Married – Name Not on Title: The Cause and Effect

Does a person have ownership rights to a piece of property if they are married, but their name is not on title?

For a community property in California, it depends upon when and how their spouse acquired the property. The law asserts that all property purchased during the marriage, with income that was earned during the marriage, is community property. Both spouses own it equally—regardless of whose name is on the title deed—and while married buyers can purchase property on their own, using only their credit, income and assets to qualify for a loan, that property is deemed to be owned by both spouses jointly.

If the intention is that the property be owned only by the spouse who purchased it, then the other spouse would have to relinquish their rights to it by executing and recording both a quit claim deed and a Preliminary Change of Ownership form.

Any real estate that was owned by one spouse prior to marriage remains separate property – as is property that is inherited or gifted to one spouse. If the other spouse’s name is not on title for either of these reasons, then they neither have ownership rights nor would they be responsible for loan repayment or other liens placed on that property – even if it resulted in foreclosure.

Spouses may comingle their separate property into community property at any time, simply by transferring that property into both names jointly. Then both spouses are on title and both have equal rights and equal responsibility for it, just as they would if they had purchased it, taken on a mortgage loan for it together, and listed both of their names on title.

Let’s talk for a moment about responsibility. When a married couple acquires a home loan, both names are typically on title – and in California, when financing is used, a trust deed is recorded. The lender releases the trust deed lien, giving the borrowers free and clear ownership rights, when the loan is fully repaid.

But if the spouses acquired the home together, and one of them, for whatever reason, relinquished their ownership rights at any time after closing (with a quit claim deed and Change of Ownership form as noted above) that spouse is still considered responsible for the loan – and any default or foreclosure would affect their credit even if their name is no longer on title. As your title partner, we’re here to help you and your clients navigate the nuances of these transactions.

By Barbara Pronin

Barbara Pronin is an award-winning writer based in Orange County, Calif. A former news editor with more than 30 years of experience in journalism and corporate communications, she has specialized in real estate topics for over a decade.

This material is not intended to be relied upon as a statement of the law, and is not to be construed as legal, tax or investment advice. You are encouraged to consult your legal, tax or investment professional for specific advice. The material is meant for general illustration and/or informational purposes only. Although the information has been gathered from sources believed to be reliable, no representation is made as to its accuracy.

How Do I Price My Home Correctly Right off the Bat?

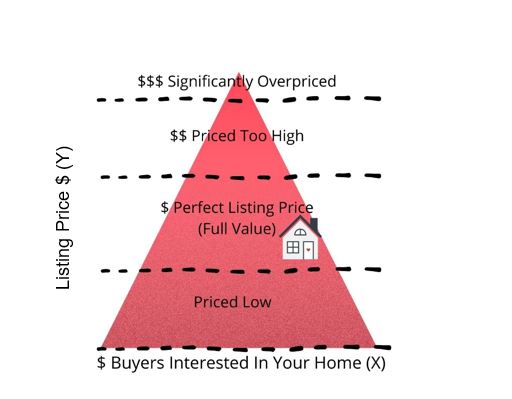

The market is constantly changing and pricing a home continues to be one of the biggest challenges real estate professionals face on a daily basis. It’s not uncommon for sellers to want to price their homes higher than recommended, but that may not be the correct solution to get the home sold.

Here are 3 ways to price your home right from the beginning.

1. Don’t wait for “later” and don’t leave “negotiation” room

You’re thinking—if it doesn’t sell for this price now, I can always reduce the price at a later date. In fact, this still leaves a sour taste in the buyer’s mouth. They immediately think that something must be “wrong” with the house. Then, if they decide to make an offer, it will be a low-ball price since they believe the seller is “highly-motivated” to sell.

Don’t limit the number of potential buyers by decreasing the visibility of your listing. For example, if you’re looking to sell your home at $300,000, but increase the listing price to $325,000 to allow room for negotiation, potential buyers searching for homes at a price range of $250,000 to $300,000 won’t even know that your house is available.

Pricing a home correctly from the start helps to eliminate these types of misconceptions.

