WHAT’S AHEAD FOR THE HOUSING MARKET FOR THE REST OF 2024?

As we enter the second half of 2024, there’s one big question on everyone’s minds right now: what’s ahead for the housing market?

With an upcoming Presidential election, affordability challenges, and a whole lot of confusing headlines out there, there are a lot of mixed feelings about the state of the housing market this year.

But no matter what’s happening in real estate, this will always remain true: the most powerful tool you have to beat your competition is knowledge.

So, let’s take a deep dive into the latest housing market projections so you have the confidence to educate your clients and crush your goals this year.

SECOND HALF OF 2024 HOUSING MARKET PROJECTIONS

Taking all of that into consideration, here’s what industry experts anticipate for the 2024 housing market.

Will Home Prices Go Up or Down?

Plus, the newest data shows an uptick in price reductions for active listings in recent months.

So, what does the future hold for home prices? Will home prices fall?

With the latest expert projections, this is what we can gather: home prices will continue to climb moderately for most markets around the country.

Why are home prices still going up? It all comes down to the number of homes for sale. Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), puts it simply:

“One thing that seems to be pretty solid is that home prices are going to continue to go up, and the reason is that we don’t have housing inventory.”

While there are more homes on the market compared to the past couple of years, it’s still not enough overall to meet today’s buyer demand. This will keep pushing prices up.

What’s Going to Happen with Mortgage Rates?

The biggest piece of advice you can give to anyone who asks is this: if they’re waiting for rates to go back down to where they were in 2020-2022, they’ll be waiting a long time.

But there is good news: experts project mortgage rates should come down later this year as inflation continues to cool.

What Will Happen with Home Sales in 2024?

But with more homes available, we’re expecting a few more sales this year compared to 2023.

Lawrence Yun, Chief Economist at NAR, said this:

“In the second half of 2024, look for moderately lower mortgage rates, higher home sales, and stabilizing home prices.”

It won’t be a massive uptick, but it does show that the market is holding steady.

Will the Housing Market Crash This Year?

Ultimately, it comes down to supply and demand.

While you may have seen some recent headlines that say a crash is possible, context is important.

As Business Insider says:

“Though many Americans believe the housing market is at risk of crashing, the economists who study housing market conditions overwhelmingly do not expect a crash in 2024 or beyond.”

Although we’ve seen an uptick in inventory over the past year, we’re still under supply. When the housing market crashed in 2008, there was an oversupply of homes. So, rest easy. There won’t be a crash, and you can use this information to ease any clients’ worries that one could be on the horizon.

WHAT DOES THIS MEAN FOR BUYERS & SELLERS FOR 2024?

But what about the rest of this year?

With experts projecting a rise in inventory and a decline in mortgage rates so long as inflation continues to ease, data suggests we’re heading for a more stable and predictable market than we’ve seen in the last few years.

There is still a lot of motivation for buyers and sellers in the market who are ready, willing, and able, and that’s not expected to change in the six months.

Bottom Line

Industry experts don’t expect any major shifts for the rest of the year. In fact, we’re looking at a steady decline in mortgage rates and a moderate, more normal climb in home prices and sales.

Renovations: Good for Resale?

According to a recent edition of the respected trade publication *Remodeling*, the top 23 major home remodeling projects were highlighted, with five of them offering homeowners more than a 100% return on investment (ROI). If you’re considering a home renovation, here are five standout projects worth contemplating:

1. HVAC Conversion

Getty Images

While electric heat pumps might not be the flashiest upgrade, they are increasingly popular among homeowners looking to replace old fossil-fuel furnaces. Heat pumps offer dual functionality—heating in the winter and cooling in the summer—making them a smart choice for regions with high cooling costs. This eco-friendly option costs about $17,747 on average but promises a remarkable ROI of over 100%, making it a worthwhile investment.

2. Garage Door Replacement

Garage doors play a crucial role in your home’s curb appeal, and upgrading to modern, four-section doors on heavy-duty galvanized steel tracks can make a significant impact. Often, these new doors can work with your existing motorized opener. This upgrade not only enhances your home’s appearance but also offers an impressive ROI of over 100%.

3. Minor Kitchen Remodel

If a full kitchen renovation is beyond your budget, consider a minor remodel to refresh your space. Instead of a complete overhaul, try refacing your cabinet fronts, updating handles and pulls, installing a new countertop or sink, replacing the flooring, and giving the walls a fresh coat of paint. These updates can transform your kitchen and provide an ROI of more than 85%.

4. Enhancing Your Outdoor Living Space

Expanding your living area outdoors is a fantastic way to enjoy your home more. Adding a deck can significantly boost your relaxation and entertainment space. While the cost can vary, with an average around $8,000, the ROI for this project is around 50%. Although this may seem modest compared to other projects, the enjoyment you get from an outdoor space is invaluable.

As you consider your next home improvement project, keep in mind the potential return on investment. Making informed decisions can lead to both financial and personal rewards. For more information on choosing the right renovation projects for your home, feel free to reach out to me. I’m here to help you make the best choices for your home and your future.

