350,000 Californians are now on the FAIR Plan, the last resort for fire insurance. Now what?

The fire-insurance premium for Bill King’s home has risen 145% since 2017 — from $399 to $979 — under the California FAIR Plan, the state’s last option for homeowners seeking fire insurance.

Add that to the increase in his auto-insurance premium, and King, who lives in Running Springs in the San Bernardino Mountains, is worried.

“What do I do?” asked King, a retiree who will turn 70 years old this summer. “Do I move out of California? At some point I’m going to have to look at things… Will I be able to face future increases depending on how long I’ll live?”

A former Orange County employee, he said he’s having a tough time wrapping his head around the situation: “It’s hard when you’ve planned your retirement and your insurance company comes along and threatens your economic well-being.”

King’s story is similar to that of other property owners who have turned to the FAIR Plan as many insurers have stopped issuing fire insurance in the state, citing climate risks and inflation. As the FAIR Plan has exploded in size — from 126,709 policies in 2018 to more than 350,000 today — homeowners and insurance brokers say they are now facing problems such as delays in mortgage closings, or homeowners losing their coverage.

Recently, King found he was unable to pay for his policy renewal online, as he usually does. He couldn’t email the FAIR Plan because the plan’s website does not provide an email address. Instead, the website tells homeowners to contact their insurance brokers. King’s broker found out that he had been assigned a new policy number without his knowledge. He barely had time to send a payment via his broker, putting him dangerously close to cancellation. Based on his individual experience, King has concluded that the FAIR Plan “is doing everything it can to help policies lapse.”

The FAIR Plan Association, a pool of insurers required by state statute to provide fire-insurance policies when property owners can’t find them elsewhere, is experiencing major growing pains.

The California Insurance Department, which under state law has oversight over the FAIR Plan — including approving its requested rate changes — in 2020 investigated consumer complaints about non-renewals and cancellations. But even after an agreement late last year that included the FAIR Plan vowing to change some of its practices, there continue to be fresh signs of turmoil.

The plan is supposed to be a temporary solution as well as a last resort for property owners, but many people, like King, have been buying insurance through the association for years.

Hilary McLean, a FAIR Plan spokesperson, said the number of policy-holders who stay on the plan has increased over the years; 90% of current FAIR Plan customers are renewing their policies for another year.

The Insurance Department has proposed new regulations, expected to be finalized at the end of the year, to try to get insurers to resume writing fire policies in the state again. But it could be a couple of years until that happens, so the FAIR Plan is likely to continue growing, which could threaten its solvency because it is taking on additional high-risk policies.

“It’s clear that a growing FAIR Plan is a problem for all Californians because of the solvency risks from a major wildfire,” said Michael Soller, spokesperson for the Insurance Department, in an email. “The commissioner’s strategy is focused on returning people to the normal market from the FAIR Plan.”

Last year, lawmakers concerned about the solvency of the FAIR Plan tried to find a legislative solution to address it and other concerns about the state’s insurance market, but no lawmaker sponsored a bill to do so.

A copy of the proposed bill language, seen by CalMatters last week, shows it would have allowed the FAIR Plan to pay for claims by issuing bonds through the California Infrastructure and Economic Development Bank, which provides low-cost financing to state and local government entities. Although the FAIR Plan is not a state entity, the bill would have deemed it “in the public interest” for the FAIR Plan to qualify for financing through the bank.

FAIR Plan President Victoria Roach refused to speak on the record for this story. Spokesperson McLean said the association is dealing with an onslaught of new applications — about 900 a day, down from 1,000 a day last November but up from 350 a day in December 2022. Incoming phone calls nearly doubled over the last half of 2023, to more than 50,000 phone calls a month. The association has hired more people, bringing the number of staff to more than 200 employees plus 80 temporary workers, to help handle the additional workload.

Making matters worse, at the end of last year the FAIR Plan went ahead with long-planned changes to its software system, leading to confusion. McLean acknowledged that led to some homeowners getting kicked off the plan — or as King describes his case, almost getting kicked off — for payment issues.

Georgia, a Placer County homeowner who requested that her last name not be used for privacy reasons, said that in mid-December, her insurance broker informed her the day her premium was due that her payment had not been received, even though the money was in escrow and she later found out that her mortgage company had already paid it. The result: She, her husband and their three kids had to part with $2,380 right before Christmas to pay their premium because they didn’t want to risk losing fire insurance.

