More home sellers are paying capital gains taxes — here’s how to reduce your bill

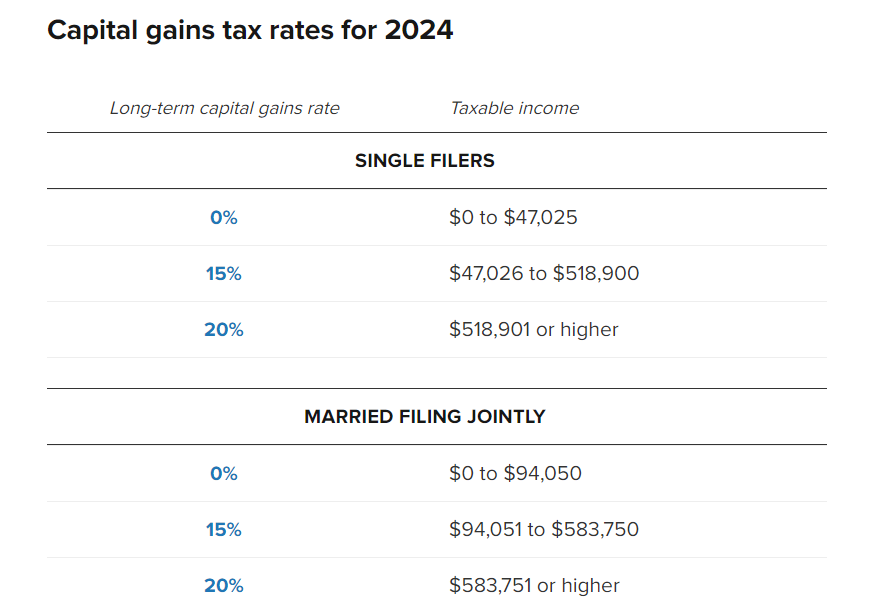

More Americans are paying capital gains taxes on home sale profits amid soaring property values — but there are ways to reduce your bill, experts say.

In 2023, nearly 8% of U.S. home sales yielded profits exceeding $500,000, compared with about 3% in 2019, according to an April report from real estate data firm CoreLogic.

It’s key for a special tax break for homeowners who make a profit when selling a primary residence. Married couples filing together can make up to $500,000 on the sale without owing capital gains taxes. The threshold for single filers is $250,000.

Those capital gains exemption thresholds haven’t been indexed for inflation since 1997, said certified financial planner Jaime Quinones with Stockade Wealth Management in Marlboro, New Jersey.

“With the recent rise in home values, more sellers have been facing a capital gains tax hit,” Quinones said.

Home sale profits above the $250,000 or $500,000 thresholds incur capital gains taxes of 0%, 15% or 20%, depending on your income.

Capital gains taxes on a home sale are more common in high-cost areas. In 2023, the percentage of home sales that had profits exceeding $500,000 hit double digits in Colorado, Massachusetts, New Jersey, New York and Washington, the CoreLogic report found.

How to qualify for the capital gains exemption

The IRS has strict rules for qualifying for the $250,000 or $500,000 capital gains exemption, according to the IRS. To that point, you must own the home for at least two of the past five years before your home sale to satisfy the “ownership test.”

The “residence test” says the home must be your primary residence for any 24 months of the five years before the sale, with some exceptions. The 24 months don’t need to be consecutive.

How to reduce your capital gains tax bill

If you’ve lived in a home long enough to exceed the capital gains exemptions, there’s a “high probability” you’ve made improvements to the home, said Falls Church, Virginia-based CFP Parker Trasborg, senior financial advisor at CJM Wealth Advisers.

You can use those improvements to increase your home’s “basis,” or original purchase price, which reduces your profit, he said.

But routine maintenance and repairs don’t count. For example, you can increase your home’s basis by adding the cost of a new roof or addition. But fixes to leaky pipes won’t qualify.

After selling a home, the IRS receives Form 1099-S, which shows your closing date and gross proceeds. But you’ll need paperwork to prove any changes to your home’s basis in the case of an IRS audit.

