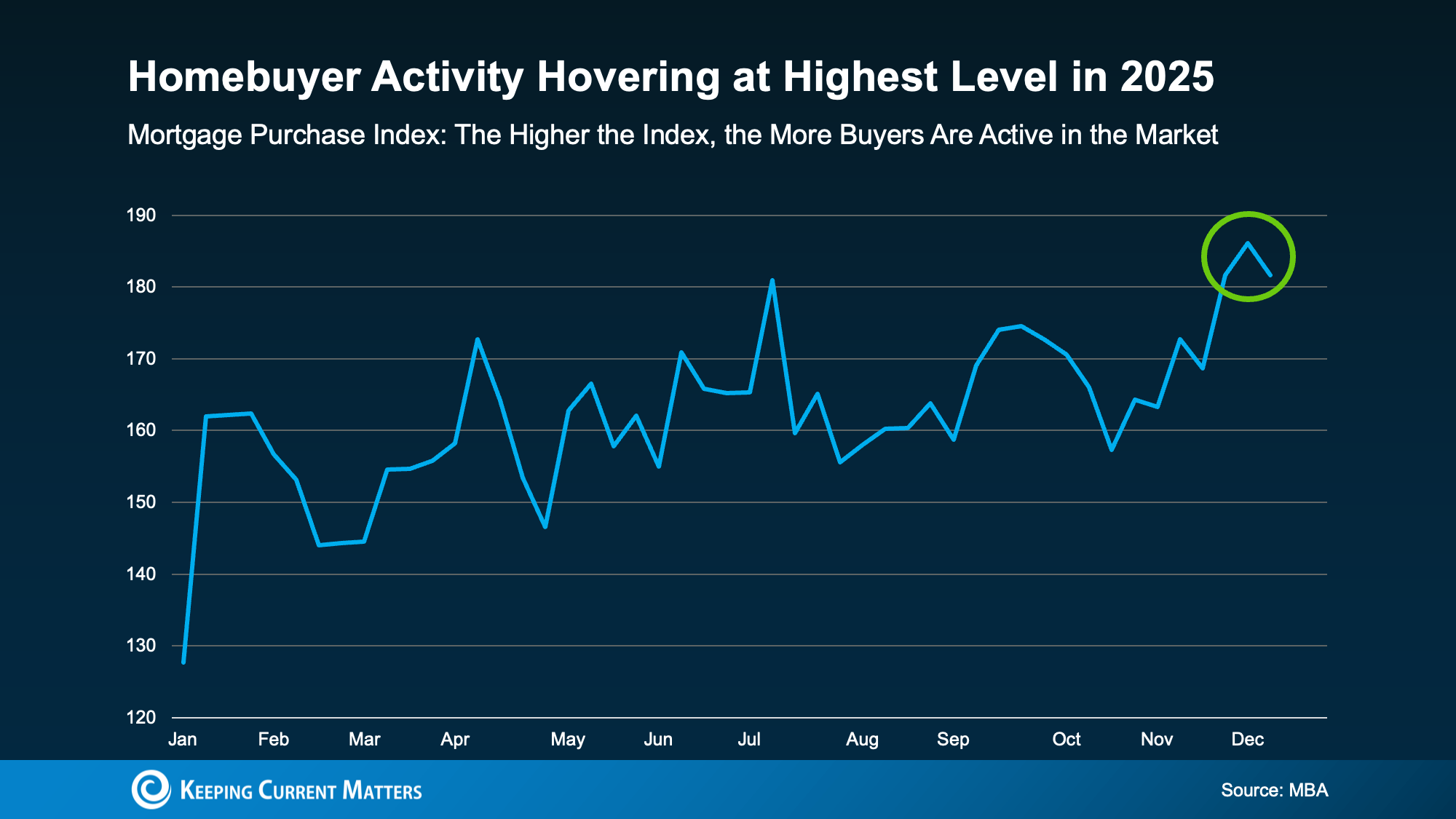

In fact, the Mortgage Bankers Association (MBA) shows the Mortgage Purchase Index is hovering at the highest level so far this year:

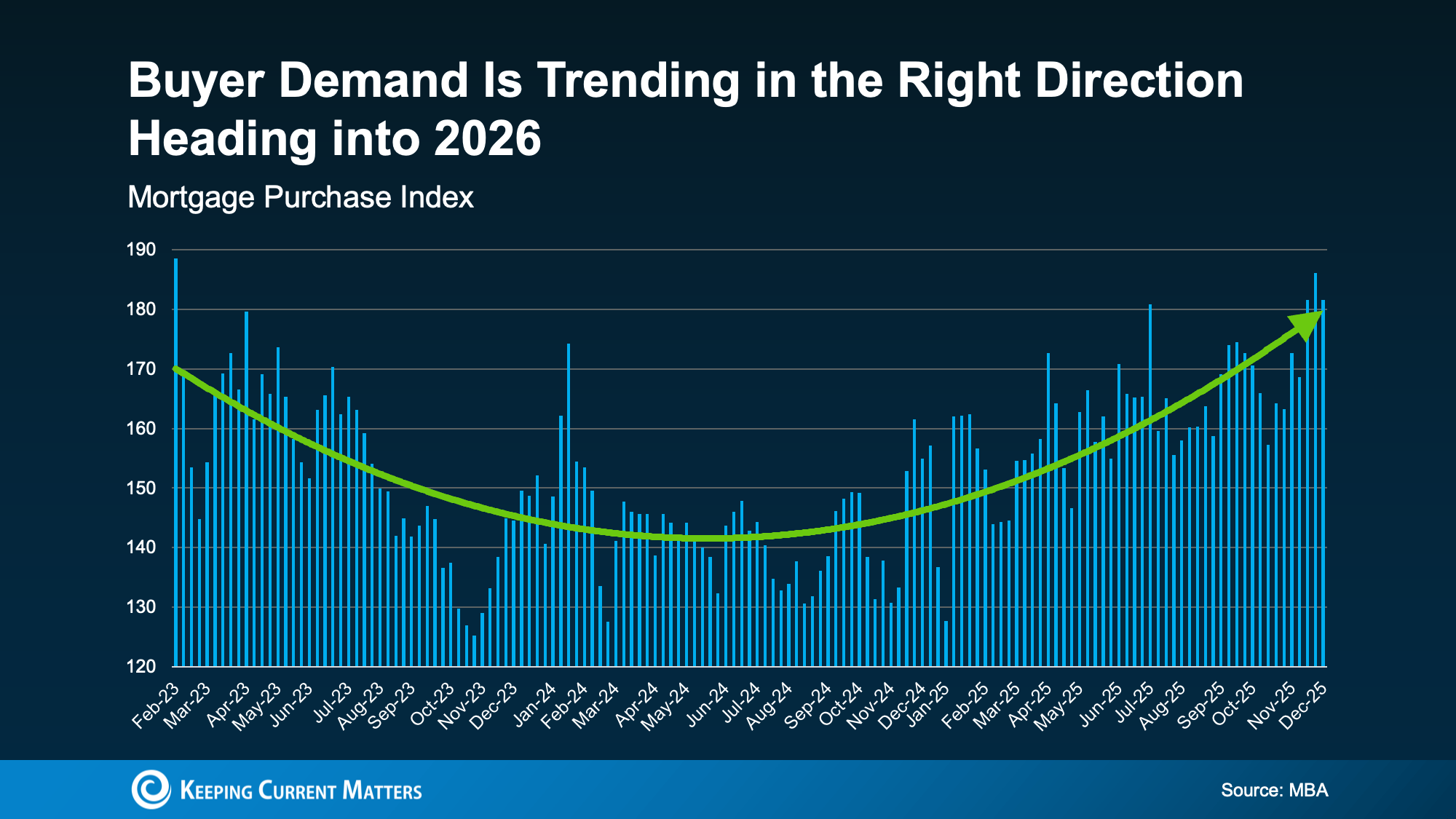

And that’s not the only sign of optimism. MBA also shows mortgage applications recently hit their highest point in almost 3 years too. A clear sign demand is moving in the right direction heading into 2026:

And just in case you were wondering, it’s not just pent-up demand coming out of the government shutdown that slowed some of the processing of government loans for a month or so. If you look back at the last graph, you’ll see the steady build-up of momentum throughout the entire year.

The big takeaway for you is this. Now that rates have come down, buyers are starting to ease back into the game. And that’s turning into real contracts on homes just like yours.

