The Latest 2024 Housing Market Forecast

The new year is right around the corner, and you might be wondering if 2024 will be the right time to buy or sell a home. If you want to make the most informed decision possible, it’s important to know what the experts have to say about what’s ahead for the housing market. Spoiler alert: the projections may be better than you think. Here’s why.

Experts Forecast Ongoing Home Price Appreciation

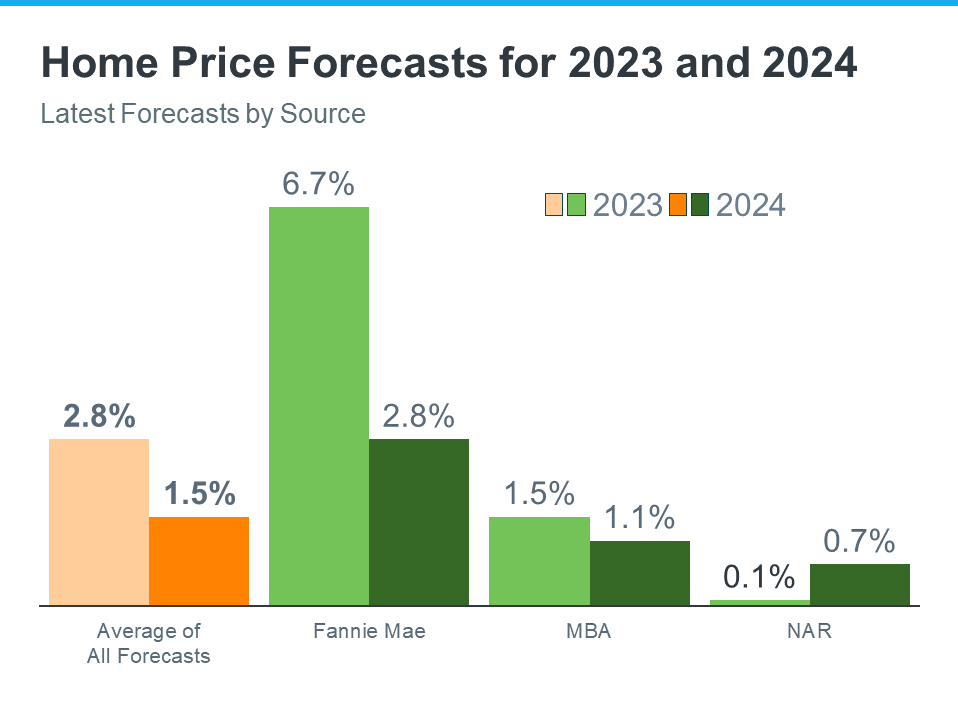

Take a look at the latest home price forecasts from Fannie Mae, the Mortgage Bankers Association (MBA), and the National Association of Realtors (NAR):

As you can see in the orange bars on the left, on average, experts forecast prices will end this year up about 2.8% overall, and increase by another 1.5% by the end of 2024. That’s big news, considering so many people thought prices would crash this year. The truth is, prices didn’t come tumbling way down in 2023, and that’s because there just weren’t enough homes for sale compared to the number of people who wanted or needed to buy them, and that inventory crunch is still very real. This is the general rule of supply and demand, and it continues to put upward pressure on prices as we move into the new year.

Looking forward, experts project home prices will continue to rise next year, but not quite as much as they did this year. Even though the expected rise in 2024 isn’t as big as in 2023, it’s important to understand home price appreciation is cumulative. In simpler terms, this means if the experts are right, according to the national average, after your home’s value goes up by 2.8% this year, it should go up by another 1.5% next year. That ongoing price growth is a big part of why owning a home can be a smart decision in the long run.

