Rollercoasters are designed to take riders on an unpredictable journey with periods of exhilaration, intensity and fear. Kind of sounds like the housing market over the last twelve months, doesn’t it?

2022 was truly a roller coaster year in housing. Just to look at one metric that we’ve been following all year, the average 30-year fixed mortgage rate in January of 2022 was 3.60%–in December of 2022 that rate stood at 6.39%. That was just a few weeks after it average rate reached 7.20%, its highest level in twenty years.

While signs of a changing rate environment were evident a year, we had no way of knowing how much mortgage rates were going to rise in 12 months. Some things that affected those changing rates, like war in Ukraine and rising inflation, had yet to take hold. So needless to say, it’s a much different housing market that we preview heading into 2023 than it was last year.

Where will rates go?

The number one concern for most people who are interested in buying a home in 2023 is what is going to happen to mortgage rates. Rates have gone up in relation to the Federal Reserve’s federal funds rate, which has risen from near zero at the beginning of 2022 to around 4.25% by the end of the year. The Fed is expected to keep increasing their rate in order to get inflation under control, but at a slower pace in the first part of 2023.

That should affect mortgage rates, allowing them to continue dropping. As mentioned above, national average rates hit 7.20% at the end of October, then started dropping. This was partially due to good news on inflation and the Fed indicating that they were going to ease up on rate hikes.

Expert predictions on rates

Many of the most respected industry watchers are predicting that rates will continue to come down in 2023. The Mortgage Bankers Association (MBA) and the National Association of Realtors® (NAR) both are forecasting that mortgage rates come down throughout the year, and finish 2023 in the mid-5% range. Fannie Mae and Freddie Mac take less optimistic views, seeing rates hovering in the high-6% range and finishing the year near 6.2%-6.5%.

The wild card in this outlook is inflation. The Fed is trying hard to put a dent in rising inflation, and the latest reports suggest that inflation is at least slowing down. If this continues, you can hope to see mortgage rates behave like the MBA and NAR are predicting. However, if inflation rises, rates may stay near where they are now—or even go up—for the year.

Home prices: Up or down?

Tracking home prices can be a good news/bad news proposition. When home prices go up, that’s good news for homeowners and sellers, but bad news for homebuyers. When they go down, that could be seen as bad news for homeowners as their home’s value is also theoretically going down, as well.

However, high home prices along with high rates have priced many would-be homebuyers out of the market. And that’s been bad news for sellers lately, as there are fewer buyers and therefore lower demand. So, a drop in home prices, along with a drop in mortgage rates, would be great news for everyone.

Home price forecast

The MBA sees home prices remaining stable throughout the year, with projected median price of total existing homes starting the year around $366,000 and ending the year around $377,000. Lawrence Yun, chief economist at NAR, foresees similar price stability, with median home prices increasing just 0.3% according to their forecasts. “Half of the country may experience small price gains, while the other half may see slight price declines,” Yun says.

Real estate website Redfin is also predicting good news for homebuyers. Their forecast is for the first year-over-year decline in the last decade, with an average home price at $368,000. So while home prices aren’t dropping to where they were pre-pandemic by most of these forecasts, they are likely staying near where they’re ending 2022 as we move ahead to 2023.

Looking ahead at housing affordability

More than the mortgage rate or the price of the home, most homebuyers start with this question: Can I afford it? Housing affordability refers to the amount of a homeowner’s monthly budget their home payments represent. Over the last twelve months, this has gotten worse and worse, making it extremely hard for first-time homebuyers in particular to purchase a home.

If mortgage rates come down, and home prices are at a lower average than last year, that means that housing affordability will come down. Hopefully, in 2023 more people will be able to answer yes to that question.

