Top Features That Will Boost Home Values in 2023

With rising mortgage rates, many homeowners are worried about the sales prices of their homes. However, according to a recent report from Zillow, there are many things you can do to increase buyer appeal and value.

The real estate website compiled data from nearly two million homes listed for sale in 2022, analyzing home prices, along with 271 features and design terms mentioned in the listing descriptions. According to the report, these are the features that corresponded to higher home sale prices. Selling your home soon? Here are the elements you’ll definitely want to highlight.

Culinary Amenities Are Hotter Than Ever

According to Zillow’s research, listings that boost a home’s value also make a chef’s mouth water. Amenities such as steam ovens, pizza ovens, and, professional-grade appliances increased sales prices by as much as 5.3 percent, compared to similar listings that didn’t have these features. These elements can add up to $17,400 to the value of a typical home in the United States.

“Not every buyer will appreciate a chef’s kitchen or a putting green in their backyard, but those who do are willing to pay more for these personalized amenities,” says Amanda Pendleton, Zillow’s home trends expert. “Post-pandemic home buyers who had plenty of time for self-reflection now have a greater sense of what they want and need in a home.”

Homes that noted soapstone in the listing sold for 2.5 percent more than similar homes with old standbys marble and granite.

Another notable finding was that 2022 was the second year in a row that quartz was a highly coveted finish. So, if you are renovating your kitchen or bathroom in hopes of selling your home in the upcoming years, it’s definitely worth it to take a look at this durable finish that’s relatively affordable compared to many stone alternatives.

Sheds Help Sell

Sheds sell homes—especially those repurposed as private living spaces, such as offices, relaxation rooms, yoga studios, and more. These ADUs garnered a premium of 2.5 percent. So if you’ve added one in recent years, it was likely worth the investment.

Just keep in mind that homes with these sheds spent an extra two days on the market. Still, this is really no time at all considering the extra cash.

Modern Farmhouse Isn’t Going Anywhere

But these weren’t the only interesting findings of Zillow’s research. The report also stated that modern farmhouses increased in value by 2.4 percent. While many argue they’re tired of the modern farmhouse trend, it’s still a popular choice that buyers are looking for.

Want to Sell Your Home Faster?

The report also shared data on the amenities that helped homes sell more quickly. If you’re looking to get out of your home fast, think about adding easy and relatively affordable upgrades, such as doorbell cameras, heat pumps, and fenced backyards.

https://www.realsimple.com/features-that-boost-home-values-2023-7375268

Homeowners’ Zeal for Curb Appeal May Pay Off Handsomely

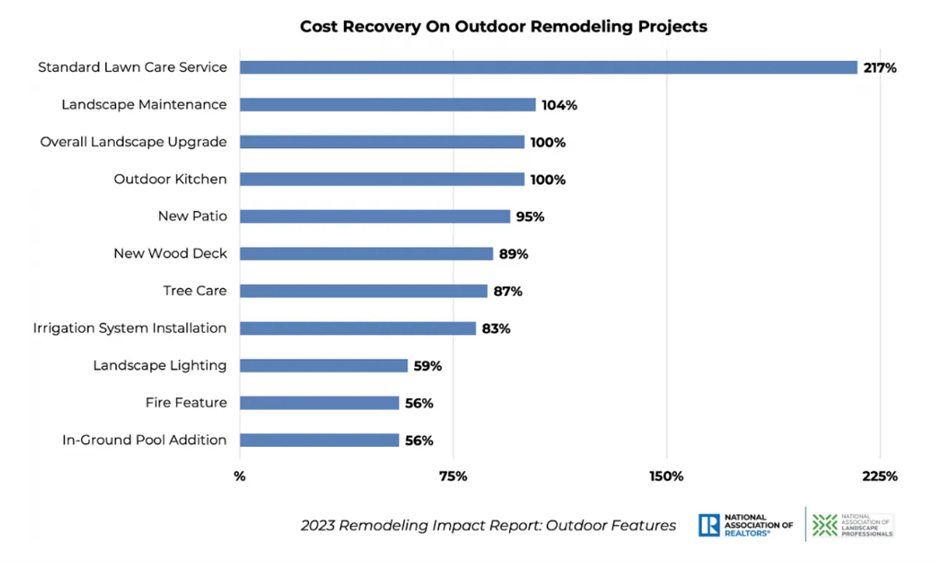

The COVID-19 pandemic changed the way Americans use their homes for daily living, relaxation and entertainment, adds Jessica Lautz, NAR’s deputy chief economist and vice president of research. “Homeowners have embraced their outdoor spaces, transforming them into oases with pools, patios, plants and greenery,” Lautz says. “These outdoor features … can also attract buyers if the owner wants to sell.”

