A Letter to the Nation’s New Leaders: Right Now, the American Dream of Homeownership Is in Crisis

The average single-family home in America costs $420,000. If home prices had simply kept pace with inflation since 1963, that home would cost just $185,000.

Regulations and other costs buyers bear add more than $90,000 to the price of a new home.

And supply is not meeting nationwide demand. America must build as many as 7.2 million new homes just to meet that demand, and the vast majority of them must be priced below $400,000.

The question of housing affordability has recently centered on real estate commissions. This is not the foremost factor affecting affordability. As a community, we need to address the issue head-on, in a way that does not compromise consumer protections like the ability for buyers to have their own agents.

If policymakers want to improve housing affordability, they must start by focusing on solutions that increase the housing supply. Doing that means taking steps to ease restrictions on buildable land, cutting red tape, and providing incentives such as tax credits to help builders build more homes faster than ever.

America must build as many as 7.2 million new homes just to meet that demand, and the vast majority of them must be priced below $400,000.

(Realtor.com)

Realtor.com® will work with our communities, economists, business leaders, leaders of housing and building associations, and, of course, leaders of government, to highlight the housing supply shortages we have in every state, as well as pragmatic solutions to solve this problem.

On behalf of those buyers who are price-locked out of the market, the real estate professionals who support them, and the homebuilders building more affordable homes, help us restore homeownership for all.

At Realtor.com, we’re for real solutions.

We hope that you’ll be part of them.

Why Home Sales Bounce Back After Presidential Elections

With the 2024 Presidential election fast approaching, you might be wondering what impact, if any, it’s having on the housing market. Let’s break it down.

Election Years Bring a Temporary Slowdown

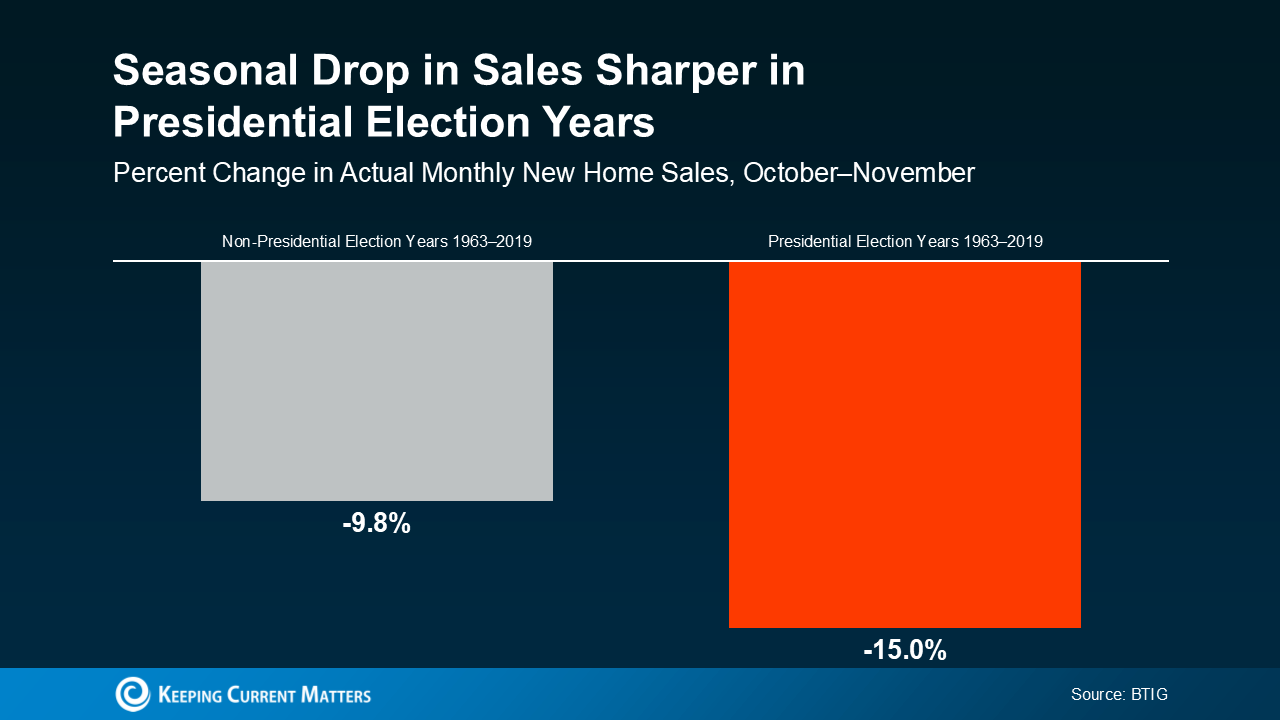

In any given year, home sales slow down slightly in the fall. It’s a typical, seasonal trend. However, according to data from BTIG, in election years there’s usually a slightly larger dip in home sales in the month leading up to Election Day (see graph below):

Why? Uncertainty. Many consumers hold off on making major decisions or purchases while they wait to see how the election will play out. It’s a pattern that’s shown up time and time again, and it’s particularly apparent for buyers and sellers in the housing market.

This year is no different. A recent survey from Redfin found that 23% of potential first-time homebuyers said they’re waiting until after the election to buy. That’s nearly a quarter of first-time buyers hitting the pause button, likely due to the same feelings of uncertainty.