2. Do some research

Take time to do some research on your local real estate market by studying past sales and statistics for homes in your area or neighborhood. Remember that these homes should be similar to your own. Additionally, take a look at current active listings. Remember that active listings should not be confused with past sales. Active listings should be seen as your competition and it’s a good idea to be aware of what your competition is doing. This will help you better understand a true market value so you can price your home accordingly.

3. Work with an Agent

Working with an experienced agent with knowledge of the local real estate market is one of the best tools you can have. Not only will they know how to price your home, but they will also be able to provide a comparative market analysis with homes that have recently sold in your area. A good real estate agent can tell you about buyer trends and what they feel is important when trying to price and sell a home.

Pricing your home correctly right from the start comes down to understanding your local real estate market and your neighborhood. Contact me today for assistance. I would love to be your neighborhood expert.

Do Granny Flats or Additional Dwelling Units add much value?

Whether you call them granny flats, in-law suites, or garage apartments– accessory dwelling units (“ADUs”) are on the rise. There are an estimated 1.4 million of them in the United States, with around 110,000 constructed in the last year alone.

In 2020, ADUs were often heralded as one answer to the growing housing affordability crisis. Their proponents argue that ADUs offer an opportunity for homeowners to make extra income, for young people to rent affordably, and for communities to grow slowly and sustainably.

But then the pandemic came and changed everything, and hardly for the better. So where did that leave ADUs in 2021?

What Is an ADU, Exactly?

In specific terms, an ADU is a secondary, generally smaller, livable unit on a property that can either be attached to the main unit, like a loft conversion or a garage apartment, or detached from it, like a granny flat or a guest cottage.

ADUs have been gaining notoriety in light of the various states and cities passing legislation impacting their legality, as well as from the rise of private companies specializing in ADU installation and design.

Likely due to the pandemic, the number of ADU permits is somewhat slowing down in cities like Portland or Los Angeles, but more Americans are still searching for ADUs online than ever before, according to Google Trends.

How Much Do ADUs Cost?

The cost of an ADU remains an elusive figure. Specialist ADU sites and advocacy groups tend to state the range at between $150,000 and $400,000, depending on the size, quality of materials, complexity of the project, the local contractor rates, and more.

“…locations with ADUs in big cities are priced 35% higher than units without one.”

Maxable, a service that helps property owners plan, hire, and manage their ADU project throughout California, claims that in the southern part of the state, an ADU costs between $95,000 and $330,000. In the San Francisco Bay Area, ADU prices range from $149,000 to $400,000.

That seems like a lot of money (and it is!), but it is worth bearing in mind that single-family homes in these highly desirable areas can cost between two to four times greater.

While these estimates appear somewhat high, you should definitely be skeptical towards any advice suggesting you can build your own ADU for $20,000 to $50,000. Maxable has a handy explainer on why such low estimates of ADU cost are likely too good to be true.

How Big Do ADUs Tend to Be?

Apart from the constraint of having enough space on the property to build a second unit, there are often legal limits for how large ADUs may be built. Still, between garage apartments, basement conversions, and completely standalone units, sizes of ADUs tend to vary.

California’s leading granny flat educators, detached units tend to run between 550 and 1200 square feet.

What’s Driving the ADU Movement?

What are some of the forces propelling ADUs into the real estate market ?

First of all, there’s housing affordability, or rather, lack thereof.

Rents continue to rise nationwide, growing 7.5% year-over-year in June 2021, according to CoreLogic. The Financial Times highlights that home prices in the 20 biggest U.S. cities are growing at twice that rate, at 15% year-over-year.

At the same time, the Washington Post reports the decline in entry-level homes, especially in the urban areas of states on the West Coast. ADUs appear to be a direct result of these trends.

The second force is the rise of multi-generational living. A recent New York Times article suggests that the trend of multiple generations of families living together has become increasingly common due to the pandemic (though this trend has been in the works for years).

But it’s not just families choosing to buy bigger homes for their parents, children, and grandparents to live under the same roof. The final driver of ADUs is the recent economic downturn brought upon by the pandemic. A recent Pew Research study finds that the majority (52%) of young American adults aged 18-29 are living with their parents.

Older Americans are also now more likely to live with their grown children instead of on their own, or in a care facility. The costs associated with having a place of their own or being in residential care are increasingly insurmountable for the older generation.