Prioritizing Outdoor Projects for Resale

Most homeowners indicate a desire for an in-ground pool or an outdoor fire feature, but the ROI on these items may not be as high as simple lawn care and landscape maintenance, the report finds. The survey defines “standard lawn care service” as six seasonal applications of fertilizer and/or weed control on a 5,000-square-foot lawn and “landscape maintenance” as mulch application, regular lawn mowing, pruning shrubs and planting about 60 perennials or annuals.

The features that make homeowners happiest, however, aren’t necessarily the ones that earn the most at resale. The least expensive projects, such as standard lawn care service, have the highest cost recovery but one of the lowest “joy” rankings from homeowners, according to the survey. Instead, the report found that the following outdoor projects received the highest satisfaction marks among homeowners:

- In-ground pool

- Landscape lighting

- New patio

- New wood deck

- Fire feature

On the other hand, the items that ranked the lowest on homeowners’ “joy” scale were:

- Outdoor kitchen

- Tree care

- Standard lawn care service

- Installing a yard irrigation system

The majority of landscape professionals surveyed say the size and scope of outdoor home improvement projects have increased since the pandemic began. REALTORS® surveyed say the landscape projects they’ve seen most often since the pandemic began are the addition of an in-ground pool, landscape maintenance and a new patio.

How to avoid being ‘house-rich, cash-poor’ by selecting the right mortgage for your budget

Owning a home doesn’t just put a roof over your head — it can also put money in your pocket (at least on paper). According to a 2022 report from the National Association of Realtors, single-family homeowners accumulated an average of $225,000 in wealth from their homes during a 10-year period.

But what if the equity you hold in your most valuable asset doesn’t make you feel any richer when you’re looking at your bank accounts?

How to avoid becoming house-poor

The best protection against becoming house-poor is getting a mortgage that works with your budget.

First, think about the size of your mortgage loan. Financial experts generally recommend the loan stay below 2.5 to 3 times your annual salary. This means that if your household’s gross annual income is $160,000, you shouldn’t take out a mortgage loan that’s more than $480,000.

Next, consider how much you’re comfortable spending on housing expenses every month. The general advice here is to keep your monthly mortgage payment under 30% of your monthly income. For example, if your monthly paycheck before taxes is $6,000, you should aim for a mortgage payment of $1,800 or less.

Finally, make sure to shop around for the best mortgage rate when you’re ready to buy. A small difference in the interest rate can shave off hundreds of dollars of your mortgage payments. Some of CNBC Select’s favorite mortgage lenders include Chase Bank, which offers flexible down payment options, and SoFi, which advertises discounts and cash incentives for home buyers. Or, if your credit score is on the lower end, Rocket Mortgage is a solid option for a loan.

How life can turn you house-poor

With the growth of home prices far outpacing wage growth, it would be easy to assume that all house-poor Americans have simply taken on mortgages they can’t afford. But changes in the economy, career setbacks, and even break-ups can conspire to turn an affordable mortgage into something that’s a burden.

For example, say a family buys a home with a large down payment and has a mortgage they’re comfortable servicing. But after a few years, the couple separates. One of the spouses gets the house, which has appreciated considerably over time. Now this homeowner has an asset with a lot of equity tied to it, but they’re solely responsible for mortgage payments which eat up a huge chunk of their income (which presumably is also less after the split). The housing expenses don’t leave room for much else.