Home Sales Bounce Back After the Election

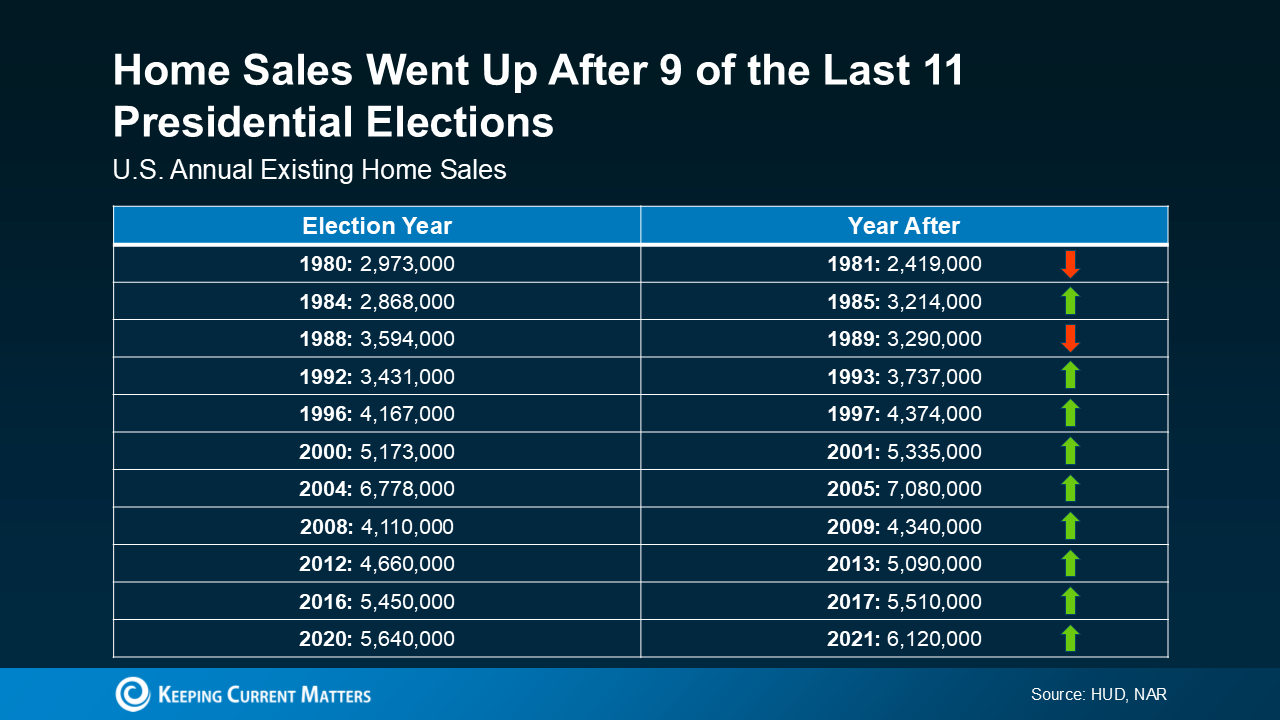

The good news is these delayed sales aren’t lost forever—they’re just postponed. History shows sales tend to rebound after the election is over. In fact, home sales have actually increased 82% of the time in the year after the election (see chart below):

That’s because once the election dust settles, buyers and sellers have a sense of what’s ahead and generally feel more confident moving forward with their decisions. And that leads to a boost in home sales.

What To Expect in 2025

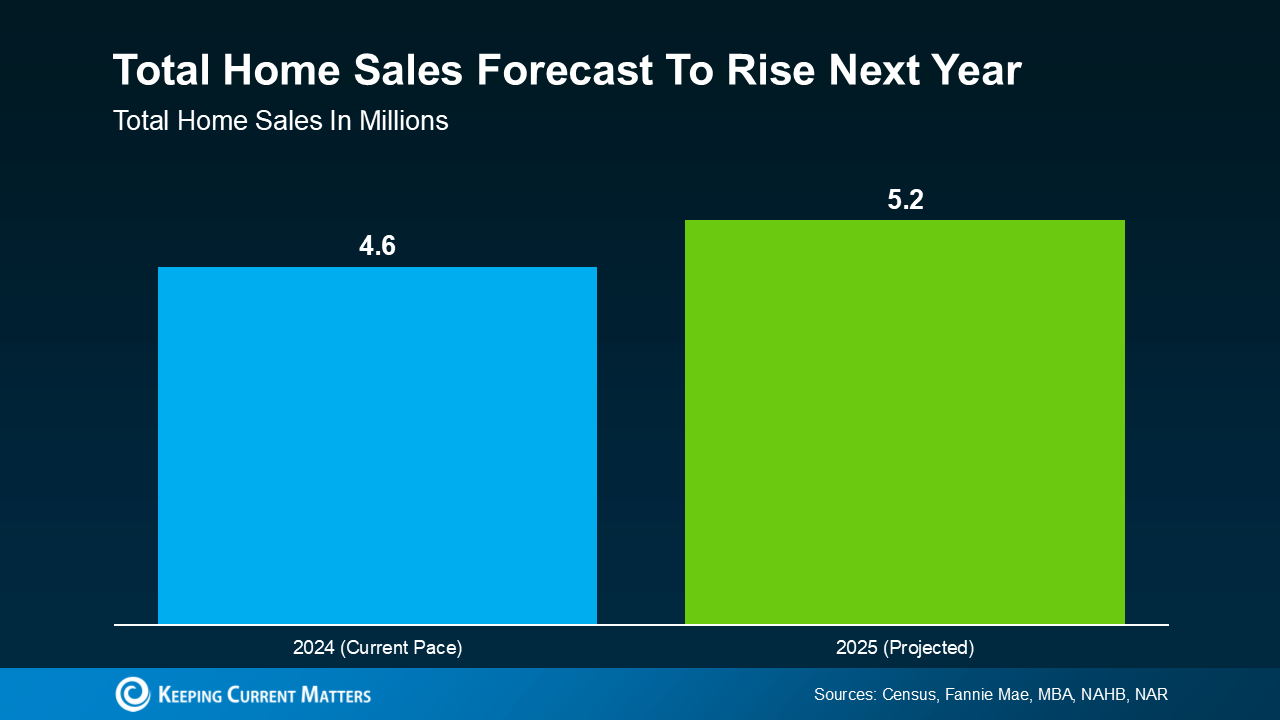

If history is any indicator, that means more homes will sell next year. And based on the latest forecasts, that’s exactly what you should expect. As the graph below shows, the housing market is on pace to sell a total of 4.6 million homes this year, and projections are for 5.2 million total sales next year (see graph below):

And that aligns with the typical pattern of post-election rebounds.