Understanding Supplemental Property Taxes After the Death of an Owner in CA

In the realm of real estate, understanding taxes is crucial, especially when it comes to changes in property ownership due to life events like the passing of an owner. If you own property in California, you may have heard of supplemental property taxes but might not fully grasp what they entail, particularly after the death of an owner. Here’s a comprehensive guide to help you navigate this aspect of property ownership.

What are Supplemental Property Taxes?

Supplemental property taxes are additional property taxes that may be due when there is a change in ownership or new construction. In California, when a property changes hands, whether through sale, inheritance, or other means, the county assessor reassesses the property to determine its new taxable value based on the current market value. This reassessment can lead to an increase in property taxes, and the supplemental tax bill reflects this difference.

Understanding Changes in Ownership

When an owner passes away, their property typically goes through a reassessment process to determine its current market value. This reassessment is crucial for calculating the new property taxes owed. It’s important to note that not all changes in ownership trigger reassessment; for instance, transfers between spouses or between parents and children may be excluded from reassessment under certain conditions, such as through Proposition 13 exclusions or Proposition 58.

Navigating the Process

- Notification: The county assessor’s office is typically notified of the change in ownership, often through the recording of a death certificate or other legal documents.

- Reassessment: The assessor then evaluates the property’s current market value. This value is used to calculate the supplemental property tax.

- Supplemental Tax Bill: Once reassessment is complete, the county sends out a supplemental tax bill to the new property owner(s). This bill covers the additional property taxes owed for the period between the date of ownership change and the end of the fiscal year.

- Payment Schedule: Supplemental tax bills are separate from regular property tax bills and have different due dates. It’s essential to pay attention to these deadlines to avoid penalties or interest.

Planning Ahead

Dealing with supplemental property taxes can be complex, especially during periods of grief and transition. Here are some tips to help you navigate this process smoothly:

- Seek Professional Guidance: Consider consulting with a real estate attorney or tax advisor who specializes in California property taxes. They can provide personalized advice based on your specific situation.

- Understand Exemptions and Exclusions: Familiarize yourself with Proposition 13 and Proposition 58 exclusions, which may allow certain transfers to avoid reassessment.

- Budgeting: Plan for potential increases in property taxes when budgeting for expenses related to the property.

- Keep Records: Maintain clear records of all transactions and communications related to the property transfer and reassessment.

Conclusion

While supplemental property taxes can seem daunting, understanding the process can help alleviate confusion and ensure compliance with California’s tax laws. By staying informed and seeking professional guidance when needed, you can navigate these changes with confidence. Remember, each situation is unique, so personalized advice is invaluable in making informed decisions regarding your property taxes.

If you have further questions or need assistance with understanding supplemental property taxes after the death of an owner in California, don’t hesitate to reach out to local experts who can provide clarity and guidance tailored to your needs.

Do Cash-Out Loans Come With A Tax Break?

First you need to understand what a cash-out refinance is. In such a refinance, you swap your existing mortgage loan for a new mortgage in which you borrow a higher amount. You use the found cash to pay for whatever you’d like.

For example, say you owe $150,000 on your current mortgage. You might refinance that for a new mortgage with a balance of $220,000. You’d then receive the extra $70,000 in a lump-sum payment. You could use that money to pay for anything from a kitchen remodel to a master bedroom addition to your child’s college tuition.

There are some limits. The amount you can borrow with a cash-out refinance is limited by the equity in your home. Equity is the difference between what your home is worth and what you owe on your mortgage. If your home is worth $350,000 and you owe $200,000 on your mortgage, you have $150,000 in equity. Your lender will let you borrow a portion of that equity in the form of a cash-out refinance.

You’ll also have to pay closing costs, which could eat into the money available to you. These costs vary but are typically 2% to 5% of the amount that you borrow. You can usually roll these costs into your total loan amount instead of paying them up front.

What about the tax break?

If you use the funds from a cash-out refinance to improve your home, boosting its value, you can claim the interest that you pay on your new loan on your income taxes. For a new loan, you can deduct the interest you pay on up to $750,000 of mortgage debt.

This means that you can deduct the interest you pay if you use your cash-out refinance to pay for a new bathroom, master bedroom addition, second-floor addition or major kitchen remodel. Any home-improvement project that is expected to increase the value of your home will qualify you for the mortgage interest deduction.

If you instead use the funds from a cash-out refinance to pay off your credit card debt, build an emergency fund or pay for a child’s college tuition, you can’t deduct the interest you pay. That’s why the best use for a cash-out refinance, just as for any home equity loan, is to cover the costs of home improvements.

As a reminder, this is just a summary of complicated provisions that are subject to change. Do not make any assumptions on your tax situation before you speak with a qualified tax professional.

Selling Smart: Why a Real Estate Agent Makes All the Difference

If you’re considering selling your house on your own as a “For Sale by Owner” (FSBO), you want to think about if it’s really worth the extra stress. Going this route means shouldering a lot of responsibilities by yourself – and, if you’re not an expert, that opens the door for mistakes to happen and can quickly become overwhelming.

A report from the National Association of Realtors (NAR) shows two key areas where people who sold their own house struggled the most: pricing and paperwork.

Here are just a few of the ways an agent makes those tasks a whole lot easier.