In a different scenario, a single homeowner lives in a house for two decades and still has a mortgage. Unfortunately, their line of work hasn’t offered much room for income growth. At the same time, inflation has increased the cost of living significantly, while property taxes have also shot up. Now the homeowner’s housing costs are higher while inflation reduces the purchasing power of their remaining funds.

As you can see, different circumstances can result in having plenty of equity in your home but not enough liquid assets. From a dip in income to investment losses to family changes, many roads can lead to the same place: all of your wealth is tied up in your home while you’re struggling to pay your bills.

What if you’re already house-rich, cash-poor

Being house-poor is a recipe for frustration and anxiety, where any unexpected expense threatens to become a crisis. Ultimately, you need to either increase your income or decrease your spending (or both), which means making tough choices. Some options homeowners should consider include:

- Downsizing: You don’t have to stay in the house that’s financially draining you. Look into buying a more affordable property and use the equity you have in your home to help you move. However, make sure you’ve lived in your current house long enough to avoid losing even more money when you pay off your current mortgage.

- Tapping into home equity: Some situations justify using your home equity. For example, if your home needs urgent costly repairs and you don’t have enough in savings, a home equity loan or line of credit can be helpful. If you have significant credit card balances eating into your budget, borrowing against your equity is also a viable debt consolidation option.

- Debt consolidation: If credit card debt from multiple cards is weighing you down but you don’t want to pay it off with the help of your home’s equity, you could use a balance transfer credit card to gather all your debts in one place. You can then pay off the balance without any interest charges during the card’s promo 0% APR period. CNBC Select’s top picks for the best balance transfer cards include the Wells Fargo Reflect® Card and the Citi® Diamond Preferred® Card.

-

Note, however, that a balance transfer card usually requires an excellent credit score. Alternatively, you can look into a debt consolidation loan. You won’t get a 0% APR period, but you can still get a lower interest rate than what your card charges. Some of our top picks for debt consolidation loans include Upstart for those with average credit and LightStream for borrowers with higher credit scores.

- Mortgage refinancing: Taking out a new loan on the remainder of what you owe on your home can lower your monthly payments — if you get advantageous terms. Remember that refinancing loans have closing costs like a regular mortgage, so keep them in mind before taking this step. Plus, you may need to meet certain credit score requirements and have enough equity in the home (usually at least 20%).

- Renting out a room: Finally, you can get additional income by renting out one or more rooms in your home. Being a landlord can be a challenging endeavor, and you might not feel thrilled to share your space. Still, it can significantly boost your bottom line and help you pay for your home.

Bottom line

If you’re buying a home, be realistic about your budget to avoid becoming house-poor. That, of course, is easy to say — plus, a high home purchase price isn’t the only thing that can put you in this position. If this has already happened to you, know that you have options and try to take small steps toward a healthier financial balance. When your mortgage consumes too much of your income and your savings are non-existent, you’re one emergency away from a financial disaster.

4 Things First-Time Home Sellers Regret Most

Selling your home is a big decision, which is why you want to make sure you and your property are ready for it when the time comes. From setting an asking price to deciding when to list your home, there’s a lot you’ll need to consider as a seller. The last thing you want to feel once your home is sold is regret over some of the choices you made—which many people say they do.

According to a new Zillow survey, 84 percent of Americans who sold a home for the first time in the past two years wish they had done something differently. The poll reveals that many recent first-time sellers have regrets about the pricing, timing, or marketing of their home. To avoid these mistakes when it’s your time to list, it helps to understand the survey participants’ key errors.

Pricing Incorrectly

The most common thing participants in Zillow’s survey say they wish they had done differently is set a higher list price. Now more than ever, it can be difficult to decide on how much to list your home for. Pricing it too high could lead to a slower sale, but pricing it too low may leave you wishing you had listed it for more.

“This spring’s sellers are more likely to regret pricing their home too high,” said Zillow senior economist Nicole Bachaud. “The price their neighbor commanded a year ago may no longer be realistic. They need to adjust their expectations if they want to avoid having their home linger on the market.”

Ignoring Online Curb Appeal

Don’t underestimate the importance of virtual curb appeal when it comes to selling your home. About 90 percent of recent first-time sellers think something could have helped them get a higher sale price—and 39 percent of those respondents believe that better listing photos could have boosted their sale (25 percent say a virtual tour also might have helped).