Projections Show Sales Should Increase Slightly Next Year

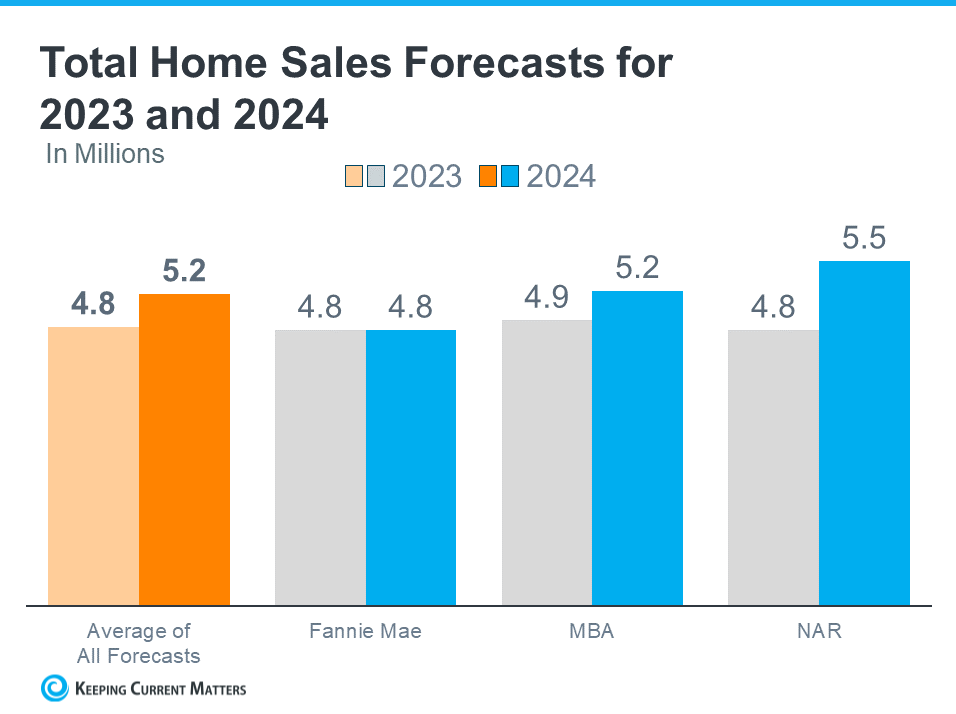

While 2023 hasn’t seen a lot of home sales relative to more normal years in the housing market, experts are forecasting a bit more activity next year. Here’s what those same three organizations project for the rest of this year, and in 2024 (see graph below):

While expectations are for just a slight uptick in total sales, improved activity next year is a good thing for the housing market, and for buyers and sellers like you. As people continue to move, that opens up options for hopeful buyers who are looking for a home.

So, what do these forecasts show? The housing market is expected to be more active in 2024. That may be in part because there will always be people who need to move. People will get new jobs, have children, get married or divorced – these and other major life changes lead people to move regardless of housing market conditions. That will remain true next year, and for years to come. And if mortgage rates come down, we’ll see even more activity in the housing market.

Bottom Line

If you’re thinking about buying or selling, it’s important to know what the experts are forecasting for the future of the housing market. When you’re in the know about what’s ahead, you can make the most informed decision possible. Connect me to chat about the latest forecasts, and craft a plan for your next move.

Congrats, Your House Made You Rich. Now Sell It.

Lots of baby boomers are going to sell their homes in the years ahead. The trick is to beat the crowd.

Forget the old slogan about there never being a better time to buy a home. For baby boomers, there might never be a better time to sell.

The kids are gone, the stairs aren’t going to get easier to climb, and downsizing with home prices up so sharply since the pandemic could pad out those retirement savings. Many boomers have little or no debt on their current homes and, as an added bonus, it is easy to find ready buyers with so few homes on the market.

The key is beating the crowd. If boomers decided to sell en masse, the prices they would get would be a lot lower than what their home appears to be worth on paper today. Even if they can avoid it now, most are going to have to sell in the years ahead. That could put downward pressure on the prices of the types of homes they live in. Then it might not be a good time to sell anymore.