Getting the Price Right

Setting the right price for your house is important. And, if you’re selling your house on your own, two common issues can happen. You might ask for too much money (overpricing). Or you might not ask for enough (underpricing). Either can make it hard to sell your house. According to NerdWallet:

“When selling a home, first impressions matter. Your house’s market debut is your first chance to attract a buyer and it’s important to get the pricing right. If your home is overpriced, you run the risk of buyers not seeing the listing.

. . . But price your house too low and you could end up leaving some serious money on the table. A bargain-basement price could also turn some buyers away, as they may wonder if there are any underlying problems with the house.”

To avoid these problems, team up with a real estate agent. Agents know how to figure out the perfect price because they have a deep understanding of the local housing market. And they’ll use that expertise to set a price that matches what buyers are willing to pay, giving your house the best chance to impress from the start.

Understanding and Performing Paperwork

Selling a house involves a bunch of paperwork and legal documentation that has to be just right. There are a lot of rules and regulations to follow, and that makes it a bit tricky for homeowners to manage everything on their own. Without a pro by your side, you could end up facing liability risks and legal complications.

Real estate agents are experts in all the contracts and paperwork needed for selling a house. They know the rules and can guide you through it all, reducing the chance of mistakes that might lead to legal problems or delays. As an article from First American explains:

“To buy or sell a home you need to accurately complete a lot of forms, disclosures, and legal documents. A real estate agent ensures you cross every ‘t’ and dot every ‘i’ to help you avoid having a transaction fall through and/or prevent a costly mistake.”

So, instead of dealing with the growing pile of documents on your own, team up with an agent who can be your advisor, helping you avoid any legal bumps in the road.

Bottom Line

Selling a house on your own can cost you a lot of time and stress. Give me a call so that I can help with all the finer details, including setting the right price, handling all the paperwork, and so much more. That way I can take that stress off of your plate.

/

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

As we move into the second half of 2024, here’s what experts say you should expect for home prices, mortgage rates, and home sales.