Home Sales Are Rebounding

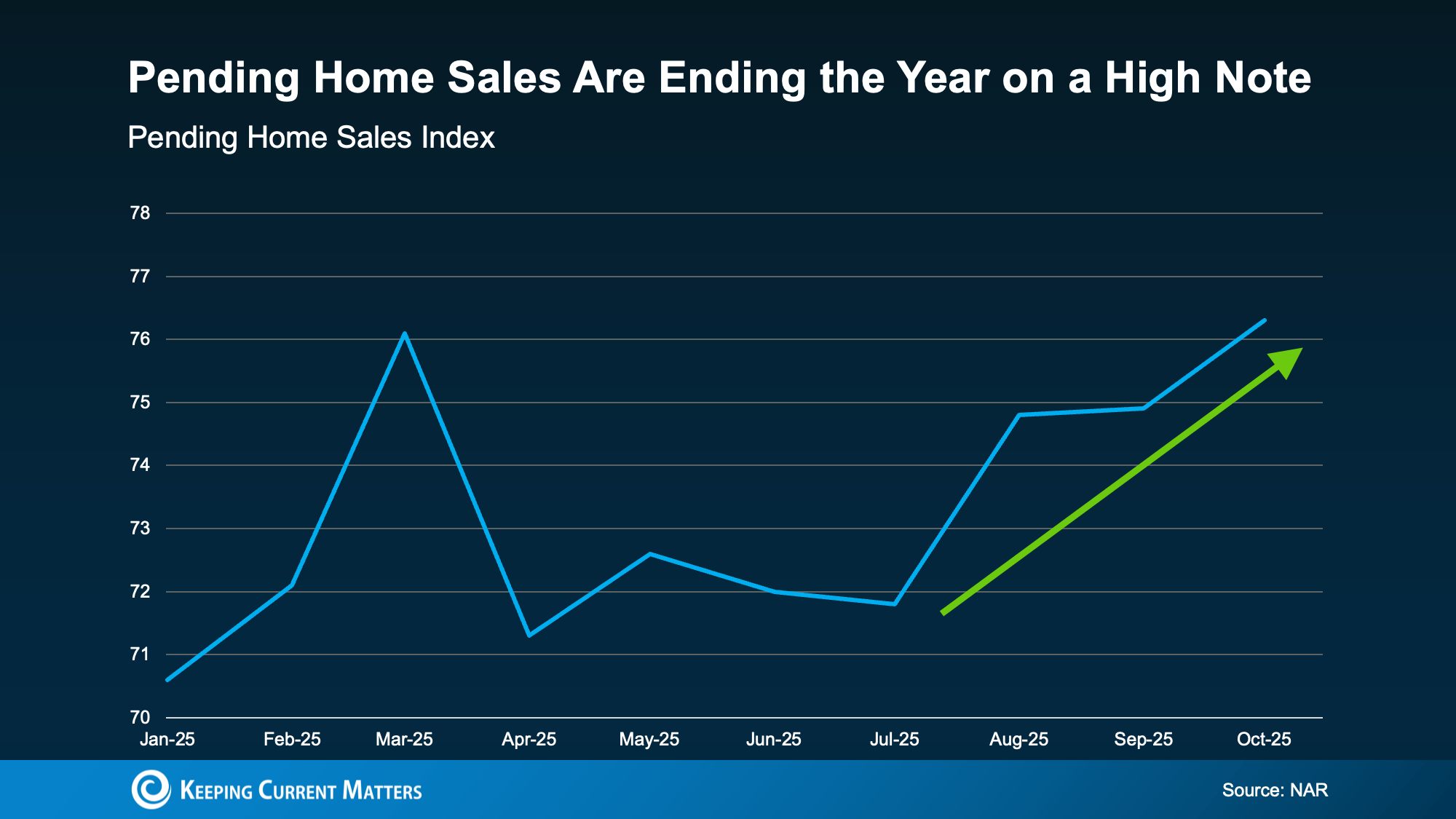

Just to really drive home that this is trending in a good direction, the most recent report from the National Association of Realtors (NAR) shows pending home sales (homes that are under contract) are picking up too. The Pending Home Sales Index is also at the highest it’s been all year (see graph below):

And that means the market is ending the year on a high note and headed into 2026 with renewed energy. While that may not seem like a big shift, it’s a rebound worth talking about.

Pending home sales are a leading indicator of where actual sales are going. If more homes are going under contract, it’s a good sign more homes will actually close over the next two months, ultimately boosting sales. This could be part of why experts project home sales will inch higher in 2026 than they were in 2025 or in 2024.

Of course, this may ebb and flow a bit as we see some year-end volatility with mortgage rates. But, it shouldn’t be enough to change this overall trend. Expert forecasts say rates should stay pretty much where they are throughout 2026. That means the stage is set for this momentum to continue going into the new year.

What This Means for You

Here’s the opportunity. Selling now means:

- More buyer demand. As affordability improves, you could see more buyer traffic and home showings (if your house is priced and staged right). And the best part? The buyers who are re-engaging feel like they’ve already waited too long for this moment. So, they’ll be eager to move.

- Being ahead of the curve. Listing sooner rather than later puts you ahead of the game, before other sellers realize something’s shifted.

Whether you’ve been putting off selling because you thought buyers weren’t buying, or you took your house off the market because you weren’t getting any bites, this is your sign to act.

Bottom Line

Want to know what’s happening with buyer activity in your area, and what it could mean if you want to sell your house in the new year?

Let’s talk about getting your house listed in early 2026, so you can take advantage of this momentum building in the market.

Thinking about Selling Your House As-Is? Read This First.

If you’re thinking about selling your house this year, you may be torn between two options:

- Do you sell it as-is and make it easier on yourself? No repairs. No effort.

- Or do you fix it up a bit first – so it shows well and sells for as much as possible?

In 2026, that decision matters more than it used to. Here’s what you need to know.