“That was my car payment, Christmas, everything we had,” she said. Her broker, mortgage company and the FAIR Plan told her she would get her money back on Jan. 5, she said, but added that she has yet to receive it.

Meanwhile, insurance broker Tyler Nelson said the new system caused delays that led to his clients losing out on loans for homes in escrow. Nelson said he would call the FAIR Plan, wait on hold for three hours and get no help. The new system, called Duck Creek, is “the most awful thing I’ve literally ever dealt with,” he said in an email.

The FAIR Plan would not discuss individual cases and complaints. McLean said the association notified brokers that they were adopting a new system, and offered them training and help. She also said the plan has made changes that “have greatly reduced delays and otherwise improved service levels.”

“In the very rare instance of a policy being canceled in error, the FAIR Plan works diligently to resolve the issue and restore coverage per the customer’s original policy agreement,” she added.

Soller, the spokesman for the Insurance Department, said consumers should contact the department if they have trouble getting coverage from the FAIR Plan.

Even before the FAIR Plan’s software transition, Ann Avalos lost her Auburn home’s fire-insurance policy in 2021 because of a payment issue after her mortgage was sold to another company.

The FAIR Plan “didn’t contact anyone until days before they dropped me,” she said, and refused to give her a grace period or reinstate her. “No communication, customer service, compassion,” she added. Her only recourse was to reapply for another policy, and she said her $2,257 annual premium increased to $3,481. Last year, she said it rose again, to $3,686. And because she can’t get fire insurance anywhere else, she has no choice but to accept the price increases.

Asked to respond, McLean said: “FAIR Plan policy agreements detail customer responsibilities… these responsibilities are consistent with industry standards, such as on-time payments and maintaining the structural integrity of the dwelling.”

“Why wouldn’t they drop you?” Avalos asked, noting that the association’s members are the insurers themselves. “Now they have the opportunity to double what they charge you.”

“We disagree with this characterization,” McLean said. “FAIR Plan rates are approved by the California Department of Insurance and rates are the same for new policyholders and renewing customers.”

The agreement reached by the Insurance Department and the FAIR Plan in November over complaints of non-renewals and cancellations between 2016 and 2019 has led the plan to make changes. One of them is to allow policy-holders to pay a surcharge if there’s a fixable issue on their property, instead of citing it as a reason to cancel their plan. Once the issue is taken care of, the surcharge is canceled. Soller, speaking for the state Insurance Department, said that because of the agreement, the FAIR Plan “should be making it easier, not harder,” for homeowners to renew their plans.

As King thinks about his own insurance worries and his future in California, he has also had to contend with FAIR Plan premium increases for his local church, where he is an associate pastor. A couple of years ago, he said, the fire-insurance premium for the church’s main building doubled from $4,000 to $8,000.

“That’s a lot of money for our little church,” he said, noting that the church’s annual budget was less than $70,000. So instead he shopped around and found a business policy that included fire insurance, which is costing the church about $6,000. “Insurance at times seems like a great evil perpetrated upon us,” he said.

Top 5 Home Renovations with the Best Return on Investment

Well-planned home renovations can really enhance your home’s appeal and amp up its price when it’s time to sell. But not all improvements bring a hefty return on investment (ROI). Knowing the most promising updates can help strategize your revamping efforts for an attractive sale. Read on for a rundown of the top five home improvements likely to supercharge your property’s resale value.

Kitchen Upgrades

A modern, functional kitchen can impress prospective buyers and significantly boost your resale value. But a complete remodel isn’t always necessary when you’re looking for a sizable ROI. If your kitchen already has a good layout, work with what you have and make strategic changes. Key renovations to consider include new countertops, an updated backsplash, a fresh coat of paint, and high-end appliances. Need some swoon-worthy inspiration to get you in the mood? These kitchen updates will make you want to start taking notes and making plans.

Bathroom Remodels

Bathroom updates are next on the list of top ROI home renovations. Your efforts here can range from replacing dated fixtures to a more comprehensive refresh, including a new soaking tub or a sleek walk-in shower. But before you pencil in a new skylight and heated floor tiles, consider every tweak’s necessity and potential upside, as bathroom work – like kitchen updates – can quickly become expensive. But if you can invest more in this space, you’ll likely see significant returns.