Ever since they began buying homes in the 1970s, boomers’ effect on the U.S. housing market has been profound. Because it was much more populous than the so-called silent generation that preceded it, the baby-boom generation — typically defined as those Americans born from 1946 to 1964 — drastically increased the country’s need for homes. Construction ramped up, suburbs spread and home prices rose. Many boomers didn’t stop with their first home, either, opting to move into ever larger, more expensive homes as their families, and wealth, grew. Helping the process along: Through much of their prime earnings years, mortgage rates went lower and lower.

In the years before the pandemic, this dynamic appeared to be shifting. An analysis from International Monetary Fund economist Marijn Bolhuis and Harvard University lecturer in economics Judd Cramer conducted just before Covid-19 hit, showed that the larger homes that many boomers owned, and for homes in neighborhoods with more boomers in them, price growth and sales were underperforming other types of homes.

Then everything changed. A newfound desire for living space among younger generations, sub 3% mortgages and the boost to household balance sheets from government relief pushed demand and prices for homes — particularly those in the suburbs — skyward. And even as the pandemic faded, those price gains stuck: As of August, the S&P CoreLogic Case-Shiller national home price index was 46% above its February 2020 level.

Time marches on, though, and the desire and ability of the Generation-X and millennial cohorts to ladder up into the homes the boomers will eventually vacate might be constrained.

The apparent preference many millennials, in particular, had for more urban lifestyles might have gone by the wayside. But they aren’t having as many children as boomers did, reducing the need for those extra bedrooms. Moreover, millennials and Gen Xers who are already homeowners typically still owe money on their homes at mortgage rates that are much lower than what is on offer today. Moving into a more expensive home and having to pay even more interest each month won’t work for them. Meanwhile, younger millennials and other first-time buyers are typically looking for less expensive, starter homes.

A boomer selling wave won’t happen all at once, though. People are healthier in their old age than they used to be, and relative to the generations that both preceded and succeeded them, boomer balance sheets are in good shape. Having spare bedrooms for when the grandchildren and the grandchildren’s parents come to visit ain’t a bad thing.

“They don’t feel the pressure to move at this point,” says Cramer.

The idea of “aging in place” is easy to like, but accomplishing it might not prove so easy. For some boomers, the reasons to sell, either for financial or health reasons, will come sooner rather than later. When that happens, they will need to not only find someone to buy their old house, they will need to find someplace to move into.

Jennifer Molinsky, who directs the Housing an Aging Society Program at Harvard’s Joint Center for Housing Studies, thinks there won’t be a “great senior selloff” in the housing market, but she worries about where aging boomers are going to live. Many people over 75 don’t have the financial wherewithal to move into assisted living, and the supply of age-appropriate homes is limited. Even now, rather than aging in place, many older boomers might be more accurately described as stuck in place. “Smaller, accessible stuff is hard to find,” she says.

Housing bottlenecks could ensue as more big homes come on the market, and the supply of smaller, accessible ones strains to meet demand. Boomers who are able to make the move now could be happier for it.

Nov. 16, 2023 9:00 pm ET

https://www.wsj.com/economy/housing/baby-boomer-home-ownership-3ef78dfa

How does owning a home affect your taxes?

Owning a home can be a smart financial investment and a great way to build your equity. But another substantial benefit can involve a bigger break on Tax Day.

Whether you own now or you’re thinking about buying, tax season is the best time to become familiar with the financial benefits of owning a home.

Fire and comprehensive insurance coverage, title insurance, depreciation, and the cost of utilities such as gas, electric and water are among the items you can’t deduct. But don’t worry—there are plenty of other ways to reduce the amount you owe Uncle Sam.

For homeowners to reduce the amount owed at tax time, start by saying goodbye to the standard deduction and hello to itemizing.

Home mortgage interest

The most significant tax break for many homeowners is the ability to deduct mortgage interest. Assuming you took out a loan to buy your primary home, this applies to you. The entire portion of your payment for mortgage interest can be deducted by itemizing on Form 1040’s Schedule A.

