What Is Home Staging?

It’s not about making your house look super trendy or like it belongs in a magazine. It’s about helping it feel welcoming and move-in ready, so it’s easy for buyers to picture themselves living there.

It’s important to understand there’s a range when it comes to staging. It can include everything from simple tweaks to more extensive setups, depending on your needs and budget. But a little bit of time, effort, and money invested in this process can really make a difference when you sell – especially in today’s market.

A study from the National Association of Realtors (NAR) shows staged homes sell faster and for more money than homes that aren’t staged at all (see below):

Which Rooms Matter Most?

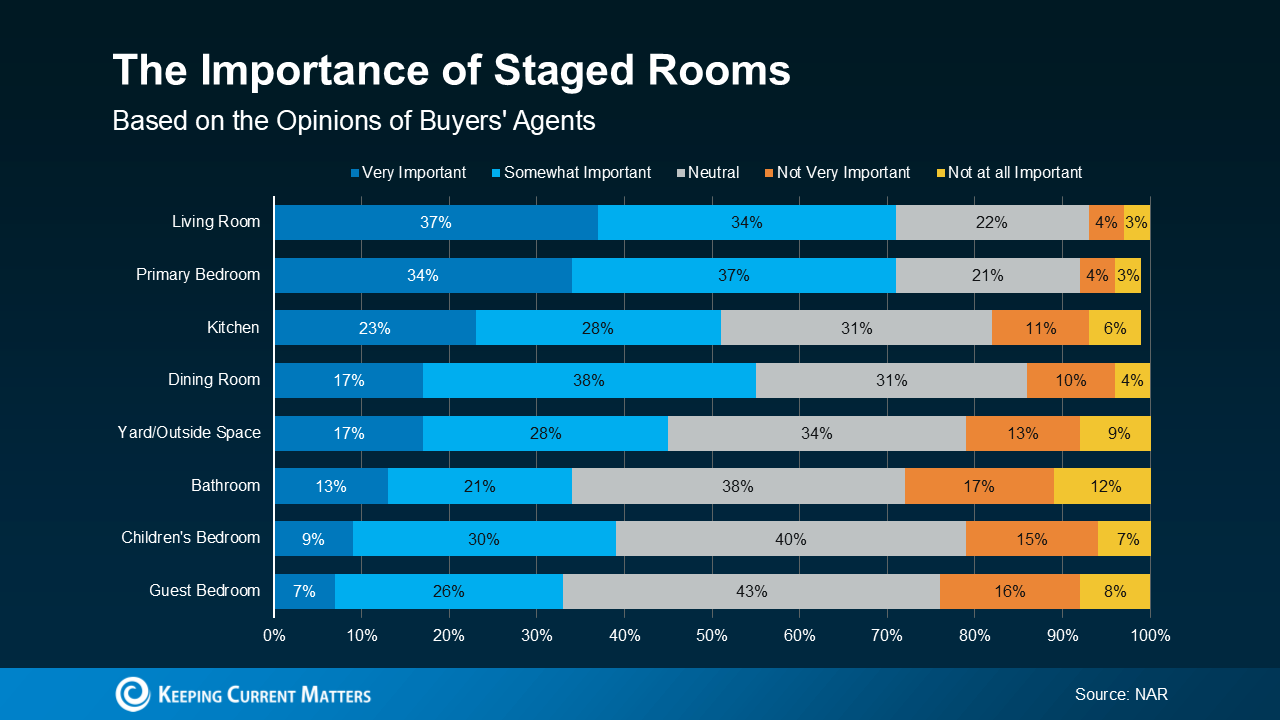

The best part is, odds are you don’t have to stage your whole house to make an impact. According to NAR, here’s where buyers’ agents say staging can make the biggest difference (see graph below):

As you can see, agents who talk to buyers regularly agree, the most important spaces to stage are the rooms where buyers will spend the most time, like the living room, primary bedroom, and kitchen.

As you can see, agents who talk to buyers regularly agree, the most important spaces to stage are the rooms where buyers will spend the most time, like the living room, primary bedroom, and kitchen.

