What’s the Difference Between Your Home’s Market and Assessed Value?

Understanding your home’s value is an important part of knowing your net worth, what you’ll likely receive if you sell the property and how the local real estate market is faring. Home value is also an integral part of determining how much property tax you’re required to pay the local and state government annually.

But depending on where you look, your home’s value may appear as wildly different numbers. Different valuations can mean different things and are often used for different reasons. The two types you’ll most likely encounter are market value and assessed value.

Here’s a quick explainer on market value vs assessed value:

- Market value is the estimated amount active buyers would currently be willing to pay for your home. Your home’s market value is determined by a real estate appraiser, who is typically hired when your lender is deciding how much money to provide in a loan or you are setting the list price when putting your home on the market.

- Assessed value, on the other hand, takes the market value and puts it in the context of your property taxes. In many counties throughout the U.S., assessed value is a portion of the market value, calculated as a percentage of the market value of the property. As a result, the assessed value of a property is typically lower than appraised market value.

Market Value

Danielle Hale, chief economist for real estate information company realtor.com, explains that market value is based on the expectation that the property would sell during the period the value is calculated.

“When people think about home values, they often mean, ‘This is the price that I could sell it for if I were to sell it today,’ or ‘This is the way a bank would value it if I were to go talk to the bank about getting a home equity loan or maybe refinancing my mortgage,’” she says.

The grayest area of market value is determining whether the value you assign to your home is based on what current market conditions say a person would pay for your house or what you think a person should pay for it.

For this reason, basing market value on recent sales of similar properties is key to ensuring the number is as accurate as possible. Professional appraisers are an instrumental part of being able to examine a property, nearby recent sales and the factors that may add to or detract from interest in a property, and then assigning a value to the house based on the information.

Appraisers are often hired by a mortgage lender, and it’s best if they are are local to the area so they understand nuances that may not be obvious to an out-of-towner, though sometimes an algorithm will be used to determine values on a larger scale or more quickly. A lender can have a property valuated to issue a mortgage for a home purchase, for refinancing or to issue a home equity loan.

Individual homeowners can also order their own appraisal to get a better understanding of their home’s current value if they’re considering selling but don’t know what the asking price should be, or simply to get a better grasp on their net worth. An appraisal typically costs between $313 and $422, according to home improvement network Angi, and is paid by the homeowner for personal use and the buyer for a lender-required appraisal.

Home Appraisals vs Home Value Estimators

An appraisal looks at the sale information of nearby homes with a similar square footage, age, number of bedrooms and other features of your property that have sold recently – most often in the last six months. Appraisers will also factor in major differences that may make your home’s valuation different.

Because the market determines the value, it’s easier to pinpoint a more accurate value for homes that are similar to many in the neighborhood than for houses that are unique. A three-bedroom house in a neighborhood of matching three-bedroom houses is relatively easy to appraise, but a Victorian home on a busy street surrounded by condos and apartment buildings will be more difficult to valuate.

Hale says online tools serve as a great jumping-off point, but they fail to take into account current and local events that may play a more immediate factor into buyer interest and the ultimate value. “Market conditions can affect that valuation,” Hale says.

Assessed Value

Market value even becomes part of the calculation of your home’s assessed value. But because assessed value is used for the sake of calculating how much you owe in property taxes, the assessed value is also based on laws of your state, county and even city, explains Margie Cusack, research manager for the International Association of Assessing Officers.

“The assessed value will be defined by the legal framework of that jurisdiction,” she says. “A lot of states have value limitations in law, so they might have a market value for the property. But then they have a per law allowable assessed value that they work off of, so it becomes very localized.”

Because of the specificity of assessed value to your exact location, Cusack recommends all homeowners – as well as homebuyers who don’t yet pay property taxes – become well-versed in the statutes that apply to the area, how the assessment is calculated and where your property taxes go.

“You really need to read your assessment notice,” she says. “Usually that will define what assessed value means for that property.”

The exact steps to assessing a property also vary by jurisdiction. Some assessor’s offices will use a predictive algorithm to help determine assessed values for more properties quickly, while others will address assessments on an individual, in-person basis, Cusack says.