PUBLISHED TUE, MAY 7 2024

7 Types of Tax-Deductible Home Improvements

Here’s an overview of a few examples of tax-deductible home improvements. As always, you should consult a tax professional to understand more about what qualifies for deductions.

Energy-Efficient Upgrades

Homeowners can potentially qualify for an Energy Efficiency Home Improvement Credit of up to $3,200 for energy-efficient improvements made after Jan. 1, 2023. The credit for 2024 is 30% of qualified expenses, but it has certain limits depending on the type of improvement.

Energy efficient upgrades can help reduce energy usage and strain on a home’s critical systems. Upgrades can include structural improvements to the home and the installation of new systems. Here are some sample projects:

- A home energy audit may be eligible for a tax credit of up to $150. An auditor will help your clients understand where they’re losing energy and identify health and safety issues in their home. A home energy audit could help save up to 30% on energy bills, according to the Department of Energy. To qualify for the credit, the audit must be conducted by a qualified home energy auditor or someone who is supervised by a qualified auditor. It also must include a written report prepared and signed by a qualified home energy auditor, and the report must be consistent with industry best practices. Find more information in Notice 2023-59.

- Install ENERGY STAR’s Most Efficient exterior windows and skylights for a credit of up to $600 based upon eligibility. Replacing windows can help improve insulation and reduce the need to run the HVAC system.

- Install biomass stoves that meet ENERGY STAR’s requirements for up to a $2,000 credit. Biomass stoves must have a thermal efficiency rating of at least 75% to qualify, and costs may include labor to install. Biomass can consist of wood pellets and grasses. Although burning biomass can reduce energy usage, insurance experts recommend following wood-burning best practices to help reduce fire and other health risks.

Clean Energy Upgrades

Homeowners could potentially qualify for the Residential Clean Energy Credit if they install new renewable energy properties in their homes. There is no dollar limit for this credit except for fuel cell properties ($500 for each half-kilowatt of capacity).

Using clean energy can help lower reliance on traditional utilities and lower usage and bills. Systems like solar panels are generally easy to maintain, typically only requiring regular cleaning to prevent debris buildup. Here are some sample projects:

- Installing a solar water heater can help reduce strain on a traditional water heater and help prolong its life, depending on the type installed. For example, a two-tank solar water heater preheats water before it reaches a traditional water heater. Water heating is typically the second largest energy expense in any home.

- Installing geothermal heat pumps can help heat and cool a home more efficiently than traditional heating and cooling systems by transferring heat to the ground rather than generating heat. They tend to be expensive, but according to the Department of Energy, it could potentially see a return on investment for homeowners in five to 10 years depending on available financial incentives.

- Battery storage technology helps store excess energy generated from clean energy sources. This gives a home a reliable energy source if the grid goes down.

Historic Home Upgrades

The Federal Historic Rehabilitation Tax Credit could apply if homeowners are undergoing a renovation of a historic home. Historic homes can qualify for this tax credit and other grants since many organizations wish to preserve historical buildings. Taking advantage of these can help lower the financial burden of potential repairs while helping to restore a home’s original beauty. Here are some sample projects:

- Upgrading or replacing old pipes may qualify for this tax credit and may be necessary to bring the home up to code and help prevent water damage.

- Replacing deteriorated parts in the structure of a home, like posts or beams, may qualify for this credit. Replacement should be visually similar to the original and at least equal to the original’s load-bearing capabilities.

- Fully replacing a deteriorating set of stairs using the same or compatible substitute material can make a home safer and also may qualify for this tax credit. The new set of stairs should look similar to the original.

Medically Necessary Upgrades

Homeowners could potentially include medically necessary home upgrades as a part of a medical expense deduction. These include improvements that help make a home more accommodating for a person with a disability, spouse or dependents that live in the home. The amount that can be included in a medical expense deduction depends on how the improvement impacts the home’s value:

- If the home’s value increases as a result of the improvement, the medical expense is considered the cost of the improvement minus the increase in home value.

- If the home’s value does not increase, it can include the entire cost in the medical expense deduction.