Many prospective buyers look for homes online, which means you shouldn’t ignore that website listing. Consider creating a media package that includes high-resolution photography to help highlight your home’s best features. According to Zillow, listings that include a virtual home tour get 69 percent more views and 80 percent more saves.

Bad Timing

Twenty-five percent of people who took Zillow’s survey say they wish they had listed their home a different time. While the best time to sell is a personal choice, if you have flexibility, the optimal time to list a home is during the second half of April, says Zillow.

Timing the sale of a home with the purchase of another house is one of the biggest stressors for sellers. About 36 percent of first-time sellers wish they had known how long it would take for their home to sell. About 37 percent of sellers say selling their home on their timeline, with a flexible closing date, or selling quickly was their top priority.

Skimping on Repairs

Sprucing up your home before selling it may be worth the extra costs. According to Zillow’s survey, 25 percent of participants believe they could have gotten a higher sale price if they had invested in more home improvements and repairs. Despite this regret, most sellers (66 percent) report taking on at least two home improvement projects before selling and 78 percent believe those projects helped them sell their home.

“The right projects can pay off,” said Amanda Pendleton, Zillow’s home trends expert. “Sellers need to think strategically about their return on investment before diving into repairs and renovations. Landscaping, interior painting and carpet cleaning are the most commonly completed seller projects for good reason. They boost online curb appeal and send a powerful signal to a buyer that a home is well-maintained.”

Expect a competitive shopping season, despite few available homes

Though easing mortgage rates are bringing buyers back, don’t expect the fervor of recent years

- Buyers should expect to face intensifying competition over the next few months.

- Homeowners are largely staying put, so attractive listings will see strong interest.

- Affordability remains the biggest challenge for buyers and sellers, with both keeping a close eye on mortgage rates.

The fast-approaching spring home shopping season should feel a bit calmer than in recent years. Shoppers can expect competition for well-priced homes, but without the crowds of buyers that packed open houses like they did in 2021 and early 2022, according to a new Zillow® analysis.

“Affordability will still be a challenge for many buyers this year, but sellers who price and market their home competitively shouldn’t have a problem finding a buyer,” said Zillow senior economist Jeff Tucker. “The slight drop in mortgage costs since October should revive demand after last fall’s slump, especially in more affordable markets and neighborhoods, but we are unlikely to see competition approach the fever pitch seen in the last two years.”

Mortgage movement sets the stage

The market cooled dramatically in the second half of 2022, amid rising mortgage rates and two straight years of red-hot competition. But as mortgage costs bumped down from their peak in the fall, sales returned. Though sales still remain below where they were a year ago, they’ve rebounded significantly over the past few months.

Buyers today are typically spending roughly 31% of their household income on a mortgage — $1,595 a month — after a 20% down payment1. That’s $170 a month below the 34% of income required in October, but far above the 20%–22% they were spending in the ten years before the pandemic — the monthly cost of principal and interest was less than $900 in January 2019.

Still, even while affordability impacts the share of households looking to buy, demographics are contributing to demand through sheer numbers. Zillow’s 2022 national consumer survey found the median age of the first-time home buyer was 35 years old. The youngest members of the massive millennial generation are now entering their late 20s, the oldest are approaching their mid-40s, and the bulk will soon be hitting prime first-time home-buying milestones.

Spring outlook and what it means for buyers, sellers and prices

There are as few homes for sale to start the year as there were in 2021, which, at the time, was a new record for scarcity. But the market is far from the white-hot demand-side conditions of early 2021 and 2022, when ultralow mortgage rates triggered bidding wars over most listings.

Buyers should expect competition — especially in more affordable markets like Cincinnati and St. Louis — and at lower price points. Buyers will mostly be motivated by the life transitions that have always triggered home purchases — new jobs, marriages and births — and less by the deal of a lifetime on mortgage rates.

On the sellers’ side, well-priced, well-marketed homes will receive attractive offers during their first weekend on the market, but many listings will take longer and will need price cuts to sell. Last month, 22% of listings saw a price cut, more than any January since at least 2018.