What if You Disagree With Your Home’s Appraised or Assessed Value?

At times, homeowners will disagree with the appraised or assessed value assigned to their property. In both scenarios, there are options for contesting the valuation.

For market value, a homeowner or buyer may be able to request a property be appraised a second time with new information the appraiser may not have been aware of before – a finished basement, for instance, can change the value of a home if it can be counted in the square footage. An appraiser may be willing to take a second look at the property without extra charge if something was missed, but you may also need to pay for another complete appraisal to have your house fully reevaluated.

When it’s a lender issuing the appraisal and considering the value, however, there’s not much chance you’ll be able to convince the lender to change his or her mind on issuing a loan or refinance.

For assessed value, many assessor’s offices have contact information listed and occasionally host public forums to discuss individual issues with property value information. Like the calculation of assessed value itself, the process for petitioning a reassessment varies widely between states and counties, so it’s best to explore your local assessor’s office website for information on discussing the matter.

https://realestate.usnews.com/real-estate/articles/whats-the-difference-between-your-homes-market-and-assessed-value

Five Ways to Build Home Equity

Whether you currently own a home or are thinking of purchasing one, you may be looking for ways to build equity. Home equity is the overall difference between the amount you owe on your mortgage loan and your home’s market value. Home equity can be used to take out a loan, invest, build long term wealth or sell your home for more than you owe and keep the profit.

The equity you have access to will increase as you make payments that pay off your mortgage balance. It can also grow when your home’s value increases. The following details five of the quickest ways to build home equity.

1. Make a Larger Down Payment

The simplest and quickest way to build equity in a home is to make a large down payment when you first buy the property. The down payment you make is immediate equity. Let’s say that you’re buying a home for $200,000. With a $10,000 down payment, you’ll owe $190,000 on the mortgage and have $10,000 in equity.

If you can afford it, you could instead choose to make a down payment of $40,000, which means that you would owe $160,000 on the mortgage and have $40,000 in equity when you first move in. Keep in mind that a 20% down payment will also remove the private mortgage insurance requirements for conventional loans, which is an added benefit.

2. Make Mortgage Payments More Often

Only a percentage of the mortgage payment you make each month is put towards the principal of your house. The remainder of the payment goes towards interest and taxes. When you make additional payments or provide a payment that’s higher than the minimum amount, you are putting more money toward the principal and increasing your equity.

3. Consider a 15-year Mortgage

If you take out a 15-year mortgage as opposed to a 30-year one, your monthly mortgage payments will be significantly larger. When you take this approach, you’ll be paying off more of the principal each month, which will help you build equity quicker. You’ll also pay less interest over the course of the loan.

If you’ve already purchased your home, you could decide to refinance the mortgage loan, which would allow you to switch from a 30-year loan to a 15-year option and build equity faster. Make sure that you can afford the higher monthly payments before choosing this solution, and make sure you take current interest rates into account as well.

4. Invest in Home Improvement and Remodeling Projects

You can also build equity in your home by investing in home improvement and remodeling projects that will increase the home’s value. The most popular renovations include kitchen and bathroom remodels. Make sure that you select projects that will get you the best return-on-investment (ROI). Reach out if you want to discuss projects with the highest ROI in our area.

5. Use Gifts and Windfalls

Consider building equity by using any gifts or windfalls you receive to pay down the balance of the loan. Do you receive birthday or holiday gift cards? If so, these can be converted to cash and added to your mortgage payment. The same is true of any inheritance you receive.

Building home equity gives you financial security and allows you to prepare for your future. By making a large down payment, paying more money each month, and improving the quality of your home, you can build equity relatively quickly.

Tips for a Successful Yard Sale

Yard sales are a great way to convert items that you hardly ever use into cash that can be saved, donated, or put towards a large purchase. However, a successful yard sale takes a considerable amount of preparation and planning. Here are some tips on how to hold a great yard sale.

Set a Goal

First, it’s a good idea to think about why you want to hold a yard sale. Are you hoping to generate income or use the sale to get rid of items you’re no longer using? Having a goal in mind can help you decide what to sell, how to price your items, and how flexible you want to be with hagglers.