Homeowners can invest in upgrades that can help make their home more accessible and help prevent future maintenance issues (which is especially important if they plan to age in place). For example, lowering kitchen cabinets or installing pull-down shelves can help prevent potential falls and damage when straining for out-of-reach items. Here are some sample projects:

- Installing modified smoke detectors and other monitoring systems can help alert those with a disability, like alarms with strobe lights for those who are hard of hearing. Smart monitoring systems, like water leak detectors, can also make it easier to detect issues early in hard-to-reach areas.

- Grading, or leveling, the ground can improve accessibility and also help protect a home from water runoff. Grading can help reduce steep slopes and create more accessible pathways for those with mobility challenges. It can also help direct runoff away from a home and prevent standing water.

- Bathroom modifications, like grab bars and railings, can help prevent slips and falls. These modifications also can help prevent water splashes that could lead to mold or mildew over time.

Home Office Repairs and Improvements

Homeowners may be eligible to deduct home office repair expenses if they have a dedicated part of their home that they regularly use as their main place of business. The amount that can be deducted depends on whether the project impacts the entire home or just the office. Home office improvements are not tax deductible and would be categorized similarly to capital improvements. Here are some sample projects:

- If installing a full home security system, homeowners could potentially deduct the cost of maintaining and monitoring the system that relates to the business part of their home.

- Repairing damaged outlets and wiring may be tax deductible and, more importantly, a crucial project to help prevent electrical fires and potential damage to devices. Electrical distribution or lighting equipment (which includes wiring and outlets) was the leading cause of home property damage from 2016 to 2020, according to the April 2023 National Fire Protection Association Home Structure Fires Report.

- Replacing home office windows with dual or triple-pane windows to help improve insulation and reduce noise also may be eligible. In addition to the tax benefits, homeowners may find it good for resale value, too, since this can help lower the need for cooling and heating and lower the strain on an HVAC system.

Rental Property Repairs

If homeowners rent out a part of their home, they may be able to deduct repair expenses from the amount of taxable rental income they receive. Limitations apply, such as if they’re renting a space in their current residence.

Maintaining the parts of their home that they rent can help prevent issues from impacting the rest of their home. For example, issues like water leaks or drafts in one area can lead to bigger issues if left unaddressed. Here are some sample projects:

- Repairing leaks in a tenant’s bathroom can help prevent long-term mold and mildew issues. Leaks also could impact a home’s structural integrity if drywall or floor joists are left wet over time.

- Addressing air leaks in a tenant’s area can help improve insulation, keep them comfortable and lower the need to cool or heat that part of a home. Updating the weather stripping around windows and doors may also apply.

- Routinely checking the air vents in a tenant’s part of the home can improve the chances of catching airflow issues early, including dirty vents or leaky ducts. Improved airflow can help boost indoor air quality and regulate temperature throughout your home.

Capital Improvements

Capital improvements are projects that extend a home’s life, add value or refit a home for new uses. These differ from home repairs, which are part of property maintenance but don’t necessarily add value (like fixing a leak). There are some limitations to the types of eligible improvements. For example, homeowners cannot include the cost of installing carpeting if they later remove it. They also cannot include energy-related improvements if they received subsidies or tax credits for those improvements.

Homeowners can add the value of qualifying capital improvements to the cost basis of their home. When they sell their home one day, they may be able to subtract their adjusted cost basis from the sale price. This can help reduce the amount of capital gains taxes they may owe. However, they’ll also need to take into account the tax implications of the capital gains from the sale of their home.

Although homeowners won’t see tax benefits from these improvements right away, these projects can help proactively protect a home by getting ahead of potential issues. Here are some sample projects:

- Installing a new HVAC system to replace one that’s over 10 to 25 years old, isn’t running efficiently or is worn beyond repair can help save money and help protect a home. A modern and efficient HVAC system can improve air circulation, maintain temperature control, and help cut down on utility costs in the process.

- Installing attic insulation can cost about $1.80 per square foot and can help reduce heating and cooling costs, easing stress on an HVAC system. A better-insulated attic can also help maintain a roof’s temperature and prevent related damage, like the expanding and contracting that can occur with winter ice dams.