More Competition Means Your Home’s Condition Is More Important Again

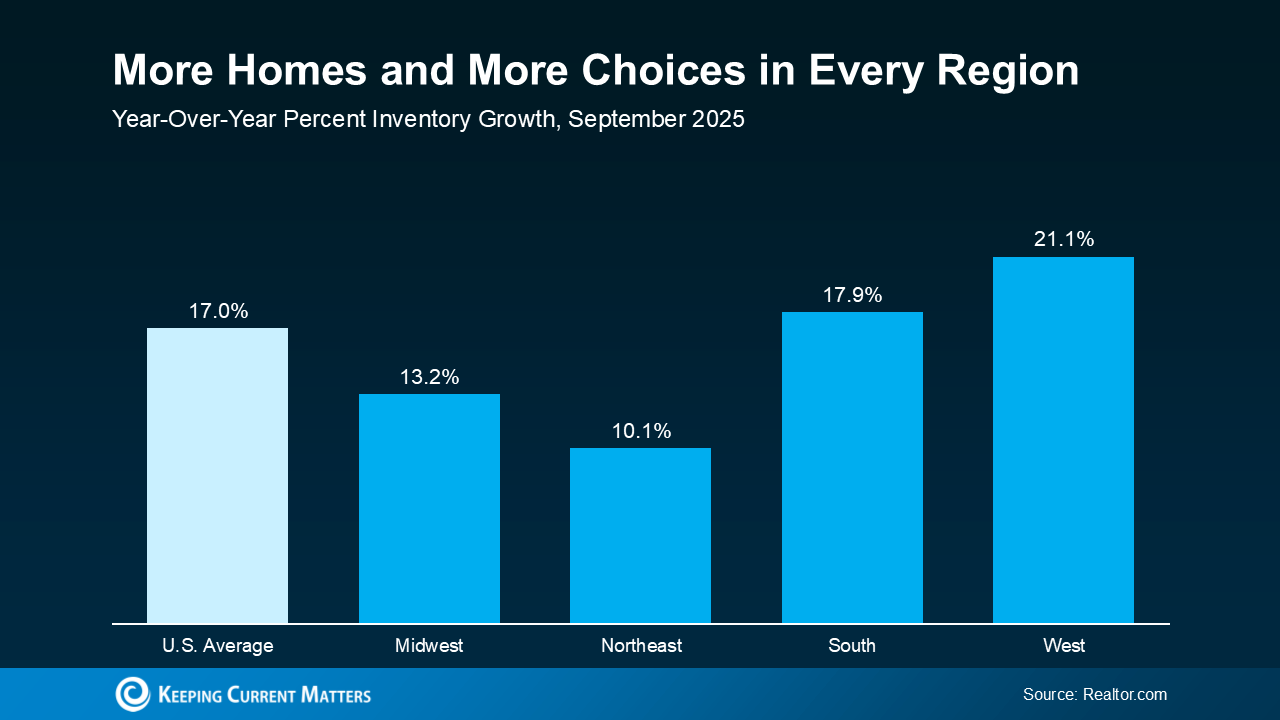

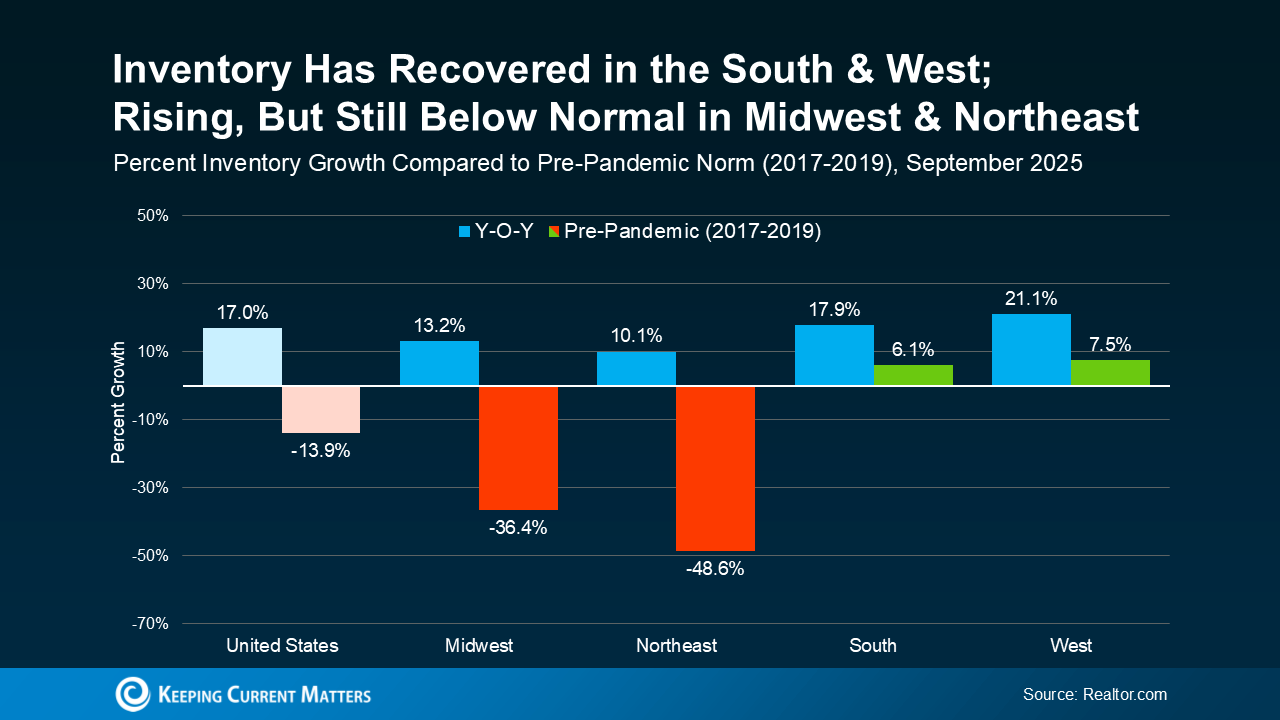

Over the past year, the number of homes for sale has been climbing. And this year, a Realtor.com forecast says it could go up another 8.9%. That matters. As buyers gain more options, they also re-gain the ability to be selective. So, the details are starting to count again.