Choose the Right Date

The best days to host a yard sale are usually Friday and Saturday. Consider the first Friday or Saturday of the month, after most people receive their paychecks and have more money to spend. Try to pick a date and time when you expect the weather to be mild and dry. You can’t predict or control the weather, but you can do a little internet research to see which weekends have had the best weather historically.

Price Out Items as You Gather Them

To avoid rushing, don’t price everything on the day before the sale. As you are collecting items to sell, you can create a comprehensive price list or go ahead and label each item with a price sticker. When pricing each item, think like your customers. They want every item to be at a steep discount.

Properly Advertise Your Yard Sale

Hang flyers and post online ads about the sale a couple weeks before it begins. You should also inform the people you know on social media a few days before the sale. Highlight any sought-after items that will be available in your sale, which can include furniture, specialty tools, collectibles, and toys. Make sure that you include the date and time of the sale as well as your full address.

Complete Preparations Early

In the week preceding the sale, gather as many tables as possible. If your friends or family can lend you a table, call them to ask well ahead of time. You should also have a cash box on hand with a wide variety of bills. Some additional items you may need include:

- Batteries

- Extension cords

- Light bulbs

- Calculator

- Chairs

- Cooler with drinks

- Hand sanitizer

- Pens

- Receipt book

- Sold tags

- Paper or plastic bags

Make Sure All Items are in Good Condition

Every item you’re selling should be in good, usable condition. Make sure that you include working batteries in electronic devices and pump air into any basketballs or soccer balls. Have someone on hand during the day to rearrange items and fold clothing so everything looks tidy and well cared for.

As long as you choose the right date, properly advertise the sale, and prepare for the event, you should avoid most of the problems that can occur when hosting a yard sale.

State Farm, Allstate stop selling home insurance to new customers in CA

State Farm and Allstate have announced they will no longer sell new home insurance policies in California because of wildfire risks and an increase in construction costs. Here are some facts:

- State Farm and Allstate are not leaving the California Insurance Market: State Farm and Allstate will continue to service and renew policies of existing clients in the state and will continue to offer new auto insurance policies. However, they will not be issuing any new property insurance policies for the time being in California.

- What are the implications of the decision for prospective homebuyers? In certain high-risk areas of the state, there are very few insurance companies willing to write new policies. In some higher risk areas, State Farm was the last private insurance company writing policies. In those areas, unless the Insurance Commissioner is successful in its effort to get more private insurers to write policies in such areas, the generally more-costly California FAIR plan may end up being the only property insurance available.

- Why did State Farm and Allstate stop issuing new policies? State Farm stated that it made the decision “due to historic increases in construction costs outpacing inflation, rapidly growing catastrophe exposure, and a challenging reinsurance market.” Allstate said the company “paused” its offerings “so they can continue to protect current customers.” State Farm and Allstate’s decision is not necessarily an indication of what other companies will do.

- Will more companies follow State Farm and Allstate’s move? There are still a wide range of companies writing policies in California. However, those willing to write new policies in higher risk areas in particular are declining and as stated above, with the departure of State Farm and Allstate, those in more high-risk areas may have no option than the FAIR plan.

- What are the main problems for the insurance market in California? The California market is heavily regulated and has various strict requirements for rate increases, which were put into place by Proposition 103 in 1988. However, there are two areas where possible changes could result in a better climate for insurance without requiring major changes to consumer-friendly rate increase requirements. Those include allowing insurance companies to have rates that better reflect their reinsurance costs and allowing insurance companies to utilize forward looking risk models. Current law only allows companies to look back when setting rates. However, given the issues with climate change, many insurance companies argue that looking backward does not allow companies to adequately capture risk.

- Where can I direct my clients for information if they are looking for homeowners insurance? The California Dept. of Insurance provides several information guides, tips and tools to help them understand home/residential insurance so that they can make the best decision for their situation. They can also call the California Dept. of Insurance Consumer Hotline for assistance.