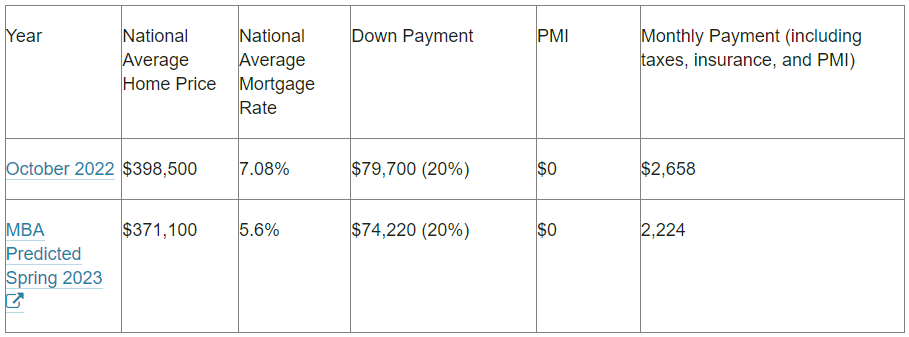

Let’s take a look at what would happen if some of the above predictions would actually happen. As an example, we’ll compare the MBA’s predictions for average home prices and mortgage rates in spring of next year with an average priced home and mortgage rate in October of 2022, assuming a 20% down payment in both cases.

*Sample rate provided for illustration purposes only and is not intended to provide mortgage or other financial advice specific to the circumstances of any individual and should not be relied upon in that regard. Guaranteed Rate Affinity cannot predict where rates will be in the future.

That’s a difference of $434 a month, with $5,480 less spent on a down payment, which could make a big difference for many and turn a potential homebuyer into a homeowner.

New construction outlook

One reason that home prices have gone up so much is that there hasn’t been enough homes available to buy. The low rates we saw during 2020 and 2021 made this problem worse, as more people were looking to purchase a home, but it’s a problem with origins that started years before the pandemic. Housing inventory has been dropping since 2010.

One solution to not enough homes available to buy is to build more homes. However, rising mortgage rates scared off many builders from starting new projects, as builder confidence went down for 11 consecutive months in 2022.

The MBA has watched new housing projects that began work, known as new housing starts, go from 1.72 million at the beginning of 2021 down to 1.461 million in the third quarter. The projected average of new housing starts for 2022 was 1.567million.

They’re expecting that downward trend to continue into 2023, forecasting 1.472 million housing starts in 2023. That likely won’t be enough to bring relief to the inventory issue and therefore won’t put significant downward pressure on home prices in the new year.

Trends to keep an eye on

With those four major factors accounted for, what will that mean for the rest of the housing market? Here are some more housing market predictions:

Hot months for homes

In most years, spring and summer are the most popular times to buy a home, but the pandemic threw that trend out the window. With rates so low in 2020 and 2021, along with the increased flexibility most people had due to work-from-home and online school, we saw demand spike throughout the year.

Now that rates have increased, many families have settled back into their pre-pandemic work and school routines. As Jeremy Collett, Executive Director of Capital Markets at Guaranteed Rate, says, “No matter what, I think we will see a return to seasonality, with a focus on home sales in spring and summer when people are more inclined to move.”

From bonkers to a buyer’s market

One of the most memorable parts of the housing market over the last few years was how much of a seller’s market it became. Houses would sell in less than 24 hours after listing, above asking price, with inspections waived. That’s how desperate buyers were to close on a home with the low rates we were seeing then.

But thankfully that’s in the past. We’ve seen demand dip as rates have gone up in the past year, and that should continue. Danielle Hale, chief economist for Realtor.com, wrote in her housing forecast, “There will be more homes for sale, homes will likely take longer to sell, and buyers will not face the extreme competition that was commonplace over the past few years.”

The importance of a fast, frictionless experience

Real estate happens more and more in a digital landscape these days. From finding a home online, to applying for a mortgage and even closing, almost the entire process can take place on a screen. But that makes customer service, speed, and efficiency all the more important.

Guaranteed Rate has been at the forefront of this revolution, from introducing the first Digital Mortgage, to FlashClose® technology and MyAccount. And we’ll continue to lead, with exciting new apps and tools on the way to make your financial life easier and give you an advantage when buying a home. All of this tech is backed up by our mortgage loan experts, who are always ready to help if you need any.

It’s our commitment to helping make the process of getting a home easier for you that we are optimistic about the year ahead. When you work with a Guaranteed Rate Affinity loan officer, you’ll know that you’ll have an expert on your side to help you realize your dream of homeownership, no matter what happens in the market in 2023.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link