—

How Popular Really Are ADUs?

Based on the estimates from a study by the mortgage lender Freddie Mac, there are 1.4 million homes with an ADU in the United States in 2019. This number includes both attached and detached units, and takes into account ADUs built both with permission and illegally.

Despite these numbers, they’re still rare. Compared to American housing stock figures from the most recent American Housing Survey, this makes up only 2% of all single-family homes in the country.

This number is consistent with our own analysis of sales listings in America’s 500 biggest cities. Of the 348,099 homes for sale, 4,307 or about 1.2% had an ADU, roughly one in every 81 homes.

The total number of ADUs in America may be small, but according to Freddie Mac, ADUs have been growing at a rate of 8.6% per year between 2009 and 2019, which means an average of 78,000 new ADUs have been added each year.

Projecting this rate onto 2020 would mean that 120,000 new ADUs were built in the last year alone, putting the total at over 1.5 million units.

Worth bearing in mind that the ADU figures quoted above are taken from home sales listings, which is to say the real number of ADUs in the United States is likely significantly higher.

—

Does an ADU Add Value to Your Home?

The short answer is yes– they definitely do.

Our analysis of ADU listings in the biggest cities in the U.S. shows that locations in big cities with ADUs are priced 35% higher than units without one.

Can ADUs Solve the Housing Affordability Problem?

Being generally smaller and therefore cheaper to build, ADUs can provide an affordable alternative to young people looking to buy or rent their first home. Equally, it’s an opportunity for families to live close to each other without crowding a singular housing unit.

ADUs are also a way for homeowners to rent out parts of their homes to get some supplemental income. Empty-nesters, for example, can use an ADU as a place to live while renting out the larger home.

Another benefit of ADUs is having more space for family members, be it for aging grandparents wishing to stay close with their family, or young adults who, for broader socio-economic reasons aren’t able to move out on their own.

Yet while it’s a move in the right direction, without centralized investment or a push for construction of ADUs, mere granny flats and in-law suites are unlikely to cover the economic gap stemming from the high demand and low supply of affordable housing.

—

Should I Consider Building an ADU?

If you’re considering adding an ADU to your home, please consider the legality of adding such a structure in the city and state where you live. There isn’t a single comprehensive resource on local legislation, but this guide by Accessory Dwellings is a good place to start Chances are, you’re going to need a permit, so check with the relevant authorities responsible for zoning and planning.

If you’re already planning your ADU, we at Porch would be happy to help you find skilled and reliable contractors in your area to help with your building addition project.

Find the original article here

20 Renovations That Will Hurt Your Home’s Value

Your home isn’t just a source of pride or a place where you can relax after a long day — it’s also an investment in your family’s future.

And while it’s natural to want to make improvements to increase your home’s resale value, some renovations will actually cost you money in the long run. Just because you see something as an improvement doesn’t mean a potential buyer will feel the same way. Find out which renovations are ones to avoid.

Lavish Lighting Fixtures

One common home improvement mistake is falling in love with unique or lavish light fixtures, said Alon Barzilay, founder of real estate development company Urban Conversions.

“Whether it be ceiling-mounted lights in a dining room or a hanging pendant, there is a psychological phenomenon that happens when you go to a lighting store … you’re going to pick something exciting and new instead of picking a new addition that suddenly matches the big picture,” Barzilay said.

Further, the passage of trends works against homeowners. “Whatever is in vogue today will look dated 10 years down the road when you are ready to sell,” he said. “Simple is best. Fortunately, lighting can easily be switched out at a low cost.”

Too Much Wallpaper

With its patterns and texture, wallpaper can be an overwhelming design choice for your home. Plus, it’s notoriously difficult to remove. Homebuyers might view wallpaper removal as a potential headache, and it could be the tipping point for someone who wants a more move-in ready home.

Fresh paint and neutral colors are always a good idea to help stage your home when it’s on the market. If you do have wallpaper, think about whether it’s beneficial to remove it and repaint the walls before any showings or open houses, so your potential buyers never have to think about your wallpaper mistakes.