- Installing water softeners can help reduce calcium and magnesium in the water. This helps reduce buildup in plumbing fixtures and pipes and helps appliances run more efficiently and last longer.

By Courtney Klosterman, home insights expert and director of communications at Hippo Insurance

Let Your Home Equity Fund Your Retirement

Struggling with Money? Learn about Home Equity Conversion Mortgages (HECMs)

If you’re low on cash, you might consider a Home Equity Conversion Mortgage (HECM). It’s like a reverse mortgage backed by the government. This means if you meet certain requirements, you can borrow money against the value of your home. The Federal Housing Administration (FHA) guarantees repayment to the lender, so it’s secure. In recent years, HECMs have become more popular, especially among older folks who need extra cash and plan to stay in their homes forever.

Understanding HECM Rules

To qualify for an HECM, you need to be at least 62 years old. Also, you’ll have to pay back the loan when you move out, sell your house, or pass away. You must own your home or have a significant portion paid off, and it must be your primary residence. Plus, you’ll need to have a session with a counselor approved by the Department of Housing and Urban Development (HUD).

Limits and Considerations

The amount you can borrow depends on factors like your age, current interest rates, and the value of your home. Typically, older homeowners with more valuable properties can borrow more.

HECM vs. Regular Mortgages

Unlike traditional mortgages, with HECMs, the amount you owe increases over time. You’ll still need to cover property taxes, insurance, and upkeep costs. Also, the interest you pay isn’t tax-deductible until you pay off the loan.

How You Get Paid

You can choose to receive HECM funds as a lump sum or in monthly payments or a line of credit. You’re free to use the money as you wish, whether for essential expenses, paying off debts, or enjoying life.

HECMs offer a flexible way to access cash when you need it, especially for retirees looking to boost their income.

Attractive features

An HECM offers some compelling advantages if your circumstances fit:

- You can plan on staying in your “forever” home, where you are settled, and can perhaps renovate it, allowing you to age in place.

- You can enjoy a reliable cash flow in order to provide more comfortable senior years.

- You need not make monthly payments on the loan balance.

- Your spouse can usually remain in the home even if you die or move to another accommodation.

- You can pay off debt balances, such as medical bills.

- You can use the proceeds to pay off existing mortgages and thereby prevent foreclosures.

- You can avoid paying withdrawal penalties on other retirement accounts.

- You can fund a grandchild’s education or any other meaningful purpose.

- Integrated protections limit your heirs’ responsibilities.

But is it right for you?

There are several significant drawbacks, so seniors must take extra care with such an important decision:

- Fees tend to be high, including upfront financed origination charges of about 2% and around .5% for annual review of mortgage insurance premiums.

- You could compromise your benefits from needs-based programs, such as Medicaid.

- You could inadvertently default by failing to meet loan requirements, including by living outside the home most of the year, neglecting property taxes or home insurance, or not making maintenance repairs. An unresolved default might lead to eviction and foreclosure.

Alternative loans may be more appropriate. For example, those under age 62 could use home equity loans (HELOCs). More expensive properties may require a jumbo reverse mortgage, with higher interest rates but no mortgage insurance. By contrast, single-purpose reverse mortgages are cheapest and can be used for specified expenses such as taxes or repairs.

Your financial advisor can help you compare different types of reverse mortgages, payment options and other considerations.

Why 90% of Homebuyers Will Continue to Choose Working with Real Estate Agents: Insights from the National Association of Realtors

Members of the National Association of Realtors will continue to be the most reliable partner for the millions of Americans striving to realize the American dream through homeownership.

Specifically, the settlement will prohibit offers of compensation from being shared on multiple listing services (MLSs), the databases that show real estate brokers the properties for sale, and it will require MLS participants to enter into written agreements with their buyers.

These changes will go into effect in mid-late July 2024.

It’s important to note that the National Association of Realtors does not set commissions, and nothing in this proposed settlement would change that. Commissions would continue to be negotiable among buyers, sellers, and their brokers.

The “cooperative compensation” rule that has been subject to litigation says that selling brokers have to specify on each listing an offer of compensation to buyers’ brokers. That offer could be any amount, even zero.