Hardwood Flooring

There’s no question about it – adding or refinishing lackluster hardwood flooring can significantly enhance the value of your home. This type of flooring offers a timeless look that harmoniously blends with various design styles, from boho chic to classic elegance. Besides their aesthetic charm, hardwood floors are sturdy, easy to clean and healthier due to the absence of trapped allergens often found in carpets. Buyers are consistently willing to pay more for a house with hardwood, making this upgrade a wise choice if you can swing it. How much will wood floors cost you? It all depends on the size of your rooms, the style you choose and the tree species.

There’s no question about it – adding or refinishing lackluster hardwood flooring can significantly enhance the value of your home. This type of flooring offers a timeless look that harmoniously blends with various design styles, from boho chic to classic elegance. Besides their aesthetic charm, hardwood floors are sturdy, easy to clean and healthier due to the absence of trapped allergens often found in carpets. Buyers are consistently willing to pay more for a house with hardwood, making this upgrade a wise choice if you can swing it. How much will wood floors cost you? It all depends on the size of your rooms, the style you choose and the tree species.

Eco-Friendly Improvements

Energy-conscious renovations have been in vogue for a while now. An energy-efficient home attracts a broad range of buyers and contributes to a greener, healthier environment for everyone. Energy-saving windows, LED lighting, Energy Star-certified appliances, higher-rated insulation, an updated HVAC system and solar panels can offer a higher selling price point and significant cost savings for the homeowner.

Adding an extra room or an outdoor living space

Expanding your total livable space can add considerable worth to your home, whether it’s a finished basement, attic or flex space. An additional bedroom or an office are always in demand, especially in this work-from-home era. If expanding indoors isn’t feasible, transform your outdoor area into a relaxing second living room. A deck or patio can be an enticing bonus for buyers looking for more usable square footage at the property. Swanky garage conversions can also provide extra room year-round with unique appeal.

The right home upgrades can substantially increase your property’s value. However, balancing your renovation budget with the prospective benefits is crucial. In addition to this list, research your market and pay attention to what features the top-selling homes in your area offer. Give me a call and I can help you make informed decisions and optimize your home renovations for the best ROI.

Want to Add a Granny Flat or Rental ADU? Here’s How to Finance It

Are you dreaming of adding an accessory dwelling unit (ADU) to your property? Whether it’s a granny flat, carriage house, or backyard cottage, ADUs are gaining popularity as an innovative solution to the shortage of affordable housing in the United States. In this guide, we’ll explore the financing options and trends that make realizing your ADU dream easier than ever.

Why ADUs Are in Demand

The demand for ADUs is on the rise, driven by a shortage of affordable housing in the US. Local and state laws are evolving to make it easier for homeowners to build ADUs, with some areas adopting “by-right approval,” reducing barriers to construction. Homeowners are exploring ADUs not only as a rental income source but also as a way to keep loved ones close by, offering an alternative to expensive nursing homes.

Types of Accessory Dwelling Units

Before diving into financing, it’s crucial to understand the types of ADUs available. From additions to existing structures to stand-alone constructions in the backyard, ADUs can take various forms. Fannie Mae sets basic requirements, such as a separate entrance, kitchen, sleeping space, and bathroom. Local regulations may dictate specifics like parking and utility hookups.

Varieties of ADU Loans

Considering financing options is a key step in turning your ADU dream into reality. Two main approaches exist: borrowing equity or opting for a construction/renovation loan.

1. Borrowing from Equity:

– Ideal for those with sufficient equity and a desire to maintain a low-rate primary mortgage.

– Potential drawbacks include higher interest rates on equity products and borrowing limitations (up to 80% of the home’s current value).

2. Construction or Renovation Loans:

– Suitable when borrowing from equity falls short.

– Allows you to borrow more based on the projected value of your property after ADU construction.

– Drawback includes accepting a potentially higher mortgage rate.

Renting Out Your ADU

If you plan to rent out your ADU, some loan programs may consider a portion of the tenant’s rent as income during the loan application process. This varies by program and may depend on factors like your previous experience as a landlord.

Finding the Right Lender

Whether you decide to borrow equity or opt for a construction/renovation loan, finding the right lender is crucial. Contractors can be valuable sources of lender referrals, helping you assess your financing needs early in the process. Alternatively, you can start by reaching out to a trusted mortgage lender for guidance and potential contractor referrals.