Buyers and sellers waiting for home prices to either plunge or skyrocket will be disappointed. Instead, prices are forecast to move on a slow, boring trajectory like they have historically, and inch a little higher in spring after seasonal winter lows.

While heat in the housing market has ticked up in the past few months, there’s no guarantee it will continue along this path. The courses of inflation, unemployment and especially mortgage rates will determine what comes next.

Mortgage rates will affect both demand and supply significantly. If rates move lower, toward 6% or below, they will bring more buyers into the fold and make it more palatable for homeowners to sell, increasing supply. If rates hover in the upper 6% range or above, buyers may once again put their house hunt on hold.

“The housing turnaround since November has coincided with what are typically the weakest three months of the year — forecasting the future off that can be dicey,” Tucker said. “The economic news from earlier this winter raised hopes for a soft landing of the economy and housing market, but the risk of renewed inflation or even a recession is still significant, and either would have a serious impact on the housing market.”

Expect a Competitive Shopping Season, Despite Few Available Homes

Though easing mortgage rates are bringing buyers back, don’t expect the fervor of recent years

- Buyers should expect to face intensifying competition over the next few months.

- Homeowners are largely staying put, so attractive listings will see strong interest.

- Affordability remains the biggest challenge for buyers and sellers, with both keeping a close eye on mortgage rates.

SEATTLE, Feb. 16, 2023 /PRNewswire/ — The fast-approaching spring home shopping season should feel a bit calmer than in recent years. Shoppers can expect competition for well-priced homes, but without the crowds of buyers that packed open houses like they did in 2021 and early 2022, according to a new Zillow® analysis.

“Affordability will still be a challenge for many buyers this year, but sellers who price and market their home competitively shouldn’t have a problem finding a buyer,” said Zillow senior economist Jeff Tucker. “The slight drop in mortgage costs since October should revive demand after last fall’s slump, especially in more affordable markets and neighborhoods, but we are unlikely to see competition approach the fever pitch seen in the last two years.”

Mortgage movement sets the stage

The market cooled dramatically in the second half of 2022, amid rising mortgage rates and two straight years of red-hot competition. But as mortgage costs bumped down from their peak in the fall, sales returned. Though sales still remain below where they were a year ago, they’ve rebounded significantly over the past few months.

Buyers today are typically spending roughly 31% of their household income on a mortgage — $1,595 a month — after a 20% down payment1. That’s $170 a month below the 34% of income required in October, but far above the 20%–22% they were spending in the ten years before the pandemic — the monthly cost of principal and interest was less than $900 in January 2019.

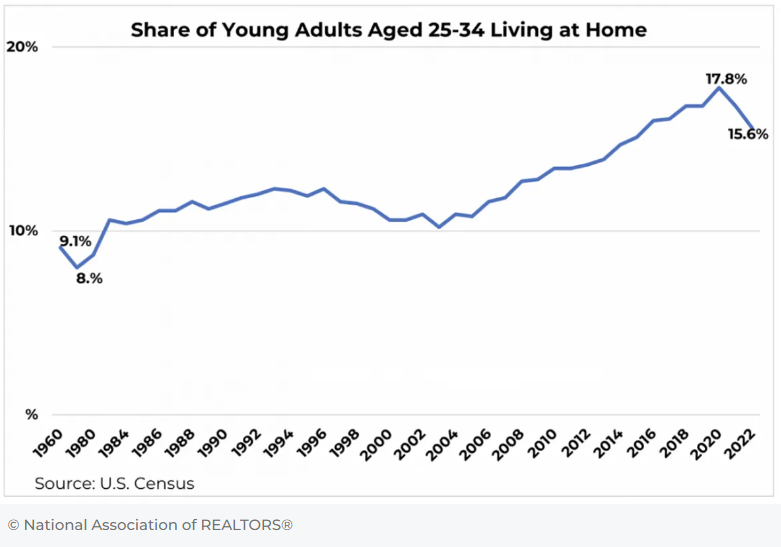

Still, even while affordability impacts the share of households looking to buy, demographics are contributing to demand through sheer numbers. Zillow’s 2022 national consumer survey found the median age of the first-time home buyer was 35 years old. The youngest members of the massive millennial generation are now entering their late 20s, the oldest are approaching their mid-40s, and the bulk will soon be hitting prime first-time home-buying milestones.