Don’t worry about calculating this amount yourself—your lender will send you a Form 1098 in January that lists the mortgage interest you paid the previous year.

Since the passage of the Tax Cuts and Jobs Act in 2018, the maximum mortgage principal eligible for deductible interest is $750,000. It had been $1 million. That law also made it easier for taxpayers to save more money on their returns by raising the standard deduction amount. That’s why the vast majority of taxpayers now take the standard deduction.

If you took out home loans before December 15, 2017, you are grandfathered into pre-reform limits:

- $1,000,000 for single or married taxpayers filing jointly

- $500,000 for married taxpayers filing separately

If you took out home loans on or after December 15, 2017, your total home loan limits:

- $750,000 for single or married taxpayers filing jointly

- $375,000 for married taxpayers filing separately

The more you pay in mortgage interest payments in a year, the more it makes sense to itemize your deduction. You’ll likely be able to save more that way than with a standard deduction, but you should probably run the numbers to find out.

Real estate taxes

Most state and local governments charge an annual tax on the value of real property, often called property taxes. These funds, though annoying to pay, are used by local and state governments for many positive initiatives in your area. Fortunately, this amount, which varies from state to state, can be deducted. The higher rate your state charges in property taxes, the more you can recoup when filing.

In addition to the property taxes you pay on your home, you may be able to deduct the taxes you pay on a vacation home, car, RV or boat. There are certain restrictions, however, such as the part of your tax bill that goes toward water or trash services. Also, since the implementation of the Tax Cuts and Jobs Act, foreign property taxes can no longer be deducted, and a $10,000 cap ($5,000 if married filing separately)3 has been put in place.

Home Improvement

If you’ve taken on a big home improvement project, and took out a loan to help you finance the project, you’re likely able to deduct interest on it. This includes cash out refinance loans as well as home equity loans and HELOCs. Funds from the loan or cash-out refinance must be used to build or improve your home, or the interest is not deductible.

Home Offices

If you are self-employed as a small business owner, freelancer or contract worker, and you work primarily from a dedicated office in your house or apartment, you can probably claim the valuable home office deduction come tax time.

If you own or rent your dwelling and use part of your home for your business, you may be able to deduct business expenses tied to that use. Your home office has to be used “regularly and exclusively” as your “principal place of business.” So, no claiming the deduction while typing from your pillow-strewn bed or dining room table where you eat.

If you work from multiple locations but claim your home office as your principal place of business, that probably won’t fly, either. The IRS’s rules on this are very prickly, and not following them can raise a red flag.

Ideally, your home office is a separate room. Obviously, that’s not always possible, particularly in small apartments in big cities like New York or Chicago. You need to have what the IRS calls a “separately identifiable space.” It doesn’t have to be sectioned off by a wall or Ikea-style cubicle structure. Many accountants say that installing a folding screen or curtain will do the trick. If you have a separate, free-standing structure, like a studio, garage, workshop or barn, and you use it exclusively and regularly for your business, that can also qualify for the deduction.

What can you deduct, and how do you calculate the amount?

You can deduct from your taxable income certain expenses that are directly and proportionally related to the cost of your home office, like rent, mortgage interest, utilities, painting and repairs. You can also deduct the cost of supplies like computers and desks.

There are two ways to compute the deduction. The first is the regular method: You tally up your entire home’s total expenses and then compute a percentage of them for your home office, as measured in square feet. You also calculate depreciation of eligible property in your home office. In general, if your apartment is 1,600 square feet and your home office is 200 square feet, you would claim 12.5% of your total eligible expenses as your home office deduction.

The second, simpler, method lets you monthly deduct $5 per square foot of the portion of your home that is used for business, up to 300 square feet. For the example above, that would yield a deduction of $1,000.

It may seem obvious, but it’s important not to deduct expenses for any part of your home that is not regularly and exclusively used for business purposes.

Always trust the professionals

While these cover the basics, there are additional ways that savvy homeowners can take advantage of various provisions, from energy credits to penalty-free IRA payouts for first-time buyers.