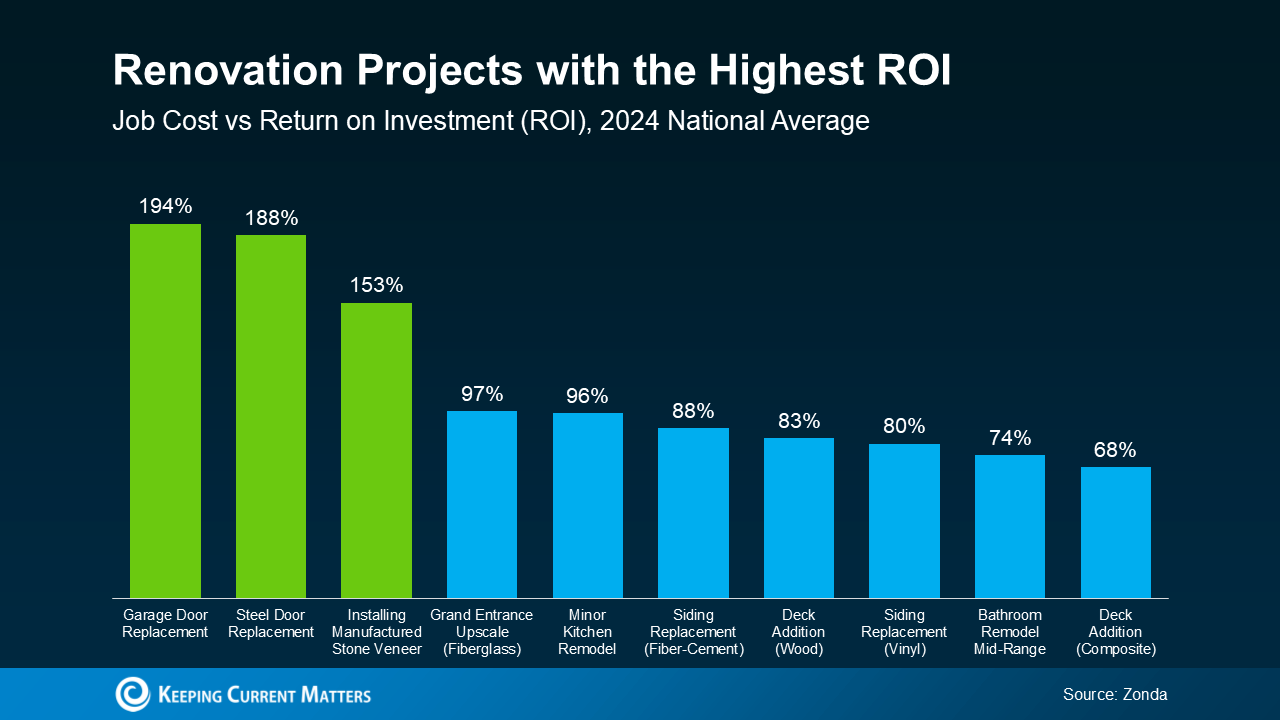

While this can give you a good general idea of what may be worth it and what’s probably not, it can’t match a local agent’s expertise.

How an Agent Helps You Decide What You Need To Do

Agents are experts on what buyers are looking for where you live, because they hear that feedback all the time in showings, home tours, walkthroughs, and from other agents. And they’ll use those insights to give their opinion on your specific house and what areas may need a little bit of staging help, like if you need to:

- Declutter and depersonalize by removing photos and personal items

- Arrange your furniture to improve the room’s flow and make it feel bigger

- Add plants, move art, or re-arrange other accessories

A lot of buyers can use the agent’s know-how as the only staging advice they need. But, if your home needs more of a transformation, or it’s empty and could benefit from rented furniture, a great agent will be able to determine if bringing in a professional stager might be a good idea, too. Just know that level of help comes with a higher price tag. NAR reports:

“The median dollar value spent when using a staging service was $1,500, compared to $500 when the sellers’ agent personally staged the home.”

A local agent will help you weigh the costs and benefits based on your budget, your timeline, and the overall condition of your house. They’ll also consider how quickly similar homes are selling nearby and what buyers are expecting at your price point.

Bottom Line

Staging doesn’t have to be over-the-top or expensive. It just needs to help buyers feel at home. And a great agent will help you figure out the level of staging that makes the most sense for your goals.

Which room in your house do you think would make the biggest impression on a buyer?

I can do a walk through of your home with you and go over what will make your house stand out.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link