That’s one reason most sellers choose to make some updates before listing.

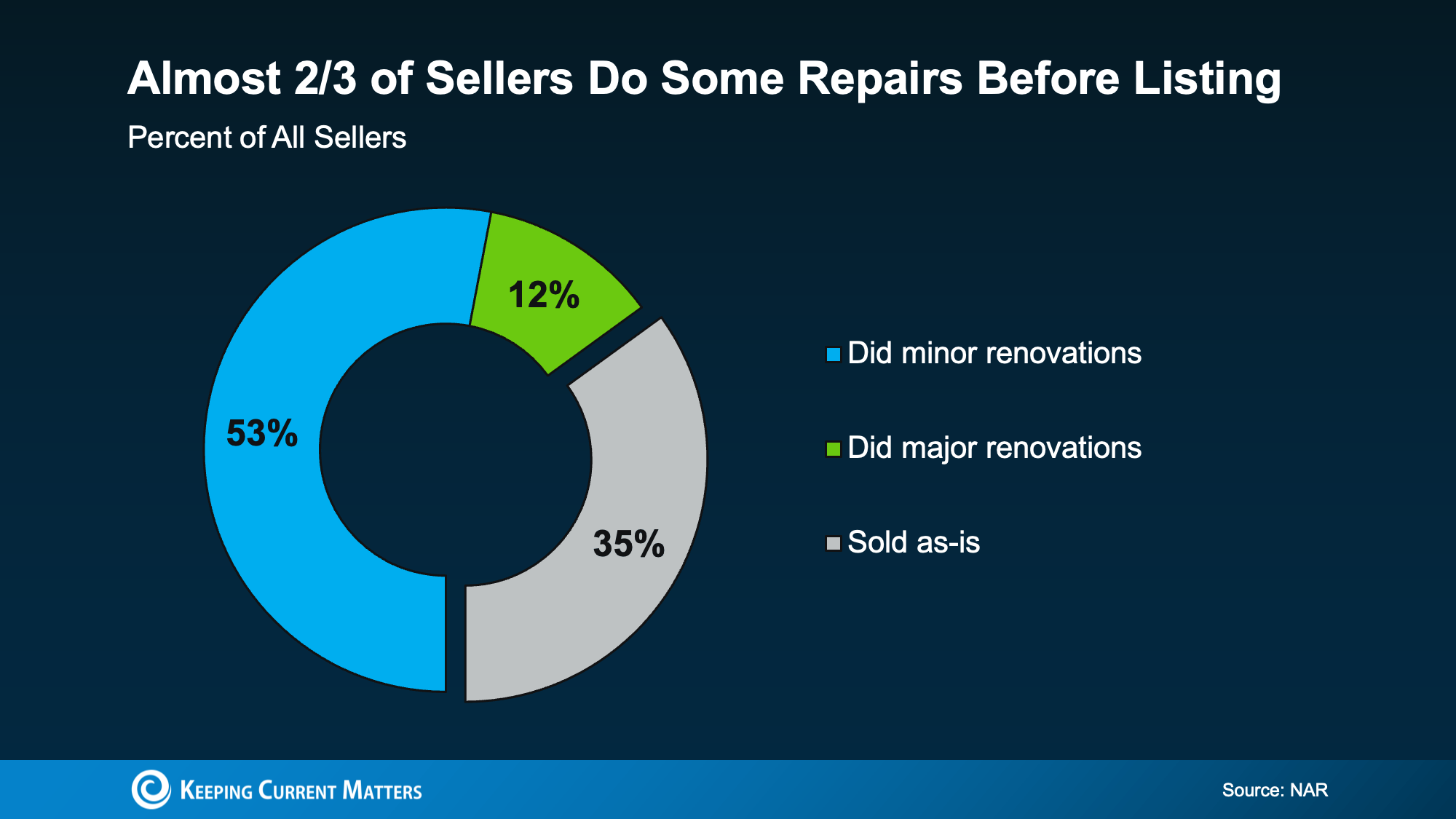

According to a recent study from the National Association of Realtors (NAR), two-thirds of sellers (65%) completed minor repairs or improvements before selling (the blue and the green in the chart below). And only one-third (35%) sold as-is:

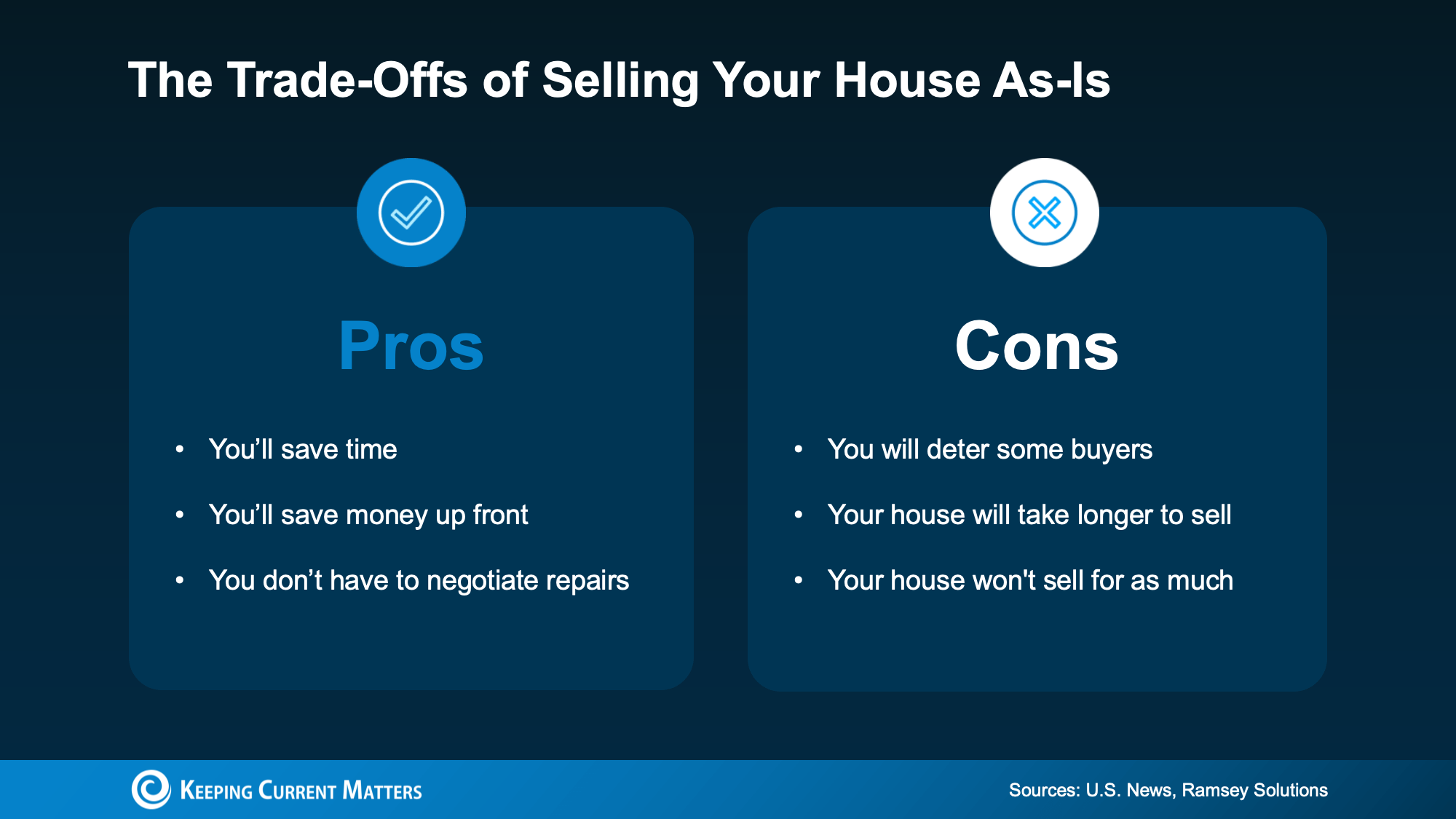

What Selling As-Is Really Means

Selling as-is means you’re signaling upfront that you won’t handle repairs before listing or negotiate fixes after inspection. That can definitely simplify things on your end, but it also narrows your buyer pool.

Homes that are move-in ready typically attract more buyers and stronger offers. On the flip side, when a home needs work, fewer buyers are willing to take it on. That can mean fewer showings, fewer offers, more time on the market, and often a lower final price.

It doesn’t mean your house won’t sell – it just means it may not sell for as much as it could have.

How an Agent Can Help

So, what should you do? The answer isn’t one-size-fits-all. It’s going to depend a lot on your house and your local market.

And that’s why working with an agent is a must. The right agent will help you weigh your options and anticipate what your house may sell for either way – and that can be a key factor in your final decision.

- If you choose to sell as-is: They’ll call attention to the best features, like the location, size, and more, so it’s easy for buyers to see the potential, not just the projects.

- If you decide to make repairs: Your agent can pinpoint what’s really worth the time and effort based on your budget and what buyers care about the most.