Texture on the Walls and Ceilings

Just like wallpaper, texture on walls and ceilings is difficult to remove. Simply knowing that a time-consuming project lies ahead might cause homebuyers to decrease their offer. Think twice before deciding on a fancy textured painting technique, and play around with textured wall décor instead.

Quirky Tiling

Any over-personalized renovation can hurt the value of a home, especially something like tiling, which requires more effort and money to replace, said Bob Gordon, realtor and blogger at Boulder Real Estate News.

“Many buyers like to upgrade the floors in their homes,” he said. “Adding tile or wood can make an improvement in value — unless you get that person who wants the 1950s diner look and installs black-and-white tile. For their vision, this is the pinnacle of cool. But for a resale value, most homebuyers will see it as a distraction and something they will need to rip out.”

Instead of falling victim to tiling mistakes, consider going with a traditional white tile floor, and buy a rug with the style you’re going for, he recommends. If you don’t want to spend a fortune on a professional to replace the flooring, consider doing this home renovation yourself.

Too Much Carpeting

In an interview with Realtor.com, home remodeling expert Alex Biyevetskiy said that new hardwood floors can increase the sale price of a home by up to 2.5%. Compared to hardwood and laminate floors, carpet can quickly show signs of damage. Plus, colors and textures are highly based on personal preference, and any overly personal touches can decrease a home’s value.

Bright and Bold Paint Colors

Bright and bold paint colors can turn off any potential buyer who might lack a bit of vision. Fortunately, repainting a room before putting your home on the market is an easy fix, albeit an important one. Choose neutral colors to present buyers with a blank canvas, which can help them envision the home in their own style, HGTV recommends.

An Extremely High-End Kitchen

The kitchen is often seen as the heart of a home, and it’s a project many homeowners save up for. The resale value of a major, high-end kitchen remodel is actually less than what you’ll invest in it, however. In 2020, the national average for a major kitchen remodel was $68,490, but the resale value was only $40,127, according to the site Remodeling.

To avoid kitchen renovation mistakes that won’t give you a return on investment, try to focus on which aspects of the kitchen are most outdated or worn. And as tempting as it might be, consider selecting mid-range appliances rather than the expensive high-end options.

A Luxury Bathroom

An upgraded bathroom can certainly add value to a home, but it’s easy to get carried away and take the idea of luxury a little too far. Potential buyers could be scared off by bathroom remodel mistakes like over-personalized finishes and over-the-top whirlpool tubs that are hard to clean and hard for some people to climb into. Instead, consider a walk-in shower, which typically uses less floor space.

A Home Office Conversion

Thanks to improved technology, more professionals have the opportunity to work from home, and some might consider creating a dedicated home office space to get the job done. If the new office was formerly a bedroom, this could be a costly mistake.

Along with removing bedroom furniture, you will likely need to add wall outlets and phone jacks (up to $425) and install new hardware, which could bring the total cost up to $3,000, according to HomeAdvisor. If a prospective buyer would rather have the bedroom space, you spent a lot of money for nothing.

Combining Bedrooms To Create a Bigger Room

Combining two small bedrooms to create a bigger room might seem like a good idea to a young couple with no children or to empty nesters whose children have left the house. But this is a bad move if you don’t plan on staying in that home forever, said Brian Davis, real estate investor and director of education of renting resource SparkRental.

“Even small bedrooms add value to homes, as most families want children to have their own rooms but don’t mind if they’re on the small side,” he said. “In my experience, each bedroom can add about 15% to the value of a home.”

Instead of knocking down walls, try simple tricks to make your bedroom space look bigger, like lighter colors and modern, slim furniture.

Removing Closets

Michele Silverman Bedell, owner of residential agency Silversons, told MarketWatch that she’s seen firsthand how removing a closet to make room for another upgrade, such as a larger bathroom or bedroom, can hurt a home’s resale value.

“People need closets,” Bedell said. “They’ll walk in and count the number of closets per room.”

A Sunroom Addition

A sunroom can be a great space to enjoy the outdoors away from the elements, but according to Remodeling, a sunroom addition is one of the worst home renovations when it comes to return on investment, with a cost of an addition exceeding approximately $75,000 while only adding just over $35,000 to the value of the house.