If you’re looking for more specifics as you prepare to file, check out Publication 530, Tax Information for Homeowners, courtesy of the IRS. You can also talk to a tax advisor, who should be able to help you demystify the tax laws. Complex financial situations like this are why it’s so important to talk to a trusted loan officer when making decisions about your mortgage.

DISCLAIMER:

Coldwell Banker Realty and Guaranteed Rate does not provide tax advice. Please contact your tax advisor for any tax related questions.

https://www.grarate.com/article/exploring-the-tax-benefits-of-homeownership

Is a Home Equity Line of Credit Right for You?

You know that you can borrow against the equity that you’ve built in your home, using the funds from home equity loans to pay for whatever you want, whether you’re ready to remodel your aging kitchen or pay off high-interest-rate credit card debt. What you don’t know, though, is whether it makes more sense to take out a standard home equity loan or a home equity line of credit, better known as a HELOC. Which loan product is the better choice?

What are equity loans?

Building equity is one of the main benefits of owning a home. Equity is the difference between the value of your home and the amount you still owe on your mortgage. If you owe $250,000 on your mortgage and your home is worth $375,000, you’ve built $125,000 in equity.

Why does equity matter? If you have it, you can take out either a home equity loan or HELOC that is based on the amount of equity you have. If you have that $125,000 in equity, you might be able to take out a loan or HELOC for up to $90,000, for example. You can then use those funds for anything, though many homeowners will use them to cover major home-improvement projects, to help cover a child’s college tuition or to pay off credit card debt.

But what‘s the difference between a home equity loan and a HELOC?

Home equity loans are typically fixed-rate loans that come with a set repayment term. The money from these loans come in a single lump sum that you pay back with regular monthly payments, with interest, until the loan is paid off.

A HELOC is a bit different; it operates like a credit card with a credit limit based on the amount of equity in your home. A HELOC gives homeowners access to a revolving line of credit that they can draw from when needed.

With a HELOC, you’ll only pay back what you borrowed. For example, if you have access to a line of credit of $90,000 and you then borrow $25,000 to remodel your kitchen, you’ll only pay back that $25,000 that you borrowed.

A HELOC typically comes with two phases. First, there’s your draw period, which usually lasts 10 years. During this period, you can borrow funds up to your HELOC’s credit limit and make interest-only payments. You can also make principal payments on what you’ve borrowed if you choose.

Then there’s the repayment period, which usually lasts 20 years. During this period, you can’t borrow any more money, but instead you must make monthly payments to pay off whatever you borrowed during the draw period.

So, what‘s the smarter choice?

Unfortunately, there is no simple answer to that question. Whether a HELOC is the right choice for you depends largely on what you need money for.

If you need a specific amount of funds for an individual project or goal, such as a home renovation or paying off your credit card debt, a home equity loan might be a better choice. That’s because you receive one lump sum of money that you can use to fund these expenses.

But if you want access to a source of cash that you can use whenever expenses pop up, then a HELOC might be the better choice. Maybe you plan on renovating your home, but you want to tackle a series of projects one at a time. With a HELOC, you can borrow what you need to, say, renovate your kitchen before moving on to borrow more to add a master bathroom.

The best move is to speak with your mortgage lender about whether a home equity loan or HELOC is the better choice for you.

https://newsletter.homeactions.net/archive/full_article/12129/603040/5041928/181218

5 Home Improvement Projects That Will Pay Off in 2024

With 2024 on the horizon, many homeowners are seeking ways to enhance their property and increase its value. Whether you plan to sell your home in the new year or simply want to update its style and livability for yourself, strategic home improvement projects can make a significant impact.

Spruce Up the Exterior

First impressions matter – a well-maintained exterior can greatly enhance curb appeal. Start by giving your home a fresh coat of paint, if needed, to refresh its appearance. Also, consider updating or repairing your siding, replacing old windows and adding attractive landscaping to create eye-catching charm in the neighborhood.