- What is C.A.R. doing? C.A.R. has been in discussions with both the Insurance Industry representatives and the Department of Insurance on State Farm and Allstate’s move and other homeowner insurance issues. The Insurance Industry and the Department of Insurance have also been looking at and discussing ways to address the state’s insurance challenges. The issue is large and complicated. We have cautious hope that these moves may create some greater urgency on how to address this insurance situation.

June 1, 2023

https://www.car.org/aboutus/mediacenter/news/statefarm

Homeownership as a Vehicle to Build Wealth

Over the last decade, the median-priced home in the U.S. gained $190,000 in value, making the typical homeowner 40 times wealthier than if they had remained a renter, according to a new report.

Low-income homeowners (those earning no greater than 80% of the area median income) built $98,900 in wealth as their homes while middle-income (those making more than 80% but less than 200% of median area income) and upper income (those earning more than 200% of median area income) homeowners accumulated $122,100 and $150,800 in wealth respectively, according to a report released Tuesday by the National Association of Realtors.

“Over a long time of period, home ownership is a solid path towards building wealth,” says Lawrence Yun, chief economist for National Association of Realtors told USA TODAY. “It works in two ways: first you have the advantage of home price appreciation and second, it forces homeowners to save for monthly mortgage payments which renters don’t have.”

To dive into where homeowners built the most wealth, there’s a handy chart with the story.

Top Features That Will Boost Home Values in 2023

With rising mortgage rates, many homeowners are worried about the sales prices of their homes. However, according to a recent report from Zillow, there are many things you can do to increase buyer appeal and value.

The real estate website compiled data from nearly two million homes listed for sale in 2022, analyzing home prices, along with 271 features and design terms mentioned in the listing descriptions. According to the report, these are the features that corresponded to higher home sale prices. Selling your home soon? Here are the elements you’ll definitely want to highlight.

Culinary Amenities Are Hotter Than Ever

According to Zillow’s research, listings that boost a home’s value also make a chef’s mouth water. Amenities such as steam ovens, pizza ovens, and, professional-grade appliances increased sales prices by as much as 5.3 percent, compared to similar listings that didn’t have these features. These elements can add up to $17,400 to the value of a typical home in the United States.

“Not every buyer will appreciate a chef’s kitchen or a putting green in their backyard, but those who do are willing to pay more for these personalized amenities,” says Amanda Pendleton, Zillow’s home trends expert. “Post-pandemic home buyers who had plenty of time for self-reflection now have a greater sense of what they want and need in a home.”

Homes that noted soapstone in the listing sold for 2.5 percent more than similar homes with old standbys marble and granite.

Another notable finding was that 2022 was the second year in a row that quartz was a highly coveted finish. So, if you are renovating your kitchen or bathroom in hopes of selling your home in the upcoming years, it’s definitely worth it to take a look at this durable finish that’s relatively affordable compared to many stone alternatives.

Sheds Help Sell

Sheds sell homes—especially those repurposed as private living spaces, such as offices, relaxation rooms, yoga studios, and more. These ADUs garnered a premium of 2.5 percent. So if you’ve added one in recent years, it was likely worth the investment.

Just keep in mind that homes with these sheds spent an extra two days on the market. Still, this is really no time at all considering the extra cash.

Modern Farmhouse Isn’t Going Anywhere

But these weren’t the only interesting findings of Zillow’s research. The report also stated that modern farmhouses increased in value by 2.4 percent. While many argue they’re tired of the modern farmhouse trend, it’s still a popular choice that buyers are looking for.

Want to Sell Your Home Faster?

The report also shared data on the amenities that helped homes sell more quickly. If you’re looking to get out of your home fast, think about adding easy and relatively affordable upgrades, such as doorbell cameras, heat pumps, and fenced backyards.

https://www.realsimple.com/features-that-boost-home-values-2023-7375268

Homeowners’ Zeal for Curb Appeal May Pay Off Handsomely

The COVID-19 pandemic changed the way Americans use their homes for daily living, relaxation and entertainment, adds Jessica Lautz, NAR’s deputy chief economist and vice president of research. “Homeowners have embraced their outdoor spaces, transforming them into oases with pools, patios, plants and greenery,” Lautz says. “These outdoor features … can also attract buyers if the owner wants to sell.”