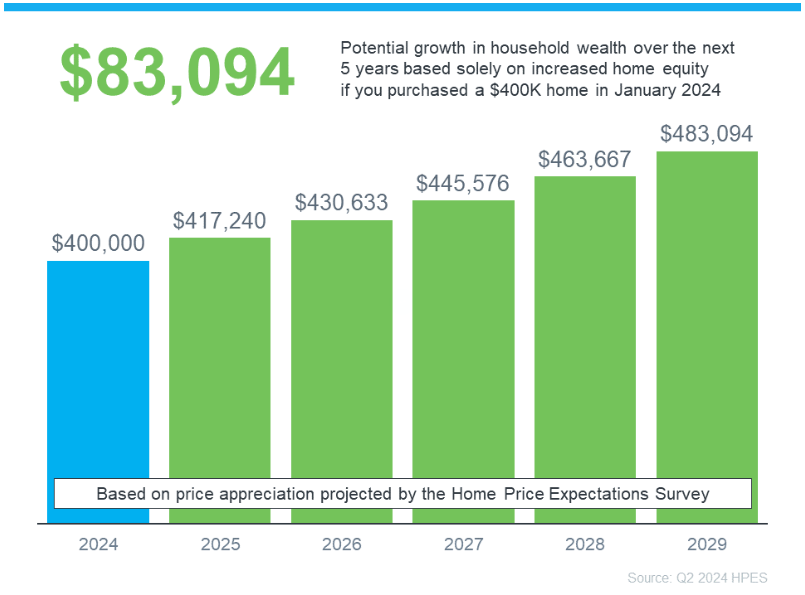

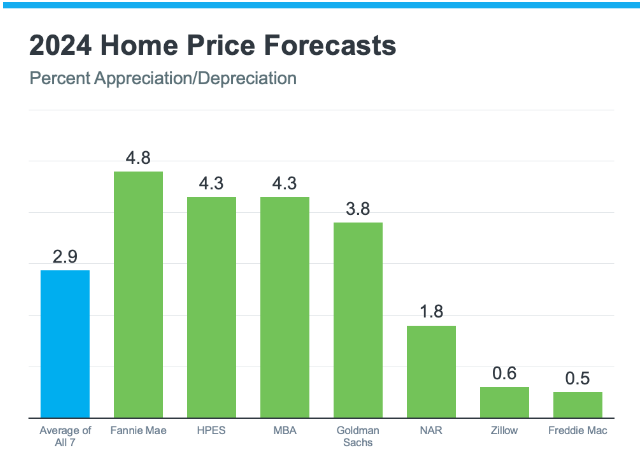

Home Prices Are Expected To Climb Moderately

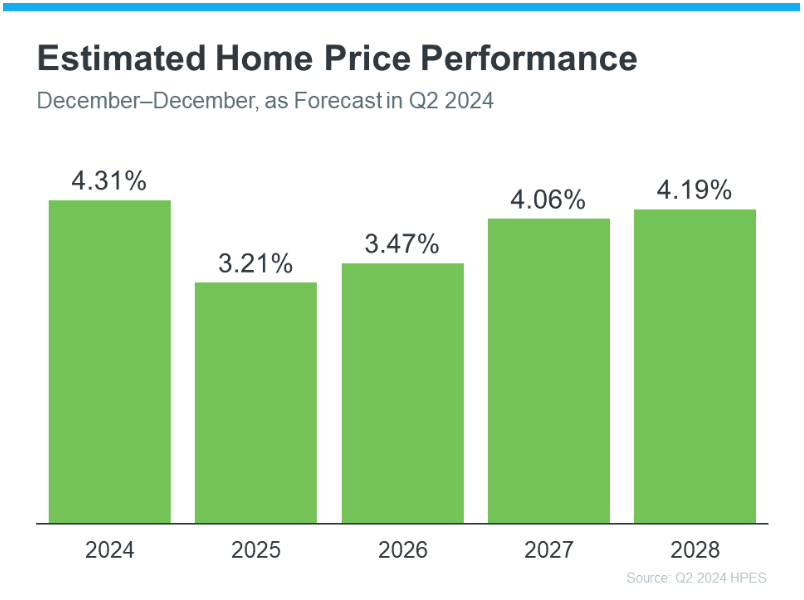

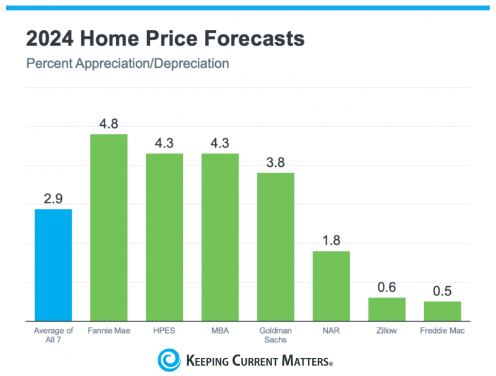

Home prices are forecasted to rise at a more normal pace. The graph below shows the latest forecasts from seven of the most trusted sources in the industry:

The reason for continued appreciation? The supply of homes for sale. Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), explains:

“One thing that seems to be pretty solid is that home prices are going to continue to go up, and the reason is that we don’t have housing inventory.”

While inventory is up compared to the last couple of years, it’s still low overall. And because there still aren’t enough homes to go around, that’ll keep upward pressure on prices.

If you’re thinking of buying, the good news is you won’t have to deal with prices skyrocketing like they did during the pandemic. Just remember, prices aren’t expected to drop. They’ll continue climbing, just at a slower pace.

So, getting into the market sooner rather than later could still save you money in the long run. Plus, you can feel confident experts say your home will grow in value after you buy it.

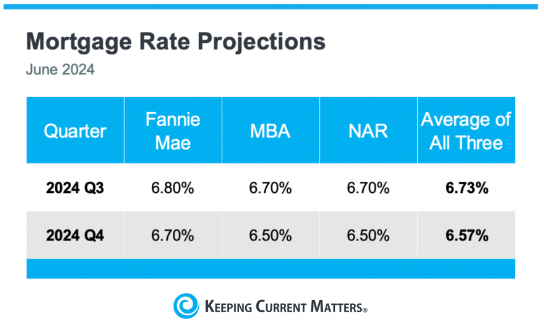

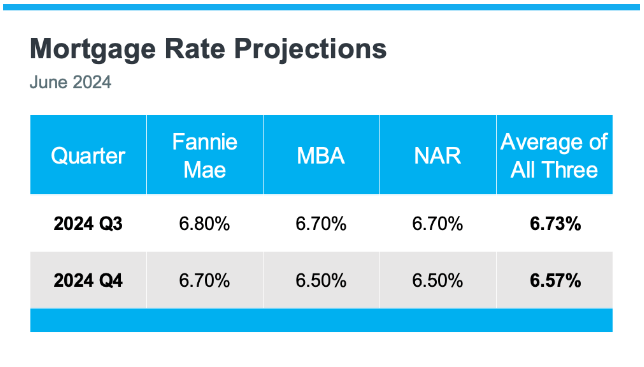

Mortgage Rates Are Forecast To Come Down Slightly

One of the best pieces of news for both buyers and sellers is that mortgage rates are expected to come down a bit, according to Fannie Mae, the Mortgage Bankers Association (MBA), and NAR (see chart below):

When you buy, even a small drop in mortgage rates can make a big difference in your monthly payments. For sellers, lower rates will bring more buyers back into the market, which can help you sell faster and potentially at a higher price. Plus, it may help you get off the fence, if you’ve been hesitant to sell due to today’s rates.

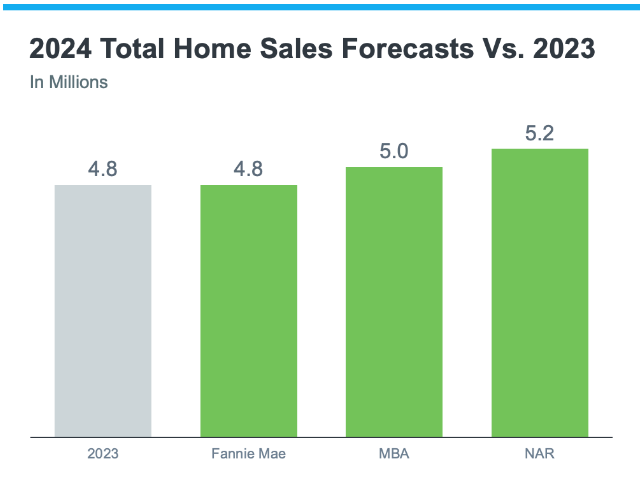

Home Sales Are Projected To Hold Steady

For 2024, the number of home sales will be about the same as last year and may even rise slightly. The graph below compares the 2024 home sales forecasts from Fannie Mae, MBA, and NAR to the 4.8 million homes that sold last year:

The average of the three forecasts is about 5 million sales in 2024 – a small increase from 2023. Lawrence Yun, Chief Economist at NAR, explains why:

“Job gains, steady mortgage rates and the release of inventory from pent-up home sellers will lead to more sales.”