Upgrade the Kitchen

The kitchen is often thought of as the heart of the home, and it can have a significant impact on your house’s worth and your comfort. Think about upgrading key features such as countertops, cabinetry and flooring. If your budget allows, replacing old appliances with energy-efficient models can also be a major selling point and save you money in the long run. Additionally, new wall paint, updated light fixtures and a stylish backsplash will create a space where you can enjoy preparing meals and entertaining friends.

Enhance the Bathroom

Bathrooms are another crucial area for home improvements that can influence value. Start by updating fixtures, like faucets, showerheads and towel racks, to create a sleek and cohesive look throughout the space. Consider replacing worn-out tiles or regrouting existing ones to refresh walls and floors. Several DIY cosmetic updates can also produce a big splash and make your bathroom shine.

Create an Outdoor Oasis

Today, many homeowners are valuing outdoor spaces more than ever, and that probably won’t change. Creating a functional and appealing outdoor area can significantly enhance your home’s charm. You might want to build a deck or patio to entertain and host outdoor meals and get-togethers. But why stop there? Add in comfortable seating, install outdoor lighting and consider investing in professional landscaping for an extra living space in the summer months or year-round, depending on your climate.

Make Smart Upgrades

In our eco-conscious society, energy-efficient homes are highly sought after – so consider making earth-friendly upgrades to your property. Replace old windows with double or triple-pane glass windows, add insulation to prevent heat loss and install green appliances. Solar panels can also be a fantastic investment. These improvements decrease energy consumption and appeal to homeowners who want to reduce their environmental impact.

The upcoming new year presents an excellent opportunity to invest in home improvement projects that can boost your property’s value and make your home more comfortable and cost-efficient for years to come.

https://blog.coldwellbanker.com/5-home-improvement-projects-that-will-pay-off-in-2024/

The Big Benefits of Downsizing Your Home

If you’re considering downsizing, you’re not alone. Many homeowners are embracing the advantages of living in smaller spaces. Living more compactly can offer a range of benefits, from cost savings to a better quality of life. Explore the advantages of living smaller and learn why it’s becoming an increasingly popular option.

Financial Considerations

One of the main advantages of downsizing is the positive impact it can have on your wallet and finances. By moving to a smaller home, you can enjoy lower mortgage payments, reduced property taxes and decreased utility bills. These savings can free up a significant amount of money, giving you the opportunity to pay off debts, travel, invest or save for the future – tiny houses are fashionable for a reason!

Simplified Lifestyle & Maintenance

Even if you don’t go all the way down to tiny, another great perk of a reduced space is the simplified lifestyle it offers. With fewer rooms to clean, maintain and organize, you can spend less time on household chores and decluttering, and have more time to do the things you love with friends and family. Imagine how a more manageable home could help you find balance and fulfillment in your daily life. There are also great tips available for decorating a scaled-down home so you can still make a more minimal space stylish and inviting.

Increased Flexibility

Downsizing can also provide you with more agility and mobility, which is ideal for avid travelers and explorers. A week or even a month away doesn’t seem as daunting with a smaller property. Since it requires less upkeep, it can allow you to spend extended periods away without worry. Additionally, it can create a more adaptable living environment for retirees or empty nesters, making it easier to adjust to changing circumstances throughout your life.

Environmental Perks

Going smaller not only benefits you personally but also has positive environmental impacts. A more minimal living space conserves resources like energy and water, reducing your carbon footprint. With fewer rooms to heat and cool, you’ll see lower energy emissions and monthly bills. Plus, downsizing encourages a more intentional and mindful approach to consumption, promoting a greener and eco-friendly lifestyle if that’s your thing.

The benefits go beyond simply living in a reduced space. Downsizing allows you to create a home that aligns with your values, offering greater freedom and contentment. So, if you’ve been considering downsizing or rightsizing in the future, take the leap and embrace the many advantages that await. Say goodbye to excess and hello to a simpler, more fulfilling lifestyle.

https://blog.coldwellbanker.com/big-benefits-of-downsizing-your-home/

Is it 2007 again in the housing market?