Cooperative compensation, where the compensation a seller pays to their broker is shared, covering the cost of a buyer broker’s services, will continue to be an important option for consumers in all transactions and especially those involving lower and middle-income homebuyers, who may already have a difficult-enough time saving for a down payment.

The bottom line is that consumers will continue to be able to choose what kind of professional real estate advice they’d like–and how much, and how, they will pay for the work of a real estate professional.

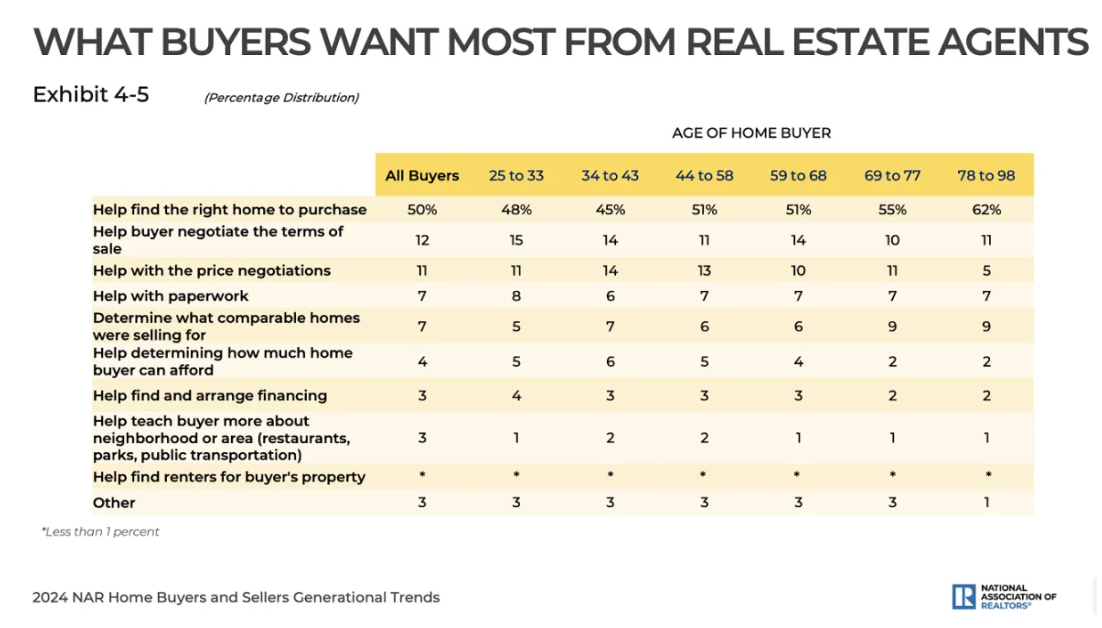

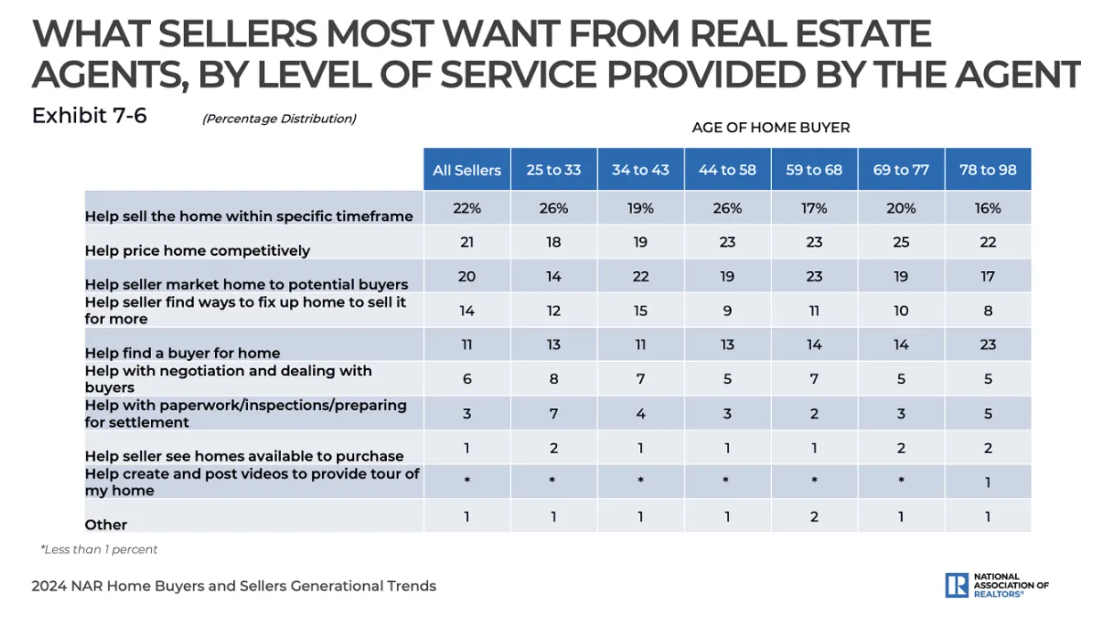

Historically, nearly 90% of homebuyers have opted to work with a real estate agent or broker. That figure is unlikely to change.

Even in an era where seemingly everything can be researched and purchased electronically, the clear value added by realtors remains evident. Nine in 10 home buyers would use their agent again or recommend their agent to others.

Seasoned agents and brokers also offer insights into property values, taxes, regulations, and zoning laws while overseeing thorough due diligence processes. And we connect buyers and sellers with other reputable real estate-related professionals such as lawyers, lenders, contractors, and inspectors–any of which can make or break a transaction.

When it comes time to make or evaluate offers, real estate professionals have a decades-long track record as skilled negotiators, ensuring that their clients submit the most competitive bids for their dream home–or hold out for what their home is really worth. And at the settlement table, we help our clients confidently close on what is likely the most significant financial transaction of their lives.

Even post-sale, real estate agents and brokers are crucial advisors for their clients, providing ongoing support, answering queries, and offering guidance as people confront the challenges and delights of homeownership.

NAR’s proposed settlement agreement and the associated practice changes will not change what makes realtors valuable: specialized knowledge, diligence, and a commitment to our clients’ best interests. And it does not change the fact that millions of people will continue to rely on us to help them fulfill their dream of homeownership.

Find the original article here

Why We Aren’t Headed for a Housing Crash

If you’re holding out hope that the housing market is going to crash and bring home prices back down, here’s a look at what the data shows. And spoiler alert: that’s not in the cards. Instead, experts say home prices are going to keep going up.

Today’s market is very different than it was before the housing crash in 2008. Here’s why.