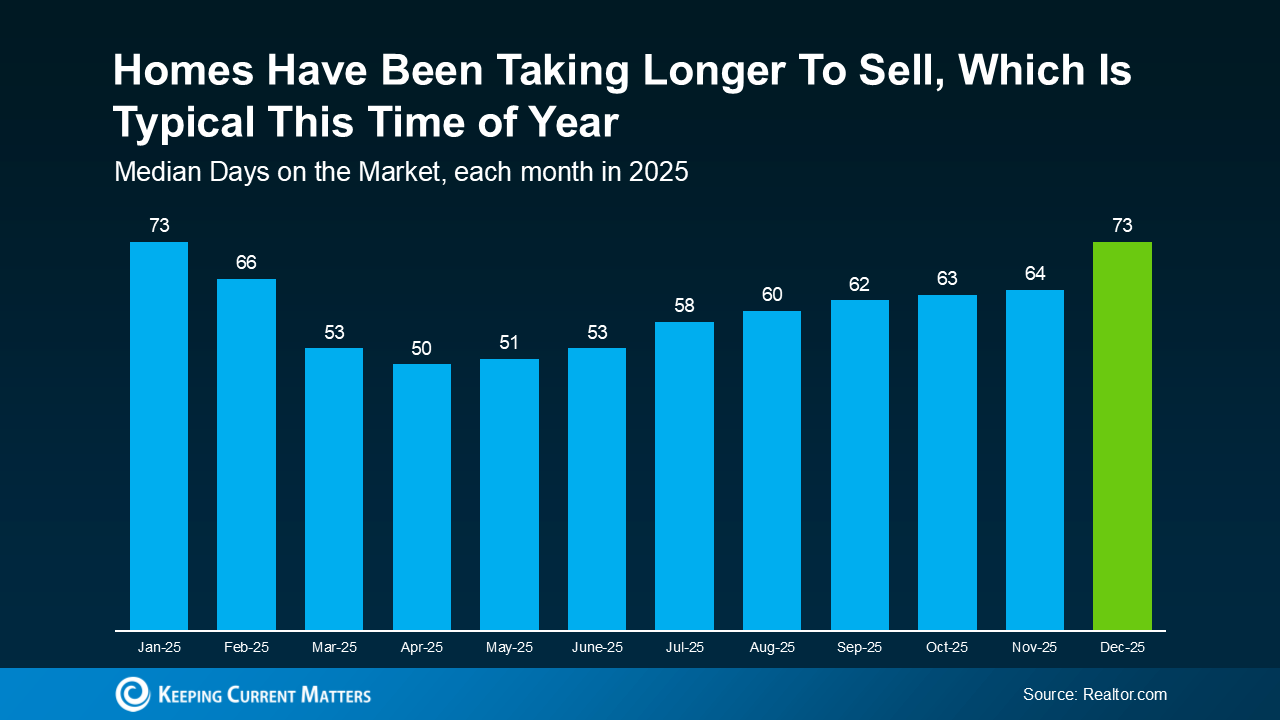

The good news is, there’s still time to get repairs done. Typically speaking, the spring is the peak homebuying season, so there are still several months left before buyer demand will be at its seasonal high. That means you have time to make some repairs, without rushing or stressing, and still hit the listing sweet spot.

The choice is yours. No matter what you end up picking, your agent will market your house to draw in as many buyers as possible. And in today’s market, that expertise is going to be worth it.

Bottom Line

While selling as-is can still make sense in certain situations, in some markets today, it may cost you. So, no, you don’t have to make repairs before you list. But you may want to.

To make sure you’re considering all your options and making the best choice possible, give me a call to have a quick conversation about your house.

Locked In Place: Why Millions of Homeowners Can’t Afford to Move

For years, America’s housing challenges have been framed as a simple supply-and-demand problem—low inventory, rising interest rates, and affordability constraints. But beneath those familiar headlines lies a deeper, structural issue we unintentionally created.