Spring outlook and what it means for buyers, sellers and prices

There are as few homes for sale to start the year as there were in 2021, which, at the time, was a new record for scarcity. But the market is far from the white-hot demand-side conditions of early 2021 and 2022, when ultralow mortgage rates triggered bidding wars over most listings.

Buyers should expect competition — especially in more affordable markets like Cincinnati and St. Louis — and at lower price points. Buyers will mostly be motivated by the life transitions that have always triggered home purchases — new jobs, marriages and births — and less by the deal of a lifetime on mortgage rates.

On the sellers’ side, well-priced, well-marketed homes will receive attractive offers during their first weekend on the market, but many listings will take longer and will need price cuts to sell. Last month, 22% of listings saw a price cut, more than any January since at least 2018.

Buyers and sellers waiting for home prices to either plunge or skyrocket will be disappointed. Instead, prices are forecast to move on a slow, boring trajectory like they have historically, and inch a little higher in spring after seasonal winter lows.

While heat in the housing market has ticked up in the past few months, there’s no guarantee it will continue along this path. The courses of inflation, unemployment and especially mortgage rates will determine what comes next.

Mortgage rates will affect both demand and supply significantly. If rates move lower, toward 6% or below, they will bring more buyers into the fold and make it more palatable for homeowners to sell, increasing supply. If rates hover in the upper 6% range or above, buyers may once again put their house hunt on hold.

“The housing turnaround since November has coincided with what are typically the weakest three months of the year — forecasting the future off that can be dicey,” Tucker said. “The economic news from earlier this winter raised hopes for a soft landing of the economy and housing market, but the risk of renewed inflation or even a recession is still significant, and either would have a serious impact on the housing market.”

1 The share of median household income needed for a new 30-year fixed-rate mortgage on a typical U.S. housing unit, measured by the Zillow Home Value Index.

Article Courtesy of Zillow

Looking ahead at the housing market in 2023

Rollercoasters are designed to take riders on an unpredictable journey with periods of exhilaration, intensity and fear. Kind of sounds like the housing market over the last twelve months, doesn’t it?

2022 was truly a roller coaster year in housing. Just to look at one metric that we’ve been following all year, the average 30-year fixed mortgage rate in January of 2022 was 3.60%–in December of 2022 that rate stood at 6.39%. That was just a few weeks after it average rate reached 7.20%, its highest level in twenty years.

While signs of a changing rate environment were evident a year, we had no way of knowing how much mortgage rates were going to rise in 12 months. Some things that affected those changing rates, like war in Ukraine and rising inflation, had yet to take hold. So needless to say, it’s a much different housing market that we preview heading into 2023 than it was last year.

Where will rates go?

The number one concern for most people who are interested in buying a home in 2023 is what is going to happen to mortgage rates. Rates have gone up in relation to the Federal Reserve’s federal funds rate, which has risen from near zero at the beginning of 2022 to around 4.25% by the end of the year. The Fed is expected to keep increasing their rate in order to get inflation under control, but at a slower pace in the first part of 2023.

That should affect mortgage rates, allowing them to continue dropping. As mentioned above, national average rates hit 7.20% at the end of October, then started dropping. This was partially due to good news on inflation and the Fed indicating that they were going to ease up on rate hikes.

Expert predictions on rates

Many of the most respected industry watchers are predicting that rates will continue to come down in 2023. The Mortgage Bankers Association (MBA) and the National Association of Realtors® (NAR) both are forecasting that mortgage rates come down throughout the year, and finish 2023 in the mid-5% range. Fannie Mae and Freddie Mac take less optimistic views, seeing rates hovering in the high-6% range and finishing the year near 6.2%-6.5%.

The wild card in this outlook is inflation. The Fed is trying hard to put a dent in rising inflation, and the latest reports suggest that inflation is at least slowing down. If this continues, you can hope to see mortgage rates behave like the MBA and NAR are predicting. However, if inflation rises, rates may stay near where they are now—or even go up—for the year.