It’s Harder To Get a Loan Now – and That’s Actually a Good Thing

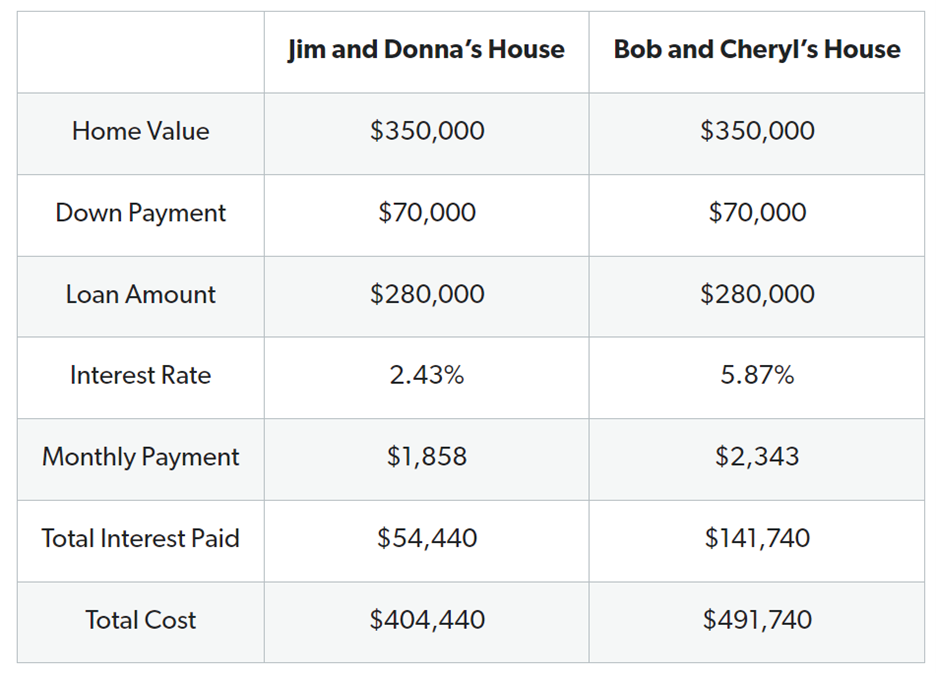

It was much easier to get a home loan during the lead-up to the 2008 housing crisis than it is today. Back then, banks had different lending standards, making it easy for just about anyone to qualify for a home loan or refinance an existing one.

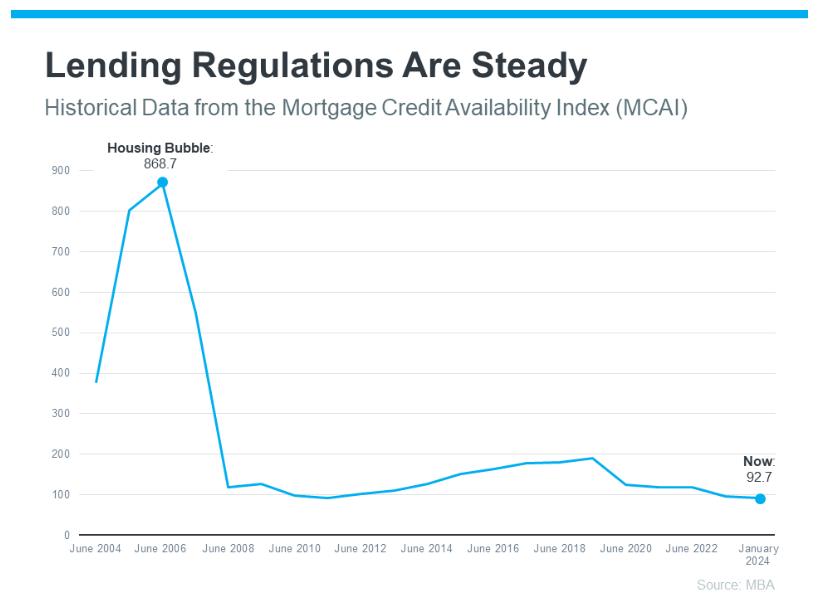

Things are different today. Homebuyers face increasingly higher standards from mortgage companies. The graph below uses data from the Mortgage Bankers Association (MBA) to show this difference. The lower the number, the harder it is to get a mortgage. The higher the number, the easier it is:

The peak in the graph shows that, back then, lending standards weren’t as strict as they are now. That means lending institutions took on much greater risk in both the person and the mortgage products offered around the crash. That led to mass defaults and a flood of foreclosures coming onto the market.

There Are Far Fewer Homes for Sale Today, so Prices Won’t Crash

Because there were too many homes for sale during the housing crisis (many of which were short sales and foreclosures), that caused home prices to fall dramatically. But today, there’s an inventory shortage – not a surplus.