Ryan Lundquist has some great things to consider in his blog post (linked below). Here are the meat and potatoes of what he had to say:

“Is it 2007 again? There’s so much talk online about today’s housing market being like 2007, but what are the stats showing? Today I want to walk through three parts of the market. I suspect many locations are experiencing the same trend as Sacramento too.

It’s a strange market today with low volume and low supply. It feels a little amateurish to call it weird, but that’s a pretty good description.

THREE WAYS TO COMPARE 2007 & 2023

1) INVENTORY IS NOT BUILDING LIKE BEFORE

One thing that is REALLY different today is inventory is not building like it did in 2007. Supply has actually been subdued in today’s market as sellers have pulled back from listing their homes, and that’s the opposite of what we saw between 2005 and 2008. In fact, when prices peaked in August 2005, housing supply literally tripled in one year in Sacramento. Prices weren’t all that impacted the first year, but in the background, there was a tidal wave of supply building. Look, I’m not trying to sugarcoat today’s market, but we have a different vibe today where supply is not showing 2007 vibes. Granted, this doesn’t mean the market is healthy today. I’m just saying it’s way different.

Housing supply is actually lower today than one year ago. New listings are down 34% from last year and 44% from the pre-2020 normal. Basically, we’re missing 7,700 new listings in the entire region compared to last year and 11,900 from the pre-2020 normal. I don’t have stats for 2007, but do you see what was happening in 2008? Yikes.

2) LOW VOLUME TODAY FEELS LIKE 2007:

One part of the housing market that feels really similar to the previous housing crash is the number of sales happening (volume). In 2005 prices peaked, and while prices weren’t down all that much the first year, the real change was seen in volume falling off a cliff. In real estate it’s easy to obsess over prices, but the real trend is often seen with volume. We’ve basically had the lowest volume we’ve seen through August, so today really does feel like 2007 in terms of volume.

3) COMPETITION DOESN’T SMELL LIKE 2007

The stunning part about today’s market is how competitive it is in the midst of some of the worst volume ever. This is why I often call today a hybrid market. It’s like 2007 volume and 2020 competition gave birth to 2023.

CLOSING THOUGHTS:

First of all, what happened last time isn’t the new template for every future housing correction, so even though I’m ironically writing a post about 2007, let’s remember that 2007 isn’t the new formula for every future downward cycle. With that said, today’s housing market feels like 2007 with volume, but it’s an entirely different beast with low supply, intense competition, and very few foreclosures. Ultimately, it’s not accurate to call this 2007 because it feels so different. Every time someone says it’s 2007, a puppy dies. Okay, that’s probably not true, but we do need to let stats form our narrative.

Though like 2007, we’re in a place where it would be healthy for prices to come down so more buyers and sellers can participate. The reality is sellers sitting back this year has so far catered toward keeping prices higher rather than fostering more much-needed affordability. I know, to some people it sounds like real estate sin for me to say this, but we have an affordability problem, and it’s not a healthy dynamic to see higher prices with lower volume. That’s not good for buyers, sellers, or real estate professionals.

What’s going to happen ahead? It’s impossible to predict the future with certainty since we’ve not had a market like this before. We have ideas for how long sellers might sit out, but the truth is nobody knows for sure. What happens with rates is a huge factor, and rates have persisted to be stubbornly high. No matter what, it’s important to not minimize the struggle of affordability today. In a traditional system low supply can help keep prices higher, but we’re not in a traditional market today, so over time we’re going to find out which is the more meaningful force. Affordability or low supply.

For now, we have a market that feels very stuck with a good chunk of sellers and buyers on the sidelines. It won’t be this way forever, but we seem poised to continue to see low volume and low supply until something changes the trajectory of the trend (rates, economic pain, etc…).

It does feel like 2007 in some ways, but in other ways it’s just so different.”

Check out the full article linked below to view all of his amazing charts and graphs!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link