Unlock the potential of your property with an ADU and explore the financing options that align with your goals. From keeping family close to generating rental income, ADUs offer a versatile solution to the evolving housing landscape. Start your journey towards an enhanced living space today!

Appraised Value vs. Market Value

When it comes to real estate, understanding the value of a property is more than just a number—it’s about making informed decisions. The often-confused concepts of “appraised value” and “market value” leave many confused. Understanding the differences between the two is crucial for navigating property transactions successfully.

What is Appraised Value?

The appraised value of a property is an estimate of its worth as determined by a professional appraiser. This process involves a thorough inspection of the property, considering factors such as location, condition, and recent sales of comparable properties in the area. Appraisers also take into account current market trends and the unique features of the property to arrive at a value. This appraisal is often used by lenders to determine the amount of a mortgage loan.

What is Market Value?

Market value, on the other hand, is the estimated amount a property would fetch in the current market. It’s largely influenced by supply and demand dynamics. Factors such as the desirability of the location, the condition of the property, and current real estate market trends play a significant role in determining this value. Unlike appraised value, market value is not a fixed number and can fluctuate based on market conditions.

Key Differences Between Appraised Value and Market Value

The primary difference lies in their determination: appraised value is assessed by a professional appraiser, while market value is influenced by the real estate market. Appraised value is more static and is used primarily for financing purposes. In contrast, market value is dynamic and reflective of the current real estate market conditions.

Appraised value is an estimate of a property’s worth as determined by a professional appraiser.

Determination Factors: Based on property inspections, local comparisons, and market trends.

- Purpose: Used primarily by lenders for mortgage loan determination.

- Stability: More static, reflecting the property’s condition and the market at the time of appraisal.

- Influence: Determined by objective criteria and professional assessment.

Market value is the estimated amount a property would sell for in the current market.

- Determination Factors: Influenced by supply and demand, location desirability, and property condition.

- Purpose: Reflects what buyers are willing to pay in the open market.

- Stability: Dynamic, can fluctuate based on current real estate market conditions.

- Influence: Shaped by the real estate market dynamics and buyer-seller negotiations.

Why Both Values Matter in Real Estate

Understanding both values is important in real estate transactions. The appraised value is crucial for securing financing, as lenders use it to gauge the loan-to-value ratio. For sellers and buyers, market value offers a realistic view of what the property could sell for in the open market. Discrepancies between these values can lead to renegotiations or adjustments in sale terms.

Key Takeaway

Both appraised value and market value are essential components of real estate valuation. Understanding the difference between the two can help buyers, sellers, and investors make better, more informed decisions.

To view the original article, visit the Revive blog.

Five Ways NOT to Use Your HELOC

One of the benefits of owning a home is the chance to build equity. Equity is the difference between what you owe on your mortgage and what your home is worth. If your home is worth $300,000 and you owe $100,000 on your mortgage, you have $200,000 of equity.

You can then borrow against that equity in the form of a home equity loan, or HELOC. A HELOC is a bit like a credit card with your home’s equity serving as your credit limit. Say you have $200,000 of equity. You might qualify for a HELOC of $150,000. You can then borrow up to that limit to spend the funds on whatever you want. And you only pay back what you borrow.

Say you need to spend $50,000 on a major kitchen renovation. You can borrow that $50,000 from your HELOC. You’ll then pay back what you borrowed in regular monthly payments, with interest.

HELOCs tend to come with lower interest rates than credit card s or personal loans do, which makes them a more affordable option when financing home repairs or renovations.

s or personal loans do, which makes them a more affordable option when financing home repairs or renovations.

Using your HELOC to fund improvements that will increase the value of your home is the best use of your HELOC dollars. You’ll even gain a tax benefit: You can write off the interest you pay on your HELOC if you use the funds for renovations or improvements that boost the value of your home.

What should NOT be financed with a HELOC

A dream vacation: You might want to fly to Europe or take that Alaskan cruise. But save up money to pay for it; don’t use your HELOC to fund it. If you fall behind on your HELOC payments, your lender can foreclose on you, eventually evicting you from your home and taking possession of it. Taking that risk to fund a vacation isn’t worth it.

Your or your children’s college education: Because the interest rates with HELOCs can be lower than what you’d get with private student loans, you might consider funding all or part of your or your children’s college tuition with a HELOC. Again, this is risky. If you stop making student loan payments, your credit score will tumble. But your lenders can’t take possession of your home. The same can’t be said if you stop making payments on a HELOC.