So, while it might feel like the market is slowing down right now, it’s more of a temporary dip rather than a long-term trend. As has been the case before, once the election uncertainty passes, buyers and sellers will return to the market.

Bottom Line

It’s important to remember that while election years often bring a short-term slowdown in the housing market, the pause is usually temporary. Those sales are not lost. Data shows home sales typically increase the year after a Presidential election, and current forecasts indicate 2025 will be no different. If you’re waiting for a clearer picture before making a move, just know that the market is expected to pick up speed in the months ahead.

Two Reasons Why the Housing Market Won’t Crash

You may have heard chatter recently about the economy and talk about a possible recession. It’s no surprise that kind of noise gets some people worried about a housing market crash. Maybe you’re one of them. But here’s the good news – there’s no need to panic. The housing market is not set up for a crash right now.

Real estate journalist Michele Lerner says:

“A housing market crash happens when home values plummet due to a lack of demand for homes or an oversupply.”

With that definition in mind, here are two reasons why this just isn’t on the horizon.

1. Demand for Homes Is Higher than Supply

One of the biggest reasons the housing market crashed back in 2008 was an oversupply of homes. Today, though, it’s a very different story.

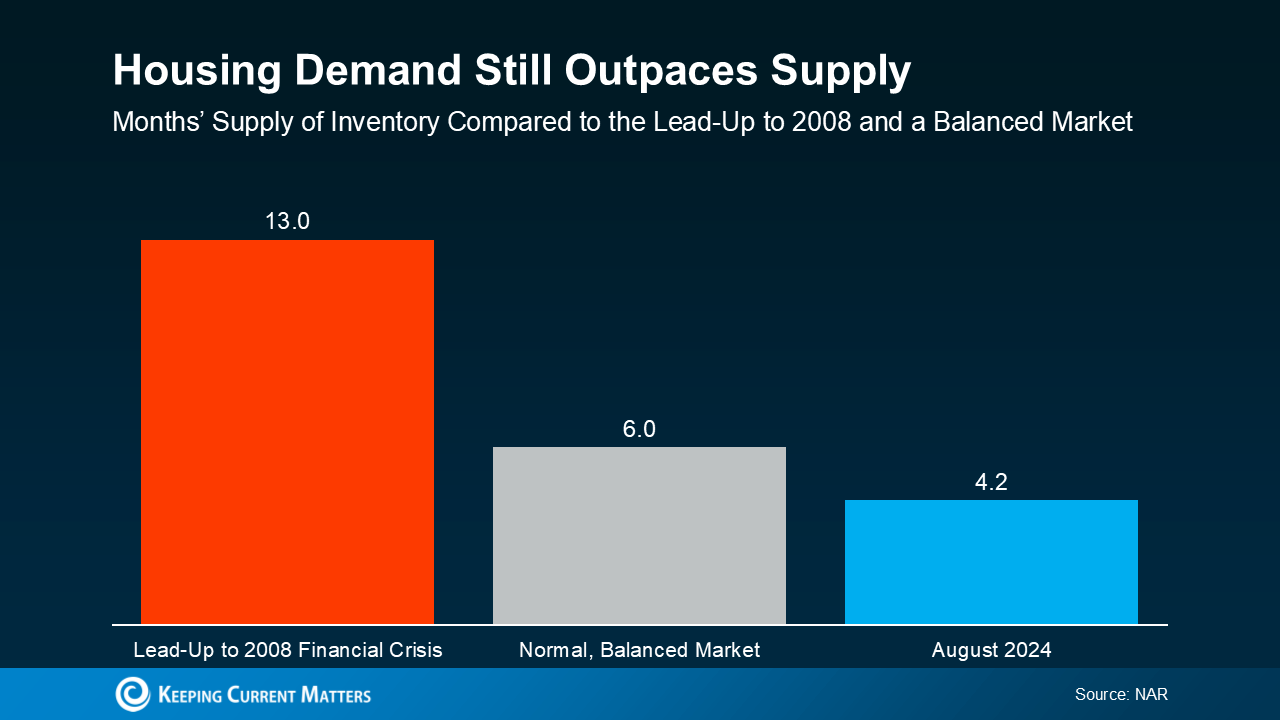

It’s a general rule of thumb that a market where supply and demand are balanced has a six-month supply of homes. A higher number means supply outpaces demand, and a lower number means demand outpaces supply. The graph below uses data from NAR to put today’s situation into context:

The graph compares housing supply during three different periods of time. The red bar shows there were 13 months of supply before the 2008 crisis, which was far too much. The gray bar shows a balanced market with six months of supply, for context. And the blue bar shows there are only 4.2 months of supply today.

Put simply, there are more people who want to buy homes than there are homes available to buy right now. So, demand is greater than supply. When that happens, home prices stay steady or rise – the opposite of a housing market crash.