With more inventory available and mortgage rates expected to go down, a few more homes are expected to be sold this year compared to last year. This means more people will be able to move. Let’s work together to make sure you’re one of them.

Bottom Line

If you have any questions or need help navigating the market, reach out to me, I am happy to help.

/

The Downsides of Selling Your House Without an Agent

Some Highlights

- Considering selling your house without an agent? You should know there are some serious downsides to handling it on your own.

- You’ll be missing out on marketing tools that draw in more buyers, pricing and market expertise, essential negotiation skills, in-depth knowledge of the fine print in contracts, and so much more.

- Don’t take all of this responsibility on. Instead, connect with an agent so you have someone with the knowledge and experience you’ll need on your side.

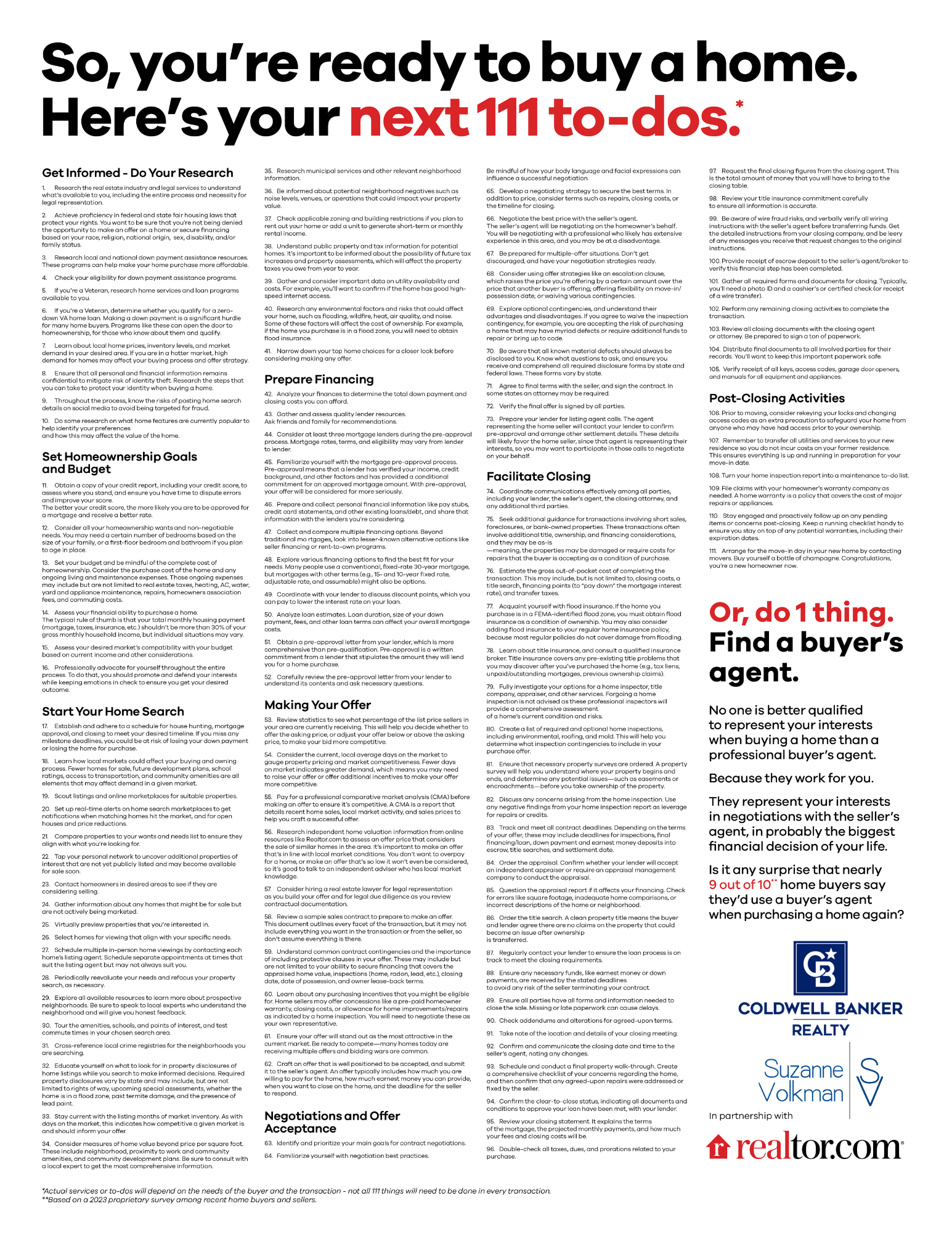

Buying a home? 111 reasons to use a buyer’s agent

So, you’re ready to buy a home.

Here’s your next 111 to-dos.

