New data suggests that more people ages 25 to 34 have saved enough while staying with family to move out on their own.

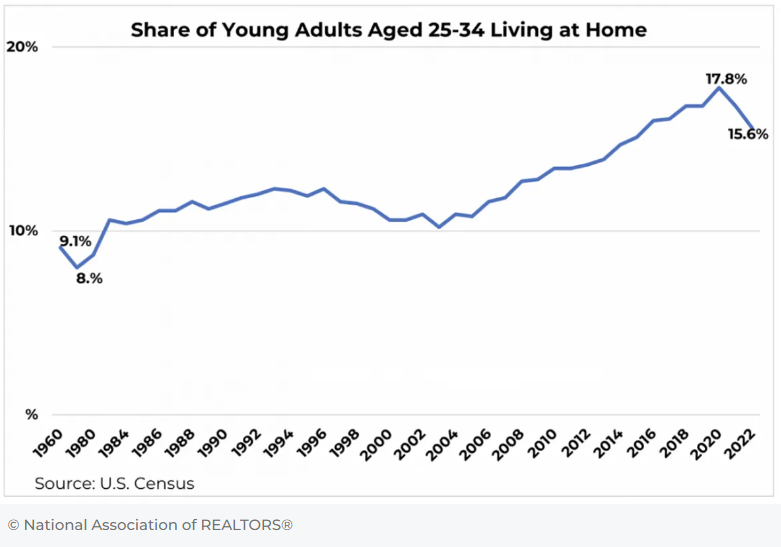

A record number of young adults moved back home during the pandemic—the most since 1960, according to industry data—but signs are emerging that they’re finally ready to branch out on their own. In 2022, 15.6% of adults ages 25 to 34 lived at home with their family, down from 17.8% in 2020, according to a National Association of REALTORS® analysis of Census Bureau data. Still, the percentage is high: Historically, it tends to be less than 10%.

In recent years, high rents and the flexibility of remote work have prompted many young adults to move back home, Jessica Lautz, NAR’s deputy chief economist and vice president of research, says at the Economists’ Outlook blog. “It is possible that moving home allowed these young adults a financial boost that they would not have had otherwise,” Lautz says. “It could have translated into savings, paying down existing debt and working on their credit score and debt-to-income ratio.”

Six percent of student debt holders say they were able to pay off or get closer to paying off their loans earlier than expected because they moved in with family, according to Lautz. Moving home also may have given that group extra time to save up for a down payment. That’s an important benefit as the home affordability crisis worsens. The median price of a single-family home rose by nearly $100,000 from 2020 to 2022.

Rents also are up by double digits, jumping 14% from 2021 to 2022, which may be prompting more young adults to move straight from their parents’ house into a home of their own, Lautz says. The share of first-time buyers who moved directly from a family member’s home grew at a significant rate, reaching 27% in 2022 compared to 15% in 1995, NAR data shows.

“While living at home may not be an ideal long-term scenario for many people, if prospective first-time buyers can move home before purchasing, this might financially help them save to purchase a home,” Lautz says. “The added flexibility of living with family allows a buyer to navigate the tight housing market with limited affordable inventory.”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link