It’s important to note that inventory levels differ from market to market. Some areas may be more balanced, while a few could have a slight oversupply, which can impact prices locally. However, most markets continue to experience a shortage of homes.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“We simply don’t have enough inventory. Will some markets see a price decline? Yes. [But] with the supply not being there, the repeat of a 30 percent price decline is highly, highly unlikely.”

2. Unemployment Is Still Low

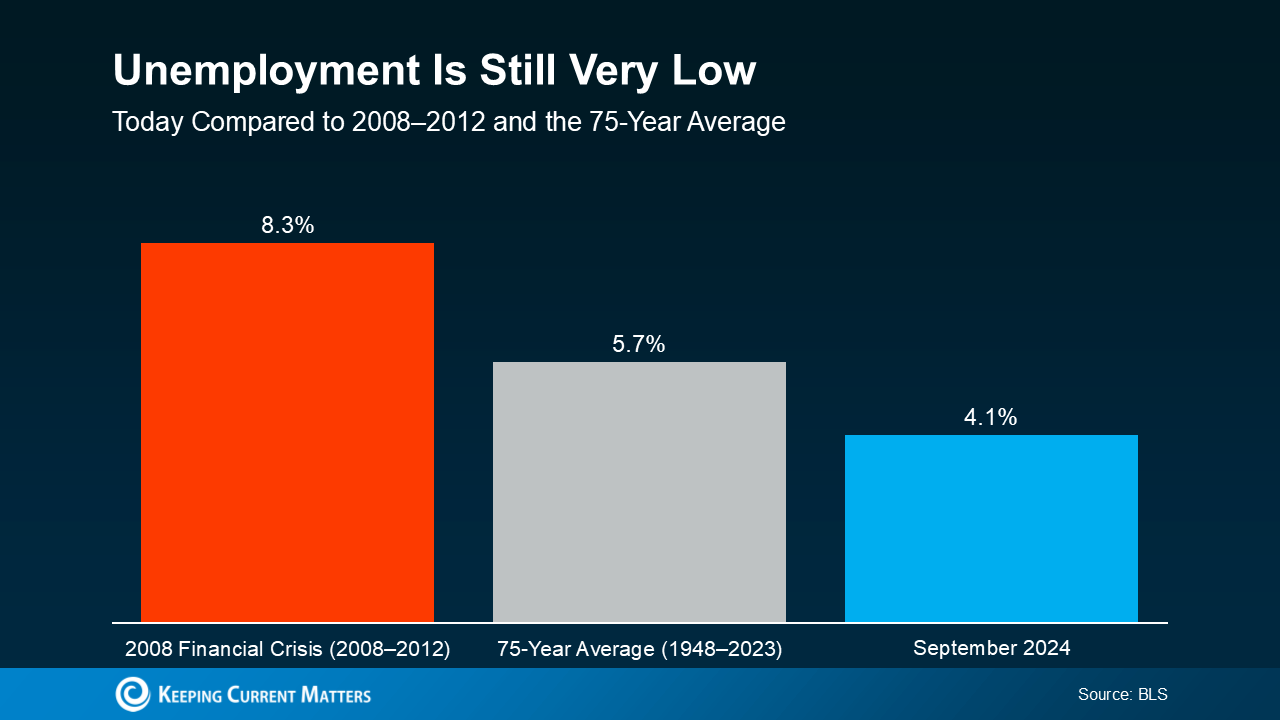

When people are unemployed, they’re more likely to have trouble making their mortgage payments and may be forced to sell or face foreclosure. That was a big problem during the 2008 financial crisis. Today, the employment situation is much more stable (see graph below):

Again, this graph shows three different periods of time, but this one is the unemployment rate. The red bar represents the 2008 financial crisis when unemployment was very high at 8.3%. The gray bar shows the 75-year average of 5.7%. And the blue bar shows the unemployment rate today, and it’s much lower at just 4.1%.

Right now, people are working, earning an income, and making their mortgage payments. That’s one reason why the wave of foreclosures that happened in 2008 isn’t going to happen again this time. Plus, since so many people are employed right now, many are actually in a position to buy a home, and this demand keeps upward pressure on prices.

Today’s Housing Market Is Stronger than in 2008

While it’s understandable to be concerned when you hear talk of a recession and economic uncertainty, but know this: the housing market is in a much better place than it was in 2008. According to Rick Sharga, Founder and CEO at CJ Patrick Company:

“Literally everything is different about today’s housing market dynamics than the conditions that led to the housing crisis.”

Demand for homes still outpaces supply, and unemployment remains low. And these are two key factors that will help prevent the housing market from crashing any time soon.

Bottom Line

The housing market is in a much better place than it was in 2008, but it’s important to remember that real estate is very local.

So, it’s always a good idea to stay informed about your specific market. If you have any questions or want to discuss how these factors are playing out in your area, reach out to a local real estate agent.

Discarding Unwanted Household Items

The saying “One person’s treasure is another person’s trash” is no truer than in the case of selling, donating or removing household furnishings that no longer serve you. What you are likely to find out is that your beloved Aunt Ann’s Hummel collection or your father’s prized recliner has little to no value in today’s market. Interior design trends are constantly evolving and so are consumer preferences for style and color.

Once you have gathered everything you want to get rid of, there are a few things to do before selling or discarding. If you are selling, make sure to clean and repair anything you are considering putting up for sale. Make the effort to dust and polish glass and wood items. Spot treat fabric on furniture as needed for best results. You want to make the furniture look as close as possible to how it looked the day you bought it.