Prioritizing Outdoor Projects for Resale

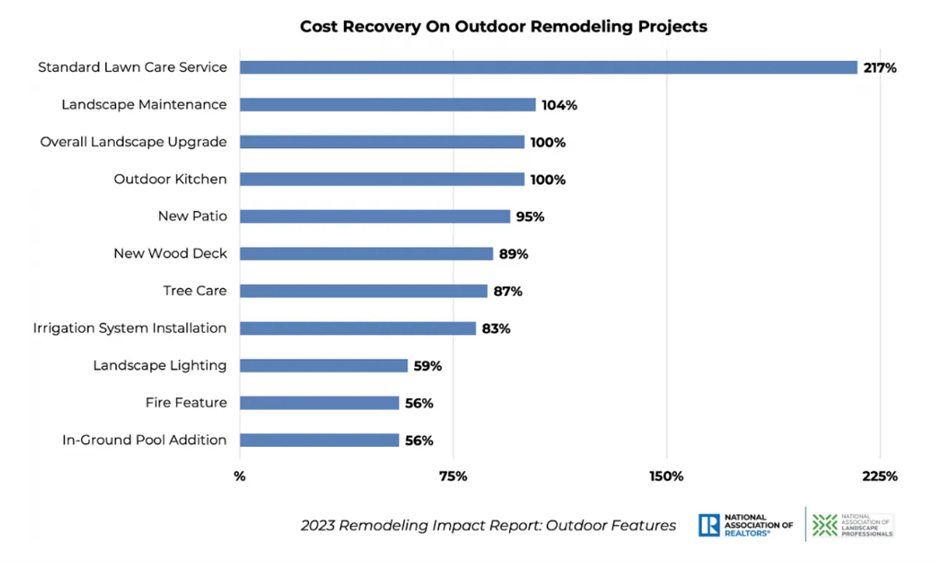

Most homeowners indicate a desire for an in-ground pool or an outdoor fire feature, but the ROI on these items may not be as high as simple lawn care and landscape maintenance, the report finds. The survey defines “standard lawn care service” as six seasonal applications of fertilizer and/or weed control on a 5,000-square-foot lawn and “landscape maintenance” as mulch application, regular lawn mowing, pruning shrubs and planting about 60 perennials or annuals.

The features that make homeowners happiest, however, aren’t necessarily the ones that earn the most at resale. The least expensive projects, such as standard lawn care service, have the highest cost recovery but one of the lowest “joy” rankings from homeowners, according to the survey. Instead, the report found that the following outdoor projects received the highest satisfaction marks among homeowners:

- In-ground pool

- Landscape lighting

- New patio

- New wood deck

- Fire feature

On the other hand, the items that ranked the lowest on homeowners’ “joy” scale were:

- Outdoor kitchen

- Tree care

- Standard lawn care service

- Installing a yard irrigation system

The majority of landscape professionals surveyed say the size and scope of outdoor home improvement projects have increased since the pandemic began. REALTORS® surveyed say the landscape projects they’ve seen most often since the pandemic began are the addition of an in-ground pool, landscape maintenance and a new patio.

How to avoid being ‘house-rich, cash-poor’ by selecting the right mortgage for your budget

Owning a home doesn’t just put a roof over your head — it can also put money in your pocket (at least on paper). According to a 2022 report from the National Association of Realtors, single-family homeowners accumulated an average of $225,000 in wealth from their homes during a 10-year period.

But what if the equity you hold in your most valuable asset doesn’t make you feel any richer when you’re looking at your bank accounts?

How to avoid becoming house-poor

The best protection against becoming house-poor is getting a mortgage that works with your budget.

First, think about the size of your mortgage loan. Financial experts generally recommend the loan stay below 2.5 to 3 times your annual salary. This means that if your household’s gross annual income is $160,000, you shouldn’t take out a mortgage loan that’s more than $480,000.

Next, consider how much you’re comfortable spending on housing expenses every month. The general advice here is to keep your monthly mortgage payment under 30% of your monthly income. For example, if your monthly paycheck before taxes is $6,000, you should aim for a mortgage payment of $1,800 or less.