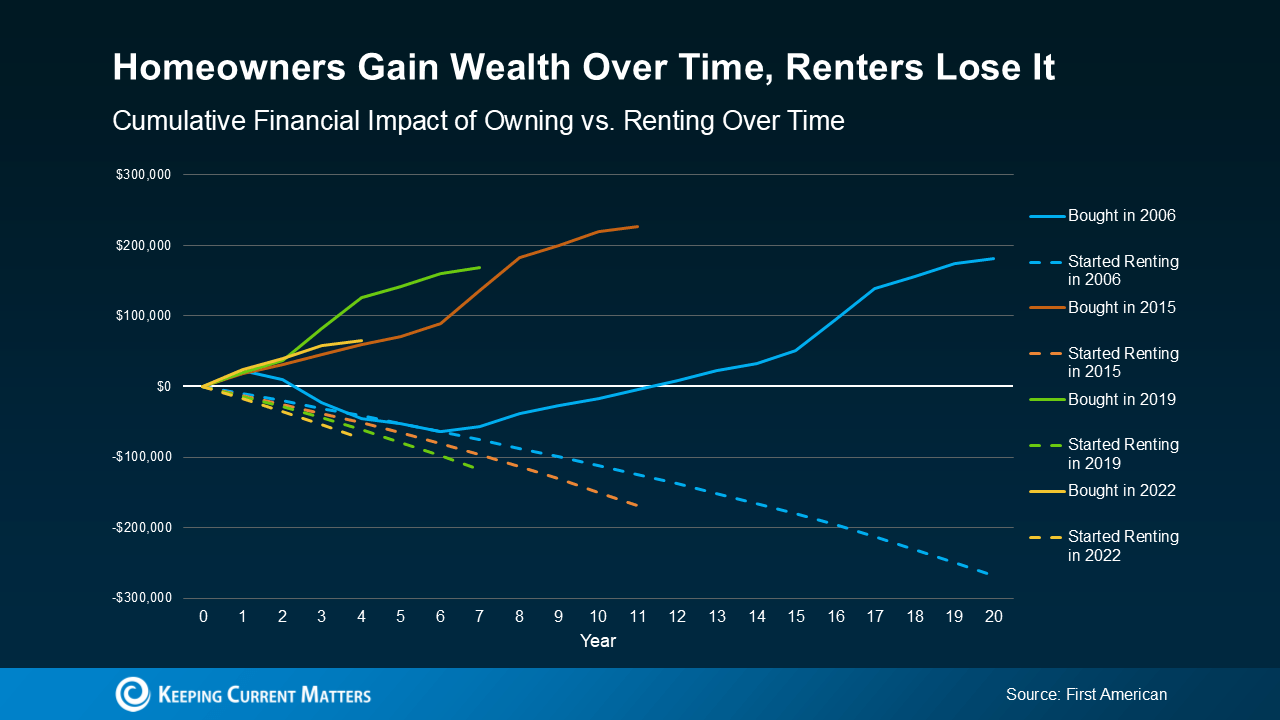

Today, millions of homeowners are wealthier on paper than ever before. They hold record levels of equity and historically low mortgage rates. Yet many of them cannot afford to move.

Not because they lack buying power.

But because moving no longer makes financial sense.

The Mortgage Lock-In Effect

Recent national data shows just how severe this gap has become. According to Realtor.com, the typical U.S. homeowner currently pays about $1,300 per month in principal and interest. Selling that home and purchasing a “typical” home today would require a monthly payment of approximately $2,236—a 73% increase in housing cost.

This growing gap is known as the mortgage lock-in effect. Homeowners who secured ultra-low rates during 2020–2021 are effectively trapped by them. Giving up a 3% mortgage to buy into today’s higher-rate, higher-price market often means paying significantly more—sometimes for a comparable or even smaller home.

The market isn’t frozen because people don’t want to move.

It’s frozen because moving comes with a financial penalty.

From Pandemic Stimulus to Market Stagnation

When mortgage rates fell below 3% during the pandemic, buyers surged into the market. Millions refinanced. Millions more purchased homes. Cheap financing softened the sting of rising prices, allowing values to climb rapidly—often 25% to 40% in many markets.

When inflation followed, rates snapped back sharply. Prices, however, did not.

The same mechanism that once encouraged mobility now suppresses it.

Federal housing research confirms this effect. A Federal Housing Finance Agency (FHFA) working paper estimates that rising mortgage rates have prevented millions of otherwise normal home sales by discouraging owners from listing their homes.

Why Homeowners Are Staying Put

It’s easy to assume homeowners stay because they “love their homes.” Many do—but that only tells part of the story. The real constraint is financial.

Homeowners face a stark choice:

-

Give up an exceptionally low interest rate

-

Buy into a market with both higher prices and higher borrowing costs

Even selling at a profit often results in higher monthly expenses and reduced flexibility. Equity becomes difficult to use when accessing it raises your cost of living.

This isn’t a lifestyle decision.

It’s a structural trap.

The Ripple Effect on the Housing Market

When homeowners can’t move, inventory shrinks. When inventory shrinks, affordability worsens—especially for first-time buyers.

This dynamic is already visible. Sellers are increasingly choosing to pull listings rather than cut prices or trade into higher-rate mortgages. According to Investopedia, delistings surged 45% year over year, highlighting the reluctance of owners to transact under current conditions.

Low inventory, in this context, is not the cause—it’s the symptom.

How We Unlock a Trapped Housing Market

This is not a short-term cycle. It’s a structural flaw that requires structural solutions:

-

Portable and assumable mortgages that allow buyers to take over existing low-rate loans

-

Incentives for downsizing and life transitions, particularly for long-time homeowners

-

Housing built for real demand, including townhomes, ADUs, and smaller, more attainable options

-

Modern mortgage products designed for flexibility and mobility—not just long-term lock-in

-

Greater transparency around equity use, so homeowners understand the true cost of moving

The Bottom Line

We built a housing system that rewards people for staying put and penalizes them for moving. The result is equity without freedom, ownership without mobility, and a market that struggles to function.

Mobility is not a luxury. It is a cornerstone of economic health and household well-being.

If we want a housing market that truly works, we must stop celebrating locked-in equity and start creating real pathways forward.

The American Dream only works if people can move with it.

Sources:

Source: Realtor.com – A 73.2% Spike in Monthly Payments for Moving Traps U.S. Homeowners in Place

Source: Investopedia – Delistings Jump 45% as Sellers Pull Homes Rather Than Cut Prices

Source: FHFA – The Lock-In Effect of Rising Mortgage Rates (PDF)

Why Overpricing Is Hurting Sellers in Today’s Market

If you’re a homeowner thinking about selling—or already on the market—this is a must-read. Ryan Lundquist of the Sacramento Appraisal Blog has penned a powerful open letter to sellers whose homes aren’t moving because they’re priced too high. In today’s shifting market, buyers are more selective than ever, and homes that don’t check all the boxes—especially on price—are being passed over.

Ryan breaks down why the red-hot market of 2021 is behind us, and how today’s buyers are demanding more for their money. He also introduces the concept of the “purple pill”—a combination of price reductions and buyer concessions—as a strategy for sellers to stay competitive.

If you’re wondering why your home isn’t selling or want to avoid common pricing pitfalls, I highly recommend reading the full post. It’s honest, insightful, and packed with practical advice.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link