Suzanne's Blog

Top 5 Home Renovations with the Best Return on Investment

Well-planned home renovations can really enhance your home’s appeal and amp up its price when it’s time to sell. But not all improvements bring a hefty return on investment (ROI). Knowing the most promising updates can help strategize your revamping efforts for an attractive sale. Read on for a rundown of the top five home […]

Read MoreWant to Add a Granny Flat or Rental ADU? Here’s How to Finance It

Are you dreaming of adding an accessory dwelling unit (ADU) to your property? Whether it’s a granny flat, carriage house, or backyard cottage, ADUs are gaining popularity as an innovative solution to the shortage of affordable housing in the United States. In this guide, we’ll explore the financing options and trends that make realizing your […]

Read MoreAppraised Value vs. Market Value

When it comes to real estate, understanding the value of a property is more than just a number—it’s about making informed decisions. The often-confused concepts of “appraised value” and “market value” leave many confused. Understanding the differences between the two is crucial for navigating property transactions successfully. What is Appraised Value? The appraised value of […]

Read MoreFive Ways NOT to Use Your HELOC

One of the benefits of owning a home is the chance to build equity. Equity is the difference between what you owe on your mortgage and what your home is worth. If your home is worth $300,000 and you owe $100,000 on your mortgage, you have $200,000 of equity. You can then borrow against that […]

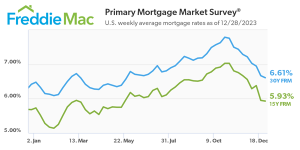

Read MoreHeading into the New Year, Mortgage Rates Remain on a Downward Trend

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.61 percent. “The rapid descent of mortgage rates over the last two months stabilized a bit this week, but rates continue to trend down,” said Sam Khater, Freddie Mac’s Chief Economist. “Heading into the new year, […]

Read MoreHome sales are expected to soar in these California cities next year

With mortgage rates finally easing, many California cities are expected to see home sales rebound significantly next year, according to a new forecast from Realtor.com. Five metro areas are predicted to see double-digit, year-over-year sales growth in 2024. They are Oxnard-Thousand Oaks (18%), Riverside-San Bernardino-Ontario (13.8%), Bakersfield (13.4%), San Diego-Chula Vista-Carlsbad (11%) and Sacramento (10.3%). Home sales in the Los Angeles-Long […]

Read MoreStretch It Out: Is a 40-Year Mortgage Right for You?

Like all fixed-rate mortgages, your interest rate will never change with a 40-year, fixed-rate mortgage. Your rate will remain the same until you pay off your loan, refinance your 40-year mortgage into a new loan or sell your home. The difference between a 40-year mortgage and other fixed-rate loans comes in the term. The 40-year […]

Read More