Think carefully about how often you’ll use a sunroom before committing to this costly renovation, especially if your home might be on the market soon. Plan ahead to avoid the sneaky expenses that come with renovating your home.

A Built-In Aquarium

A built-in home aquarium can make a home feel fancy and upscale, but it requires constant maintenance and can be costly to remove. Not all potential buyers will want to care for a large tank full of fish or pay for the maintenance that comes along with it. Instead, opt for a standard fish tank to avoid any issues down the line.

Built-In High-End Electronics

An in-house theater is perfect for any movie buff, but built-in or customized electronics that take up space in an otherwise usable room could be off-putting to potential buyers, according to famed home improvement expert Bob Vila. As with all home renovations, personalization can lead to a decrease in home value, and built-in technology that can quickly become outdated is no exception.

A Swimming Pool

Contrary to popular belief, a swimming pool renovation or addition is not the best way to add value to your home. In fact, according to HouseLogic, a swimming pool could increase a home’s value by 7% at most — and that’s only in certain circumstances.

“Unless you live somewhere that’s hot at least six months out of the year, pools are generally more trouble than they’re worth,” Davis said. “The only people who really want them are families with a certain age range of children, so it limits the potential buyers.”

Because of the cost to build a pool, maintenance expenses and a very minor potential value increase, a swimming pool addition simply isn’t worth it for most homeowners.

A Hot Tub

Like swimming pools, hot tubs are a gamble — they take up space and require constant maintenance. Plus, homebuyers with children might consider a hot tub a safety hazard.

If a hot tub is on your list of must-haves for your home, consider a portable hot tub versus a built-in hot tub. You could potentially take it with you when you move, or your home’s new owners can easily remove it if they prefer.

A Garage-to-Gym or Living Space Conversion

For a fitness lover, a garage-to-gym conversion might seem like a wonderful idea. To parents of a millennial who just moved back home, a garage-to-apartment conversion probably seems like a money saver. But future homebuyers might not agree.

Many people search for houses with a garage, and what they’re looking for isn’t a gym or an extra living space — they’re looking for a garage to serve its primary purpose of housing cars and storage items.

If you must use your garage space as a gym or as extra living space, be sure future homeowners can easily and inexpensively remove the renovations.

The Wrong Landscaping Investment

Homeowners are prone to certain devaluing landscaping mistakes in the name of “curb appeal,” said Theodore Beasley of Landscaping London. “Costly landscaping decoration will not increase the value of your home, but rather increase the maintenance required for it. A potential buyer sees this, and it might turn into a concern. Fancy decorative additions that you find attractive are pretty much subjective, as well — including your personal DIY projects.”

Keep your gardens beautiful but simple and easy to maintain, and be sure any decorative additions can be easily removed.

Beautiful but Messy Trees

Trees are an important part of any landscape, but it’s important to do your research before planting anything. Beasley recommends that homeowners particularly look out for any trees with leaves or flowers that might create a mess in the yard.

“Some trees just tend to be messier than others,” he said. “Constant leaf rain is not something that will positively attract a potential homebuyer. When fall comes, they will just know it will give them a hard time.”

Trees to stay away from include oak, female Ginkgo biloba, sweet gum, locust tree and Eastern white pine. These messy trees can decrease your curb appeal, and removal can set you back a hefty sum, depending on the tree’s size, Beasley said. Instead, choose an alternative tree, like an Eastern red cedar, crepe myrtle or Colorado blue spruce.

DIY Repairs

Always think twice before getting into the do-it-yourself home improvement game. Gordon said he’s seen several examples of DIY jobs that have decreased a home’s value.

“I’ve seen plenty of houses where you can tell the owner did the work,” he said. “The owner probably feels she made all the right improvements, but buyers quickly see the shoddy workmanship and unusual finished product.”

There are ways you can increase your home’s value with DIY projects, but you need to be strategic. Gordon went on to recommend hiring a pro the first time out.

“Then ask to be a part of the process and learn from the professional as they do the job,” he said.

The bottom line is that any over-personalization of your home can lead to a decrease in value. Yes, you want to live in a space you love, but think twice before investing in any major or costly renovations. And always make sure your home improvements are completed with the proper permits by licensed professionals.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link