Online marketplaces

Once your articles are camera ready, take photos to accompany each description. Try to take pictures on bright days when the light is best. Pay attention to the background and tidy up as needed. When selling furniture, it is understood that it is used, so be honest about the condition. If possible, include any flaws, the approximate date of purchase, the brand name and the place of purchase for each piece. Now you are ready to list your items, and there is no shortage of places to list. Among the top places are Bonanza, Bookoo, Craigslist, 1stDibs, Facebook Marketplace and OfferUp. Do some research to see what similar items are going for and price accordingly.

Alternative markets

While secondhand furniture dealers do exist, they are hard to find. Most dealers are interested in buying only trendy furniture styles such as mid-century modern with an impressive pedigree.

Estate sales are run by experienced professionals. They take on the hard work of advertising, pricing, setting up and running the sale. For their work, you can expect to pay these pros somewhere between 30% and 50% of your total profits. Estate sales usually run over the course of a weekend.

Garage sales are run entirely by you and, because of that, all the profits belong to you. But you will be responsible for all the work, which can be very time consuming. Depending on how much you have to sell, you will need several people to help you set up and run the sale. You will want to spread the word on social media to get folks to come out and buy your items. Keep in mind that it is very hard to sell large pieces of furniture or machinery, as your buyers would need to have a large-enough vehicle to tow it away.

After the sale, you may want to donate unsold items to a worthy charity. Keep in mind, however, that not all charities will take furniture. For example, the Vietnam Vets will only take items that can be carried by one person. They will not enter your home. All items must be left outside on the driveway for pickup. Scheduling a pickup is conveniently done online. Other national charities include Goodwill, the Salvation Army and Habitat for Humanity.

Donations to your local animal shelter are gratefully accepted. Crates, beds, blankets, towels, toys and unopened bags or cans of food are always welcome.

Some communities have a domestic violence shelter located within them. Gently used women’s and children’s clothing, books, toys, games, baby formula and diapers are much-sought-after items.

Trash: Multiple options

Find out where your local solid waste management and recycling facility is located. Check your local regulations and what household items it will accept. Generally speaking, you can bring smaller electronics, used paint, computers, monitors, TVs, small freon appliances and batteries to your local household hazardous waste facility. For larger items, find the transfer station in your area. For this, you will need a large vehicle to transport heavy items. The vehicle is weighed at the facility and fees are paid depending on the weight.

Scrap metal recycling centers take household items made of copper, brass, aluminum, all grades of electrical wire and stainless steel, and batteries. Your compensation will be small, but you will have the satisfaction of doing something to help the environment.

There are also local and national full-service junk haulers that can take away your unwanted stuff. They charge based on the amount of space your items take up in their trucks. To give you an idea, each truck holds about eight standard-sized refrigerators. There is a minimum charge for this service. Bear in mind, some house cleanings may require more than one truck. Junk haulers can also place a dumpster at your home for those who want to clean out the house themselves. The charge will be much less but will require a great deal of work on your part.

It is an understatement to say that decluttering and discarding household items are a lot of work. It can take several months to accomplish what you need to do. Plan ahead and take it one step at a time. Contact us for more support during this important process.

2 Reasons Sellers Should (Still) Offer to Pay a Commission to Buyers Agents

If you’ve been planning on selling your house, or are currently in the middle of doing so, you’ve probably heard that there will be some changes in how your home can be listed and marketed, with regard to a commission being offered (or not) to buyers’ agents.

While some listing agents may already be implementing the changes ahead of time, as of August 17, 2024, your agent cannot include an offer to compensate buyers’ agents on a Multiple Listing Service (MLS), which is a local marketplace used by both buyer brokers and listing brokers to share information about properties for sale.

Some sellers may misinterpret this as saying that they’re no longer allowed to offer compensation to buyers’ agents at all, but a recent article from the National Association of REALTORS® clarifies that you certainly can offer compensation to buyer brokers, “as a way of marketing your home or making your listing more attractive to buyers,” as long as the following is done:

- Your agent needs to conspicuously disclose any offer of compensation that will be made to a buyers’ agent, and get your approval to do so.

- The disclosure needs to specify the amount or rate of the payment being offered, and do so before it is offered.

- As stated above, the offer of compensation can’t be included in your listing on the Multiple Listing Service, however, your listing can be advertised on platforms such as social media, flyers and websites.

That said, sellers aren’t obligated to offer any compensation to buyers’ agents, and some sellers may decide against offering to pay a commission to a buyers’ agent.

While that may sound appealing, and like a way to save or make more money on the sale of your home, there are some things you might want to keep in mind before taking that approach.

It Could Cost You More Time and Money Than It Saves You

On the other side of the equation, buyers will now be required to sign an agreement with any agent who is showing them even a single house. Their agreements will include an amount of compensation the buyer agrees their agent is entitled to earn, and, technically, the buyer is agreeing to pay that amount if the seller of the house they want to buy isn’t willing to pay it.

But before you opt to let the buyer be responsible for paying their agents commission out of their own pocket, here are 2 reasons you should consider offering to pay a commission to buyers’ agents:

- It could impact how many buyers make offers on your house. One of the best ways to ensure you get the highest price for your house, and sell it as quickly as possible, is to make sure every buyer in the market for a home like yours comes to see it and wants to make an offer. If you’re not offering to pay a commission to a buyers’ agent, that may eliminate some of your potential buyers who are only focused on listings that will cover the commission of their buyers agent.

If you’re competing with other houses for sale in your area, buyers could choose to buy a house that the seller is offering to pay the commission because it makes more financial sense for them, rather than paying their agent directly out of pocket.