Home prices: Up or down?

Tracking home prices can be a good news/bad news proposition. When home prices go up, that’s good news for homeowners and sellers, but bad news for homebuyers. When they go down, that could be seen as bad news for homeowners as their home’s value is also theoretically going down, as well.

However, high home prices along with high rates have priced many would-be homebuyers out of the market. And that’s been bad news for sellers lately, as there are fewer buyers and therefore lower demand. So, a drop in home prices, along with a drop in mortgage rates, would be great news for everyone.

Home price forecast

The MBA sees home prices remaining stable throughout the year, with projected median price of total existing homes starting the year around $366,000 and ending the year around $377,000. Lawrence Yun, chief economist at NAR, foresees similar price stability, with median home prices increasing just 0.3% according to their forecasts. “Half of the country may experience small price gains, while the other half may see slight price declines,” Yun says.

Real estate website Redfin is also predicting good news for homebuyers. Their forecast is for the first year-over-year decline in the last decade, with an average home price at $368,000. So while home prices aren’t dropping to where they were pre-pandemic by most of these forecasts, they are likely staying near where they’re ending 2022 as we move ahead to 2023.

Looking ahead at housing affordability

More than the mortgage rate or the price of the home, most homebuyers start with this question: Can I afford it? Housing affordability refers to the amount of a homeowner’s monthly budget their home payments represent. Over the last twelve months, this has gotten worse and worse, making it extremely hard for first-time homebuyers in particular to purchase a home.

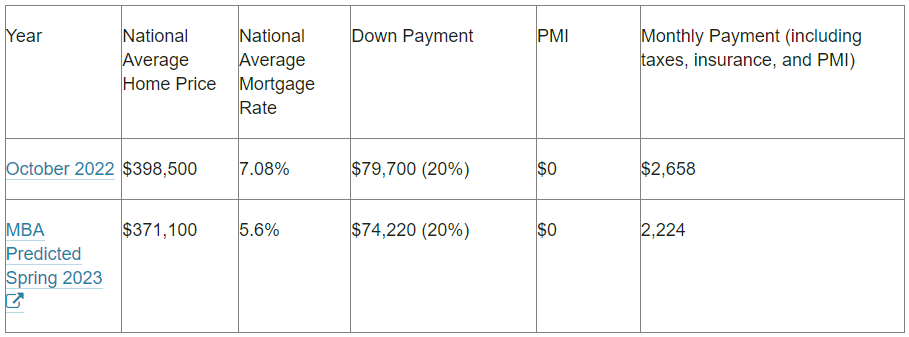

If mortgage rates come down, and home prices are at a lower average than last year, that means that housing affordability will come down. Hopefully, in 2023 more people will be able to answer yes to that question.

Let’s take a look at what would happen if some of the above predictions would actually happen. As an example, we’ll compare the MBA’s predictions for average home prices and mortgage rates in spring of next year with an average priced home and mortgage rate in October of 2022, assuming a 20% down payment in both cases.

*Sample rate provided for illustration purposes only and is not intended to provide mortgage or other financial advice specific to the circumstances of any individual and should not be relied upon in that regard. Guaranteed Rate Affinity cannot predict where rates will be in the future.

That’s a difference of $434 a month, with $5,480 less spent on a down payment, which could make a big difference for many and turn a potential homebuyer into a homeowner.

New construction outlook

One reason that home prices have gone up so much is that there hasn’t been enough homes available to buy. The low rates we saw during 2020 and 2021 made this problem worse, as more people were looking to purchase a home, but it’s a problem with origins that started years before the pandemic. Housing inventory has been dropping since 2010.

One solution to not enough homes available to buy is to build more homes. However, rising mortgage rates scared off many builders from starting new projects, as builder confidence went down for 11 consecutive months in 2022.

The MBA has watched new housing projects that began work, known as new housing starts, go from 1.72 million at the beginning of 2021 down to 1.461 million in the third quarter. The projected average of new housing starts for 2022 was 1.567million.