*

Get Informed – Do Your Research

1. Research the real estate industry and legal services to understand what’s available to you, including the entire process and necessity for legal representation.

2. Achieve proficiency in federal and state fair housing laws that protect your rights. You want to be sure that you’re not being denied the opportunity to make an offer on a home or secure financing based on your race, religion, national origin, sex, disability, and/or family status.

3. Research local and national down payment assistance resources. These programs can help make your home purchase more affordable.

4. Check your eligibility for down payment assistance programs.

5. If you’re a Veteran, research home services and loan programs available to you.

6. If you’re a Veteran, determine whether you qualify for a zero-down VA home loan. Making a down payment is a significant hurdle for many home buyers. Programs like these can open the door to homeownership, for those who know about them and qualify.

7. Learn about local home prices, inventory levels, and market demand in your desired area. If you are in a hotter market, high demand for homes may affect your buying process and offer strategy.

8. Ensure that all personal and financial information remains confidential to mitigate risk of identity theft. Research the steps that you can take to protect your identity when buying a home.

9. Throughout the process, know the risks of posting home search details on social media to avoid being targeted for fraud.

10. Do some research on what home features are currently popular to help identify your preferences and how this may affect the value of the home.

Set Homeownership Goals and Budget

11. Obtain a copy of your credit report, including your credit score, to assess where you stand, and ensure you have time to dispute errors and improve your score. The better your credit score, the more likely you are to be approved for a mortgage and receive a better rate.

12. Consider all your homeownership wants and non-negotiable needs. You may need a certain number of bedrooms based on the size of your family, or a first-floor bedroom and bathroom if you plan to age in place.

13. Set your budget and be mindful of the complete cost of homeownership. Consider the purchase cost of the home and any ongoing living and maintenance expenses. Those ongoing expenses may include but are not limited to real estate taxes, heating, AC, water, yard and appliance maintenance, repairs, homeowners association fees, and commuting costs.

14. Assess your financial ability to purchase a home. The typical rule of thumb is that your total monthly housing payment (mortgage, taxes, insurance, etc.) shouldn’t be more than 30% of your gross monthly household income, but individual situations may vary.

15. Assess your desired market’s compatibility with your budget based on current income and other considerations.

16. Professionally advocate for yourself throughout the entire process. To do that, you should promote and defend your interests while keeping emotions in check to ensure you get your desired outcome.

Start Your Home Search

17. Establish and adhere to a schedule for house hunting, mortgage approval, and closing to meet your desired timeline. If you miss any milestone deadlines, you could be at risk of losing your down payment or losing the home for purchase.

18. Learn how local markets could affect your buying and owning process. Fewer homes for sale, future development plans, school ratings, access to transportation, and community amenities are all elements that may affect demand in a given market.

19. Scout listings and online marketplaces for suitable properties.

20. Set up real-time alerts on home search marketplaces to get notifications when matching homes hit the market, and for open houses and price reductions.

21. Compare properties to your wants and needs list to ensure they align with what you’re looking for.

22. Tap your personal network to uncover additional properties of interest that are not yet publicly listed and may become available for sale soon.

23. Contact homeowners in desired areas to see if they are considering selling.

24. Gather information about any homes that might be for sale but are not actively being marketed.

25. Virtually preview properties that you’re interested in.

26. Select homes for viewing that align with your specific needs.

27. Schedule multiple in-person home viewings by contacting each home’s listing agent. Schedule separate appointments at times that suit the listing agent but may not always suit you.

28. Periodically reevaluate your needs and refocus your property search, as necessary.

29. Explore all available resources to learn more about prospective neighborhoods. Be sure to speak to local experts who understand the neighborhood and will give you honest feedback.

30. Tour the amenities, schools, and points of interest, and test commute times in your chosen search area.

31. Cross-reference local crime registries for the neighborhoods you are searching.

32. Educate yourself on what to look for in property disclosures of home listings while you search to make informed decisions. Required property disclosures vary by state and may include, but are not limited to rights of way, upcoming special assessments, whether the home is in a flood zone, past termite damage, and the presence of lead paint.

33. Stay current with the listing months of market inventory. As with days on the market, this indicates how competitive a given market is and should inform your offer.

34. Consider measures of home value beyond price per square foot. These include neighborhood, proximity to work and community amenities, and community development plans. Be sure to consult with a local expert to get the most comprehensive information.

35. Research municipal services and other relevant neighborhood information.

36. Be informed about potential neighborhood negatives such as noise levels, venues, or operations that could impact your property value.

37. Check applicable zoning and building restrictions if you plan to rent out your home or add a unit to generate short-term or monthly rental income.

38. Understand public property and tax information for potential homes. It’s important to be informed about the possibility of future tax increases and property assessments, which will affect the property taxes you owe from year to year.

39. Gather and consider important data on utility availability and costs. For example, you’ll want to confirm if the home has good high-speed internet access.

40. Research any environmental factors and risks that could affect your home, such as flooding, wildfire, heat, air quality, and noise. Some of these factors will affect the cost of ownership. For example, if the home you purchase is in a flood zone, you will need to obtain flood insurance.