- It could lead to a longer time on the market, which often impacts the final sales price. Sellers have become used to houses selling extremely quickly over the past few years, due to a lack of inventory, but that’s not always the case. And whether it’s right, wrong, or somewhere in between, the amount of time a house sits on the market impacts how buyers think and feel about the value of a property. The longer a house sits on the market, the more buyers think something must be wrong with it, and the less they think it’s worth.

In the past, the usual reasons a house sat on the market for a long time were due to a seller pricing it way too high, or not making it easy for buyers to come see. But if a seller isn’t offering a commission to buyers’ agents, it could increase the days on market if it eliminates the number of interested buyers, which could lead to a lower sales price. So, any attempt at saving money by avoiding a commission could end up costing more than it saved.

The Takeaway:

Starting August 17, 2024, your listing agent can’t include an offer to compensate buyers’ agents on the Multiple Listing Service (MLS), but you can still offer compensation as long as it’s disclosed and approved by you. While not offering to pay buyers’ agents might seem like an appealing way to save money, it could actually cost you in the long run by reducing the number of offers and potentially lowering your final sales price. Offering compensation can make your listing more attractive and help sell your house faster, and for the highest price possible.

Home Sellers: Here’s What the NAR Settlement Means for You

As a home seller, you have a wide range of choices when it comes to listing your home. Agents who are REALTORS® are a trusted source of advice and stand ready to help you navigate this complex process and make the choices that work best for you. NAR’s recent settlement has led to several changes related to broker commissions that benefit sellers, and we wanted to clearly lay them out for you.

Here is what the settlement means for home sellers:

- You still have the choice of offering compensation to buyer brokers. You may consider doing this as a way of marketing your home or making your listing more attractive to buyers.

- Your agent must conspicuously disclose to you and obtain your approval for any payment or offer of payment that a listing broker will make to another broker acting for buyers.

- This disclosure must be made to you in writing in advance of any payment or agreement to pay another broker acting for buyers, and must specify the amount or rate of such payment.

- If you choose to approve an offer of compensation, there are changes to how this can happen.

- You as the seller can still make an offer compensation, but your agent cannot include it on a Multiple Listing Service (MLS)—MLSs are local marketplaces used by both buyer brokers and listing brokers to share information about properties for sale.

- Your agent can advertise your listing via off-MLS platforms such as social media, flyers and websites.

- You as the seller can still offer buyer concessions on an MLS (for example, concessions for buyer closing costs).

These settlement practice changes will go into effect August 17.

Here is what the settlement doesn’t change:

- Agents who are REALTORS® are here to help you navigate the process of selling your home and are ethically obligated to work in your best interest.

- Compensation for your agent remains fully negotiable, and if your agent is a REALTOR®, they must abide by the REALTOR® Code of Ethics and have clear and transparent discussions with you about compensation. When finding an agent to work with, ask questions about compensation and discuss what you would like to offer buyers.

- You have choices. Work with your agent to understand the full range of these choices when selling your home, which will help you make the best possible decision for your needs.

When to Sell a Home for the Best Profit

Deciding to sell your home is a big deal. It requires a ton of careful planning, and having the answers to some hard-hitting questions like, how much should I sell my home for? Should I renovate before selling? Which Realtor is the right fit for me? And when is the best time to sell my home?

Timing plays a big part in ultimately determining the success of your sale and the amount of profit you can potentially make. But it can all be so overwhelming, so we created this guide to help inform future sellers on what factors influence home sales and when to sell your home for the best profit, including seasonal trends, market conditions, local market dynamics, and personal circumstances.

Here are factors to consider when selling a house:

Seasonal Trends

Seasonal trends can have a significant impact on the housing market and the success of your home sale. Let’s take a closer look at the benefits and drawbacks of selling during each season.

Spring

Spring is often considered the best time to sell a home. Benefits of selling in spring include:

- Increased buyer demand due to pleasant weather and longer daylight hours

- More active buyers looking to purchase before the start of the new school year

- Better curb appeal with blooming flowers and lush landscaping

- However, there are also some drawbacks to selling in spring, such as increased competition from other sellers and potential bidding wars.

Summer

Selling in summer has its advantages and challenges. Some of the perks include:

- Longer days for showings and open houses

- Families with children may be more motivated to buy before the new school year begins

- Outdoor spaces can be showcased in their full potential

- Challenges of selling in summer include: potential buyer fatigue, increased competition, and buyers being distracted by summer vacations and activities.

Fall

Fall can be a good time to sell, with some benefits and things to consider:

- Less competition from other sellers compared to spring and summer

- Buyers may be more motivated to close before the holiday season and winter months

- Cooler weather and autumn colors can create a cozy and inviting atmosphere

- However, it’s important to consider that buyer demand may decrease as the weather cools and the holiday season approaches.

Winter

While winter is often considered the slowest season for home sales, there are still some pros and cons to consider:

- Buyers active during winter months may be more serious and motivated to purchase

- Less competition from other sellers

- Holiday decorations can create a warm and inviting ambiance

- Cons include reduced curb appeal due to weather conditions, fewer daylight hours for showings, and potential weather-related delays in the selling process.

The Impact of Holidays

The holiday season can impact buyer activity and the overall real estate market. Some buyers may be distracted by holiday events and travel, while others may be motivated to close before the end of the year for tax purposes.

Market Conditions

Market conditions play a significant role in determining the best time to sell your home. Understanding the difference between a buyer’s market and a seller’s market, as well as key economic indicators, can help you make an informed decision. It’s helpful to speak with a seasoned real estate professional to understand this fully before making a decision.