Finally, make sure to shop around for the best mortgage rate when you’re ready to buy. A small difference in the interest rate can shave off hundreds of dollars of your mortgage payments. Some of CNBC Select’s favorite mortgage lenders include Chase Bank, which offers flexible down payment options, and SoFi, which advertises discounts and cash incentives for home buyers. Or, if your credit score is on the lower end, Rocket Mortgage is a solid option for a loan.

How life can turn you house-poor

With the growth of home prices far outpacing wage growth, it would be easy to assume that all house-poor Americans have simply taken on mortgages they can’t afford. But changes in the economy, career setbacks, and even break-ups can conspire to turn an affordable mortgage into something that’s a burden.

For example, say a family buys a home with a large down payment and has a mortgage they’re comfortable servicing. But after a few years, the couple separates. One of the spouses gets the house, which has appreciated considerably over time. Now this homeowner has an asset with a lot of equity tied to it, but they’re solely responsible for mortgage payments which eat up a huge chunk of their income (which presumably is also less after the split). The housing expenses don’t leave room for much else.

In a different scenario, a single homeowner lives in a house for two decades and still has a mortgage. Unfortunately, their line of work hasn’t offered much room for income growth. At the same time, inflation has increased the cost of living significantly, while property taxes have also shot up. Now the homeowner’s housing costs are higher while inflation reduces the purchasing power of their remaining funds.

As you can see, different circumstances can result in having plenty of equity in your home but not enough liquid assets. From a dip in income to investment losses to family changes, many roads can lead to the same place: all of your wealth is tied up in your home while you’re struggling to pay your bills.

What if you’re already house-rich, cash-poor

Being house-poor is a recipe for frustration and anxiety, where any unexpected expense threatens to become a crisis. Ultimately, you need to either increase your income or decrease your spending (or both), which means making tough choices. Some options homeowners should consider include:

- Downsizing: You don’t have to stay in the house that’s financially draining you. Look into buying a more affordable property and use the equity you have in your home to help you move. However, make sure you’ve lived in your current house long enough to avoid losing even more money when you pay off your current mortgage.

- Tapping into home equity: Some situations justify using your home equity. For example, if your home needs urgent costly repairs and you don’t have enough in savings, a home equity loan or line of credit can be helpful. If you have significant credit card balances eating into your budget, borrowing against your equity is also a viable debt consolidation option.

- Debt consolidation: If credit card debt from multiple cards is weighing you down but you don’t want to pay it off with the help of your home’s equity, you could use a balance transfer credit card to gather all your debts in one place. You can then pay off the balance without any interest charges during the card’s promo 0% APR period. CNBC Select’s top picks for the best balance transfer cards include the Wells Fargo Reflect® Card and the Citi® Diamond Preferred® Card.

-

Note, however, that a balance transfer card usually requires an excellent credit score. Alternatively, you can look into a debt consolidation loan. You won’t get a 0% APR period, but you can still get a lower interest rate than what your card charges. Some of our top picks for debt consolidation loans include Upstart for those with average credit and LightStream for borrowers with higher credit scores.

- Mortgage refinancing: Taking out a new loan on the remainder of what you owe on your home can lower your monthly payments — if you get advantageous terms. Remember that refinancing loans have closing costs like a regular mortgage, so keep them in mind before taking this step. Plus, you may need to meet certain credit score requirements and have enough equity in the home (usually at least 20%).

- Renting out a room: Finally, you can get additional income by renting out one or more rooms in your home. Being a landlord can be a challenging endeavor, and you might not feel thrilled to share your space. Still, it can significantly boost your bottom line and help you pay for your home.

Bottom line

If you’re buying a home, be realistic about your budget to avoid becoming house-poor. That, of course, is easy to say — plus, a high home purchase price isn’t the only thing that can put you in this position. If this has already happened to you, know that you have options and try to take small steps toward a healthier financial balance. When your mortgage consumes too much of your income and your savings are non-existent, you’re one emergency away from a financial disaster.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link