A big wedding: We get it: Weddings can be expensive. But again, funding a wedding — yours or one of your children’s — with a HELOC can put your home at risk. It’s not worth it for what is essentially a one-day event.

Stock market investments: You can make a lot of money by investing in the stock market. You can lose a lot, too. And if you use your HELOC to pay for your stock market investments? You might even lose your home if you fall behind on your payments. Again, the potential gain isn’t worth the risk. If you want to invest in the stock market, use your own funds that you’ve saved.

Credit card debt: This is a little trickier. Credit card debt comes with sky-high interest rates. It might make financial sense, then, to use a HELOC to pay off your credit card debt, as the interest rate attached to the money you’ve borrowed against your HELOC will be far lower. Again, though, there is risk. If you’re worried that you won’t be able to afford your HELOC payments, don’t borrow against your line of credit to pay off your credit card debt. Your credit card provider can’t foreclose on your home if you fall behind on your payments.

Heading into the New Year, Mortgage Rates Remain on a Downward Trend

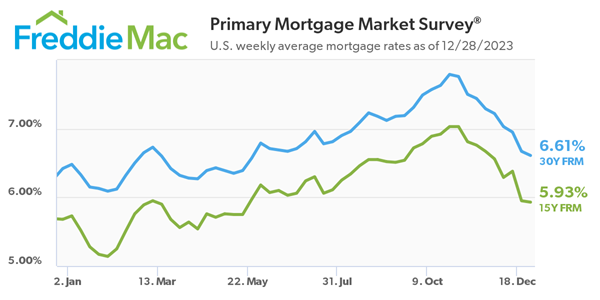

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.61 percent.

“The rapid descent of mortgage rates over the last two months stabilized a bit this week, but rates continue to trend down,” said Sam Khater, Freddie Mac’s Chief Economist. “Heading into the new year, the economy remains on firm ground with solid growth, a tight labor market, decelerating inflation, and a nascent rebound in the housing market.”

News Facts

- The 30-year FRM averaged 6.61 percent as of December 28, 2023, down from last week when it averaged 6.67 percent. A year ago at this time, the 30-year FRM averaged 6.42 percent.

- The 15-year FRM averaged 5.93 percent, down from last week when it averaged 5.95 percent. A year ago at this time, the 15-year FRM averaged 5.68 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit. For more information, view our Frequently Asked Questions.

Freddie Mac’s mission is to make home possible for families across the nation. We promote liquidity, stability, affordability and equity in the housing market throughout all economic cycles. Since 1970, we have helped tens of millions of families buy, rent or keep their home.

Home sales are expected to soar in these California cities next year

With mortgage rates finally easing, many California cities are expected to see home sales rebound significantly next year, according to a new forecast from Realtor.com.

Five metro areas are predicted to see double-digit, year-over-year sales growth in 2024.

They are Oxnard-Thousand Oaks (18%), Riverside-San Bernardino-Ontario (13.8%), Bakersfield (13.4%), San Diego-Chula Vista-Carlsbad (11%) and Sacramento (10.3%).

Home sales in the Los Angeles-Long Beach area are predicted to climb 9.2% after seeing declining sales for two years, analysts at Realtor are forecasting.

The online real estate listing service, which is certainly hoping for a turnaround, ranked the top 100 metro areas on two factors: expected single-family home sales growth and anticipated growth in median home prices.

In all six of those California markets, prices are expected to climb to more than 40% of the 2017-19 average, according to Realtor.

“Among California metros, an interesting split emerges. Five California metros entered our top 10 list of housing markets but none were Bay Area or Northern Californian metros,” Realtor notes in its report.

In 2024, Realtor’s analysts are expecting sales to decline in San Jose-Sunnyvale-Santa Clara by 18.5%, six-percent in Fresno, and be largely flat in the San Francisco-Oakland-Berkeley area.

Realtor also points out that California’s top markets tend to be more sensitive to mortgage rates than many other parts of the nation because less than a third of “homeowners” actually own their homes outright and, instead, owe money to a bank or lender.

Oxnard has the lowest share of homeowners who own their homes outright among the top 10 markets at 30.0%, followed by San Diego at 30.5% and Riverside at 38.4%.

by: Marc Sternfield

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link