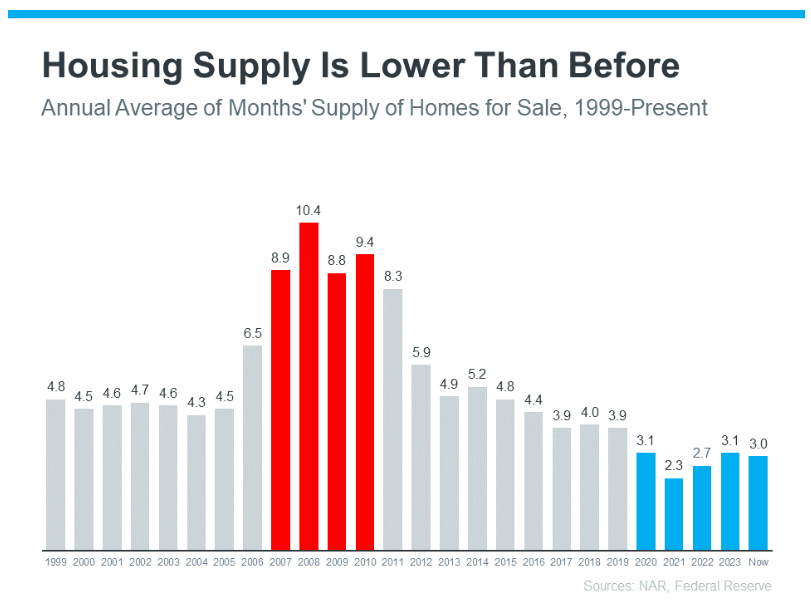

The graph below uses data from the National Association of Realtors (NAR) and the Federal Reserve to show how the months’ supply of homes available now (shown in blue) compares to the crash (shown in red):

Today, unsold inventory sits at just a 3.0-months’ supply. That’s compared to the peak of 10.4 month’s supply back in 2008. That means there’s nowhere near enough inventory on the market for home prices to come crashing down like they did back then.

People Are Not Using Their Homes as ATMs Like They Did in the Early 2000s

Back in the lead up to the housing crash, many homeowners were borrowing against the equity in their homes to finance new cars, boats, and vacations. So, when prices started to fall, as inventory rose too high, many of those homeowners found themselves underwater.

But today, homeowners are a lot more cautious. Even though prices have skyrocketed in the past few years, homeowners aren’t tapping into their equity the way they did back then.

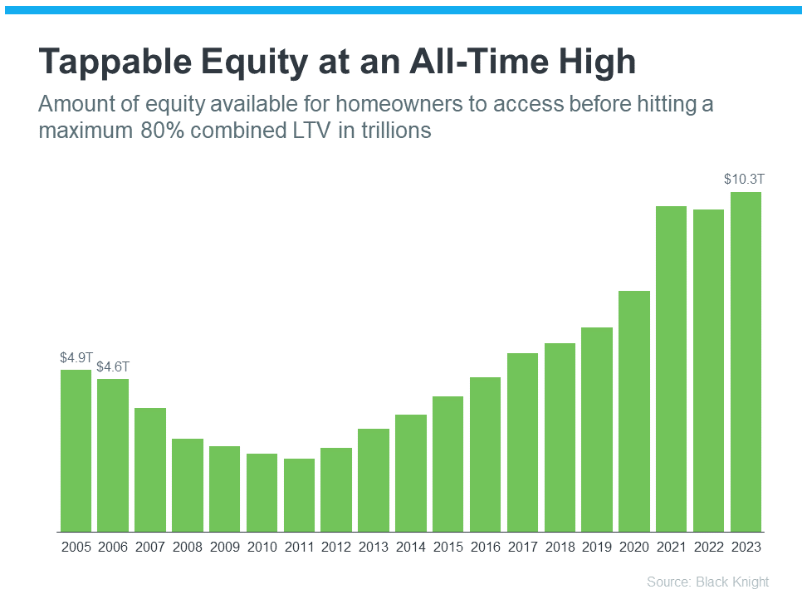

Black Knight reports that tappable equity (the amount of equity available for homeowners to access before hitting a maximum 80% loan-to-value ratio, or LTV) has actually reached an all-time high:

That means, as a whole, homeowners have more equity available than ever before. And that’s great. Homeowners are in a much stronger position today than in the early 2000s. That same report from Black Knight goes on to explain:

“Only 1.1% of mortgage holders (582K) ended the year underwater, down from 1.5% (807K) at this time last year.”

And since homeowners are on more solid footing today, they’ll have options to avoid foreclosure. That limits the number of distressed properties coming onto the market. And without a flood of inventory, prices won’t come tumbling down.

Bottom Line

While you may be hoping for something that brings prices down, that’s not what the data tells us is going to happen. The most current research clearly shows that today’s market is nothing like it was last time.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link