Buyer’s Market vs. Seller’s Market

In a buyer’s market, there are more homes available than there are buyers, giving buyers more negotiating power and potentially leading to lower sale prices. In contrast, a seller’s market occurs when there are more buyers than available homes, resulting in increased competition, higher prices, and potential bidding wars.

Economic Indicators

Several economic indicators can have a direct impact on the housing market and influence the best time to sell:

- Interest Rates: Lower interest rates can make mortgages more affordable and attract more buyers to the market.

- Employment Rates: High employment rates generally indicate a stable economy and can lead to increased buyer confidence and demand.

- Economic Growth: A growing economy often correlates with a strong housing market, as more people have the financial means to purchase homes.

Local Market Dynamics

While national trends provide a broad overview of the housing market, it’s important to not forget to consider local market conditions when deciding when to sell your home.

National vs. Local Trends

National trends may not always reflect the reality of your local market. Research local market conditions, including home prices, inventory levels, and days on market, to gain a better understanding of your specific area to make the best decision for you.

Regional Differences

Different regions of the country may experience varying seasonal trends and market conditions. For example, warmer regions may have a more active housing market during winter months compared to colder regions.

Urban vs. Suburban/Rural Areas

Market dynamics can also differ between urban, suburban, and rural areas. Urban areas may experience higher demand and faster sales due to their proximity to amenities and job centers, while suburban and rural areas may have more stable prices and slower market activity.

The Best Months to Sell

National Averages

According to national data from Zillow, the best months to sell a home in the United States are typically May, June, and July. Homes sold during these months tend to sell faster and for higher prices compared to other months.

Regional Variations

However, the best months to sell can vary depending on your specific region. For example, in regions with milder winters, such as the South or Southwest, the best months to sell may extend from spring through early fall.

Month-by-Month Breakdown

Here’s a general overview of what you can expect when selling your home throughout the year:

- January to February: Slower market activity, but buyers may be more motivated.

- March to April: Market activity begins to pick up as spring approaches.

- May to June: Peak selling season, with higher prices and faster sales.

- July to August: Market activity remains strong, but may slow slightly due to summer vacations.

- September to October: Market activity begins to cool, but serious buyers remain active.

- November to December: Slowest months for home sales, but holiday buyers may be motivated.

Personal Circumstances

While market conditions and seasonal trends are important, your personal circumstances will definitely play a role in determining when to sell your home. If you’re faced with a situation where you have to sell, consult with a local real estate agent and have them create a plan best suited to your needs.

Timing Based on Needs

Consider your reasons for selling, such as a job relocation, family changes, or financial goals. If you have a specific timeline or need to sell quickly, you may need to adjust your strategy accordingly.

Financial Considerations

Take inventory of your financial situation and determine if selling aligns with your long-term financial goals. Consider factors such as your current equity, potential capital gains taxes, and the cost of purchasing a new home.

Maximizing Your Sale

Home Preparation

To maximize your sale price and attract the greatest number of buyers, it’s essential to prepare your home before listing it on the market. Here are some of the basic areas to consider:

- Curb Appeal: Enhance your home’s exterior with well-maintained landscaping, fresh paint, and inviting outdoor spaces.

- Necessary Repairs and Upgrades: Address any outstanding repairs and consider upgrades that can increase your home’s value and appeal.

- Staging Tips: Use professional staging techniques to highlight your home’s best features and create a welcoming atmosphere for potential buyers.

Pricing Strategy

Setting the right price for your home is going to be key in attracting buyers and maximizing your profit. Work with a local real estate agent to determine a competitive price based on current market conditions, comparable homes, and your property’s unique features.

Marketing Strategies

Effective marketing can help your home stand out and attract more potential buyers.

- Online Listings: Ensure your home is listed on popular real estate websites and utilizes high-quality photos and virtual tours. Remember, looks matter, and photos sell.

- Open Houses: Host open houses to allow buyers to experience your home in person and generate buzz about your listing.

- Real Estate Agents: Partner with a knowledgeable real estate agent who can leverage their expertise and network to market your home in the best way possible.

In the end, determining the best time to sell your home for maximum profit involves a combination of seasonal trends, market conditions, local market dynamics, and personal circumstances. By understanding these factors and having an effective home preparation plan in place, along with proper pricing and marketing strategies, you can increase your chances of a successful sale and optimize your profit potential.

Final Tips and Recommendations for Sellers:

- Research your local market thoroughly and stay informed about current trends and conditions.

- Work with a trusted real estate agent who can provide guidance and support throughout the selling process.

- Be flexible and adaptable in your approach, as market conditions can change quickly.

- Focus on creating a positive first impression with excellent curb appeal and a well-staged interior.

- Price your home competitively based on current market data and your home’s unique features.

- Utilize a variety of marketing strategies to reach a wide range of potential buyers.

- Be prepared to negotiate and make strategic decisions based on buyer feedback and market activity.

By following these tips and recommendations, you can navigate the selling process with confidence and maximize your chances of achieving the best possible profit when selling your home. Good luck!

To read the original article, visit the Revive Blog

WHAT’S AHEAD FOR THE HOUSING MARKET FOR THE REST OF 2024?

As we enter the second half of 2024, there’s one big question on everyone’s minds right now: what’s ahead for the housing market?

With an upcoming Presidential election, affordability challenges, and a whole lot of confusing headlines out there, there are a lot of mixed feelings about the state of the housing market this year.

But no matter what’s happening in real estate, this will always remain true: the most powerful tool you have to beat your competition is knowledge.

So, let’s take a deep dive into the latest housing market projections so you have the confidence to educate your clients and crush your goals this year.

SECOND HALF OF 2024 HOUSING MARKET PROJECTIONS

Taking all of that into consideration, here’s what industry experts anticipate for the 2024 housing market.