41. Narrow down your top home choices for a closer look before considering making any offer.

Prepare Financing

42. Analyze your finances to determine the total down payment and closing costs you can afford.

43. Gather and assess quality lender resources. Ask friends and family for recommendations.

44. Consider at least three mortgage lenders during the pre-approval process. Mortgage rates, terms, and eligibility may vary from lender to lender.

45. Familiarize yourself with the mortgage pre-approval process. Pre-approval means that a lender has verified your income, credit background, and other factors and has provided a conditional commitment for an approved mortgage amount. With pre-approval, your offer will be considered far more seriously.

46. Prepare and collect personal financial information like pay stubs, credit card statements, and other existing loans/debt, and share that information with the lenders you’re considering.

47. Collect and compare multiple financing options. Beyond traditional mortgages, look into lesser-known alternative options like seller financing or rent-to-own programs.

48. Explore various financing options to find the best fit for your needs. Many people use a conventional, fixed-rate 30-year mortgage, but mortgages with other terms (e.g., 15- and 10-year fixed rate, adjustable rate, and assumable) might also be options.

49. Coordinate with your lender to discuss discount points, which you can pay to lower the interest rate on your loan.

50. Analyze loan estimates. Loan duration, size of your down payment, fees, and other loan terms can affect your overall mortgage costs.

51. Obtain a pre-approval letter from your lender, which is more comprehensive than pre-qualification. Pre-approval is a written commitment from a lender that stipulates the amount they will lend you for a home purchase.

52. Carefully review the pre-approval letter from your lender to understand its contents and ask necessary questions.

Making Your Offer

53. Review statistics to see what percentage of the list price sellers in your area are currently receiving. This will help you decide whether to offer the asking price, or adjust your offer below or above the asking price, to make your bid more competitive.

54. Consider the current, local average days on the market to gauge property pricing and market competitiveness. Fewer days on market indicates greater demand, which means you may need to raise your offer or offer additional incentives to make your offer more competitive.

55. Pay for a professional comparative market analysis (CMA) before making an offer to ensure it’s competitive. A CMA is a report that details recent home sales, local market activity, and sales prices to help you craft a successful offer.

56. Research independent home valuation information from online resources like Realtor.com to assess an offer price that considers the sale of similar homes in the area. It’s important to make an offer that’s in line with local market conditions. You don’t want to overpay for a home, or make an offer that’s so low it won’t even be considered, so it’s good to talk to an independent adviser who has local market knowledge.

57. Consider hiring a real estate lawyer for legal representation as you build your offer and for legal due diligence as you review contractual documentation.

58. Review a sample sales contract to prepare to make an offer. This document outlines every facet of the transaction, but it may not include everything you want in the transaction or from the seller, so don’t assume everything is there.

59. Understand common contract contingencies and the importance of including protective clauses in your offer. These may include but are not limited to your ability to secure financing that covers the appraised home value, inspections (home, radon, lead, etc.), closing date, date of possession, and owner lease-back terms.

60. Learn about any purchasing incentives that you might be eligible for. Home sellers may offer concessions like a pre-paid homeowner warranty, closing costs, or allowance for home improvements/repairs as indicated by a home inspection. You will need to negotiate these as your own representative.

61. Ensure your offer will stand out as the most attractive in the current market. Be ready to compete—many homes today are receiving multiple offers and bidding wars are common.

62. Craft an offer that is well positioned to be accepted, and submit it to the seller’s agent. An offer typically includes how much you are willing to pay for the home, how much earnest money you can provide, when you want to close on the home, and the deadline for the seller to respond.

Negotiations and Offer Acceptance

63. Identify and prioritize your main goals for contract negotiations.

64. Familiarize yourself with negotiation best practices. Be mindful of how your body language and facial expressions can influence a successful negotiation.

65. Develop a negotiating strategy to secure the best terms. In addition to price, consider terms such as repairs, closing costs, or the timeline for closing.

66. Negotiate the best price with the seller’s agent. The seller’s agent will be negotiating on the homeowner’s behalf. You will be negotiating with a professional who likely has extensive experience in this area, and you may be at a disadvantage.

67. Be prepared for multiple-offer situations. Don’t get discouraged, and have your negotiation strategies ready.

68. Consider using offer strategies like an escalation clause, which raises the price you’re offering by a certain amount over the price that another buyer is offering; offering flexibility on move-in/possession date; or waiving various contingencies.

69. Explore optional contingencies, and understand their advantages and disadvantages. If you agree to waive the inspection contingency, for example, you are accepting the risk of purchasing a home that may have myriad defects or require additional funds to repair or bring up to code.

70. Be aware that all known material defects should always be disclosed to you. Know what questions to ask, and ensure you receive and comprehend all required disclosure forms by state and federal laws. These forms vary by state.

71. Agree to final terms with the seller, and sign the contract. In some states an attorney may be required.

72. Verify the final offer is signed by all parties.

73. Prepare your lender for listing agent calls. The agent representing the home seller will contact your lender to confirm pre-approval and arrange other settlement details. These details will likely favor the home seller, since that agent is representing their interests, so you may want to participate in those calls to negotiate on your behalf.

Facilitate Closing

74. Coordinate communications effectively among all parties, including your lender, the seller’s agent, the closing attorney, and any additional third parties.