They’re expecting that downward trend to continue into 2023, forecasting 1.472 million housing starts in 2023. That likely won’t be enough to bring relief to the inventory issue and therefore won’t put significant downward pressure on home prices in the new year.

Trends to keep an eye on

With those four major factors accounted for, what will that mean for the rest of the housing market? Here are some more housing market predictions:

Hot months for homes

In most years, spring and summer are the most popular times to buy a home, but the pandemic threw that trend out the window. With rates so low in 2020 and 2021, along with the increased flexibility most people had due to work-from-home and online school, we saw demand spike throughout the year.

Now that rates have increased, many families have settled back into their pre-pandemic work and school routines. As Jeremy Collett, Executive Director of Capital Markets at Guaranteed Rate, says, “No matter what, I think we will see a return to seasonality, with a focus on home sales in spring and summer when people are more inclined to move.”

From bonkers to a buyer’s market

One of the most memorable parts of the housing market over the last few years was how much of a seller’s market it became. Houses would sell in less than 24 hours after listing, above asking price, with inspections waived. That’s how desperate buyers were to close on a home with the low rates we were seeing then.

But thankfully that’s in the past. We’ve seen demand dip as rates have gone up in the past year, and that should continue. Danielle Hale, chief economist for Realtor.com, wrote in her housing forecast, “There will be more homes for sale, homes will likely take longer to sell, and buyers will not face the extreme competition that was commonplace over the past few years.”

The importance of a fast, frictionless experience

Real estate happens more and more in a digital landscape these days. From finding a home online, to applying for a mortgage and even closing, almost the entire process can take place on a screen. But that makes customer service, speed, and efficiency all the more important.

Guaranteed Rate has been at the forefront of this revolution, from introducing the first Digital Mortgage, to FlashClose® technology and MyAccount. And we’ll continue to lead, with exciting new apps and tools on the way to make your financial life easier and give you an advantage when buying a home. All of this tech is backed up by our mortgage loan experts, who are always ready to help if you need any.

It’s our commitment to helping make the process of getting a home easier for you that we are optimistic about the year ahead. When you work with a Guaranteed Rate Affinity loan officer, you’ll know that you’ll have an expert on your side to help you realize your dream of homeownership, no matter what happens in the market in 2023.

Consumer confidence in housing finally rises, thanks to falling home prices

Mortgage rates are still twice what they were a year ago, but home prices have been falling since June, and that’s finally making consumers feel better about what had been an overheated, highly competitive housing market.

A monthly housing sentiment index from Fannie Mae showed sentiment improving from November to December. The index is still lower than it was a year ago and just slightly off its record low set in October and November.

On selling, however, sentiment continued to drop. The share of respondents saying now is a good time to sell dropped to 51% from 54%, while the share saying now is a bad time to sell increased.

More consumers now believe home prices will fall in the next 12 months, and more also said they believe mortgage rates will come down.

Prices in November, the most recent measurement, were 2.5% lower than the spring 2022 peak, according to CoreLogic. They were still over 8% higher year over year, but that annual comparison is now half of what it was in June.

The average rate on the popular 30-year fixed mortgage hit a recent high of 7.37% in October but then fell back into the mid-6% range throughout November and into December. As of last Friday it had dropped to 6.2%, according to Mortgage News Daily.

That tension will continue to drive home sales lower in the coming months, Duncan said.

Adding to the confidence in housing, the share of consumers who said they were concerned about losing their jobs in the next 12 months dropped from 21% to 17%. Fewer, however, said their household income is significantly higher than it was a year ago.

With the housing market now in its historically slow winter season, some agents are reporting activity is “frozen.” Pending home sales, which represent signed contracts on existing homes, dropped more than expected in November, suggesting that closed sales in January will be lower as well.

Those sellers who are braving the housing chill are offering more concessions: Roughly 42% of sellers did so in the fourth quarter, the highest share in recent years, according to Redfin, a real estate brokerage. That’s up from just over 30% in both the previous quarter and the fourth quarter of 2021, and is higher than the previous high of 40.8%, notched during the three months ending July 2020, at the start of the Covid pandemic.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link