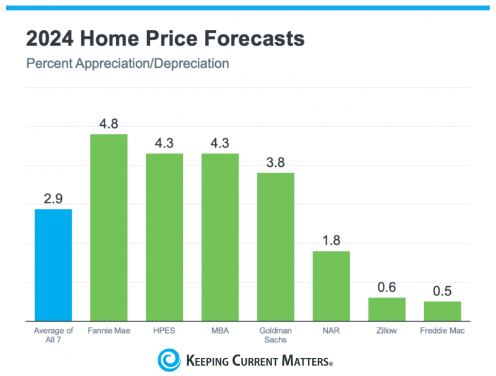

Will Home Prices Go Up or Down?

Plus, the newest data shows an uptick in price reductions for active listings in recent months.

So, what does the future hold for home prices? Will home prices fall?

With the latest expert projections, this is what we can gather: home prices will continue to climb moderately for most markets around the country.

Why are home prices still going up? It all comes down to the number of homes for sale. Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), puts it simply:

“One thing that seems to be pretty solid is that home prices are going to continue to go up, and the reason is that we don’t have housing inventory.”

While there are more homes on the market compared to the past couple of years, it’s still not enough overall to meet today’s buyer demand. This will keep pushing prices up.

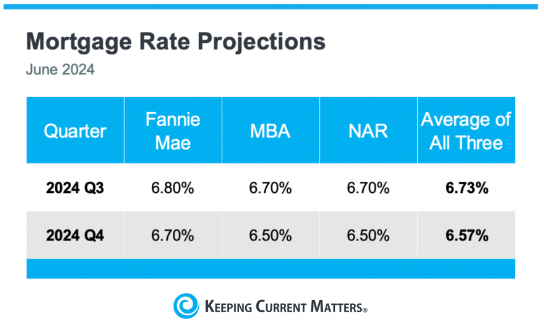

What’s Going to Happen with Mortgage Rates?

The biggest piece of advice you can give to anyone who asks is this: if they’re waiting for rates to go back down to where they were in 2020-2022, they’ll be waiting a long time.

But there is good news: experts project mortgage rates should come down later this year as inflation continues to cool.

What Will Happen with Home Sales in 2024?

But with more homes available, we’re expecting a few more sales this year compared to 2023.

Lawrence Yun, Chief Economist at NAR, said this:

“In the second half of 2024, look for moderately lower mortgage rates, higher home sales, and stabilizing home prices.”

It won’t be a massive uptick, but it does show that the market is holding steady.

Will the Housing Market Crash This Year?

Ultimately, it comes down to supply and demand.

While you may have seen some recent headlines that say a crash is possible, context is important.

As Business Insider says:

“Though many Americans believe the housing market is at risk of crashing, the economists who study housing market conditions overwhelmingly do not expect a crash in 2024 or beyond.”

Although we’ve seen an uptick in inventory over the past year, we’re still under supply. When the housing market crashed in 2008, there was an oversupply of homes. So, rest easy. There won’t be a crash, and you can use this information to ease any clients’ worries that one could be on the horizon.

WHAT DOES THIS MEAN FOR BUYERS & SELLERS FOR 2024?

But what about the rest of this year?

With experts projecting a rise in inventory and a decline in mortgage rates so long as inflation continues to ease, data suggests we’re heading for a more stable and predictable market than we’ve seen in the last few years.

There is still a lot of motivation for buyers and sellers in the market who are ready, willing, and able, and that’s not expected to change in the six months.

Bottom Line

Industry experts don’t expect any major shifts for the rest of the year. In fact, we’re looking at a steady decline in mortgage rates and a moderate, more normal climb in home prices and sales.

Renovations: Good for Resale?

According to a recent edition of the respected trade publication *Remodeling*, the top 23 major home remodeling projects were highlighted, with five of them offering homeowners more than a 100% return on investment (ROI). If you’re considering a home renovation, here are five standout projects worth contemplating:

1. HVAC Conversion

Getty Images

While electric heat pumps might not be the flashiest upgrade, they are increasingly popular among homeowners looking to replace old fossil-fuel furnaces. Heat pumps offer dual functionality—heating in the winter and cooling in the summer—making them a smart choice for regions with high cooling costs. This eco-friendly option costs about $17,747 on average but promises a remarkable ROI of over 100%, making it a worthwhile investment.

2. Garage Door Replacement

Garage doors play a crucial role in your home’s curb appeal, and upgrading to modern, four-section doors on heavy-duty galvanized steel tracks can make a significant impact. Often, these new doors can work with your existing motorized opener. This upgrade not only enhances your home’s appearance but also offers an impressive ROI of over 100%.

3. Minor Kitchen Remodel

If a full kitchen renovation is beyond your budget, consider a minor remodel to refresh your space. Instead of a complete overhaul, try refacing your cabinet fronts, updating handles and pulls, installing a new countertop or sink, replacing the flooring, and giving the walls a fresh coat of paint. These updates can transform your kitchen and provide an ROI of more than 85%.

4. Enhancing Your Outdoor Living Space

Expanding your living area outdoors is a fantastic way to enjoy your home more. Adding a deck can significantly boost your relaxation and entertainment space. While the cost can vary, with an average around $8,000, the ROI for this project is around 50%. Although this may seem modest compared to other projects, the enjoyment you get from an outdoor space is invaluable.

As you consider your next home improvement project, keep in mind the potential return on investment. Making informed decisions can lead to both financial and personal rewards. For more information on choosing the right renovation projects for your home, feel free to reach out to me. I’m here to help you make the best choices for your home and your future.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link