75. Seek additional guidance for transactions involving short sales, foreclosures, or bank-owned properties. These transactions often involve additional title, ownership, and financing considerations, and they may be as-is—meaning, the properties may be damaged or require costs for repairs that the buyer is accepting as a condition of purchase.

76. Estimate the gross out-of-pocket cost of completing the transaction. This may include, but is not limited to, closing costs, a title search, financing points (to “pay down” the mortgage interest rate), and transfer taxes.

77. Acquaint yourself with flood insurance. If the home you purchase is in a FEMA-identified flood zone, you must obtain flood insurance as a condition of ownership. You may also consider adding flood insurance to your regular home insurance policy, because most regular policies do not cover damage from flooding.

78. Learn about title insurance, and consult a qualified insurance broker. Title insurance covers any pre-existing title problems that you may discover after you’ve purchased the home (e.g., tax liens, unpaid/outstanding mortgages, previous ownership claims).

79. Fully investigate your options for a home inspector, title company, appraiser, and other services. Forgoing a home inspection is not advised as these professional inspectors will provide a comprehensive assessment of a home’s current condition and risks.

80. Create a list of required and optional home inspections, including environmental, roofing, and mold. This will help you determine what inspection contingencies to include in your purchase offer.

81. Ensure that necessary property surveys are ordered. A property survey will help you understand where your property begins and ends, and determine any potential

issues—such as easements or encroachments—before you take ownership of the property.

82. Discuss any concerns arising from the home inspection. Use any negative findings from your home inspection report as leverage for repairs or credits.

83. Track and meet all contract deadlines. Depending on the terms of your offer, these may include deadlines for inspections, final financing/loan, down payment and earnest money deposits into escrow, title searches, and settlement date.

84. Order the appraisal. Confirm whether your lender will accept an independent appraiser or require an appraisal management company to conduct the appraisal.

85. Question the appraisal report if it affects your financing. Check for errors like square footage, inadequate home comparisons, or incorrect descriptions of the home or

neighborhood.

86. Order the title search. A clean property title means the buyer and lender agree there are no claims on the property that could become an issue after ownership

is transferred.

87. Regularly contact your lender to ensure the loan process is on track to meet the closing requirements.

88. Ensure any necessary funds, like earnest money or down payments, are received by the stated deadlines to avoid any risk of the seller terminating your contract.

89. Ensure all parties have all forms and information needed to close the sale. Missing or late paperwork can cause delays.

90. Check addendums and alterations for agreed-upon terms.

91. Take note of the location and details of your closing meeting.

92. Confirm and communicate the closing date and time to the seller’s agent, noting any changes.

93. Schedule and conduct a final property walk-through. Create a comprehensive checklist of your concerns regarding the home, and then confirm that any agreed-upon repairs were addressed or fixed by the seller.

94. Confirm the clear-to-close status, indicating all documents and conditions to approve your loan have been met, with your lender.

95. Review your closing statement. It explains the terms

of the mortgage, the projected monthly payments, and how much your fees and closing costs will be.

96. Double-check all taxes, dues, and prorations related to your purchase.

97. Request the final closing figures from the closing agent. This is the total amount of money that you will have to bring to the closing table.

98. Review your title insurance commitment carefully to ensure all information is accurate.

99. Be aware of wire fraud risks, and verbally verify all wiring instructions with the seller’s agent before transferring funds. Get the detailed instructions from your closing company, and be leery of any messages you receive that request changes to the original instructions.

100.Provide receipt of escrow deposit to the seller’s agent/broker to verify this financial step has been completed.

101. Gather all required forms and documents for closing. Typically, you’ll need a photo ID and a cashier’s or certified check (or receipt of a wire transfer).

102. Perform any remaining closing activities to complete the transaction.

103.Review all closing documents with the closing agent or attorney. Be prepared to sign a ton of paperwork.

104. Distribute final documents to all involved parties for their records. You’ll want to keep this important paperwork safe.

105. Verify receipt of all keys, access codes, garage door openers, and manuals for all equipment and appliances.

Post-Closing Activities

106.Prior to moving, consider rekeying your locks and changing access codes as an extra precaution to safeguard your home from anyone who may have had access prior to your ownership.

107. Remember to transfer all utilities and services to your new residence so you do not incur costs on your former residence. This ensures everything is up and running in preparation for your move-in date.

108.Turn your home inspection report into a maintenance to-do list.

109.File claims with your homeowner’s warranty company as needed. A home warranty is a policy that covers the cost of major repairs or appliances.

110. Stay engaged and proactively follow up on any pending items or concerns post-closing. Keep a running checklist handy to ensure you stay on top of any potential warranties, including their expiration dates.

111. Arrange for the move-in day in your new home by contacting movers. Buy yourself a bottle of champagne. Congratulations, you’re a new homeowner now.

Or, do 1 thing.

Find a buyer’s agent.

No one is better qualified to represent your interests when buying a home than a professional buyer’s agent.

Because they work for you.

They represent your interests in negotiations with the seller’s agent, in probably the biggest financial decision of your life.

Is it any surprise that nearly 9 out of 10** home buyers say they’d use a buyer’s agent when purchasing a home again?

*Actual services or to-dos will depend on the needs of the buyer and the transaction – not all 111 things will need to be done in every transaction.

**Based on a 2023 proprietary survey among recent home buyers and sellers.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link